Why housing market’s ‘peak fear’ phase has passed

Aussies frustrated with flailing house prices have been told what to expect going forward amid the country’s ongoing economic uncertainty.

The “peak fear” phase of Australia’s housing market has ended, according to a leading property buyers agency.

The market has been turbulent for both buyers and sellers in recent times as both groups struggle to navigate the impacts of Covid-19 and rising interest rates.

House prices have continued to go up, with Australians hesitant to enter or stay in the market due to the country’s continued economic uncertainty.

But BuyersBuyers co-founder Pete Wargent believes “we’ve passed peak fear”, citing improved auction clearance rates and falling capital city prices.

“The downturn has been driven by a combination of lower borrowing capacity and deeply negative sentiment, but we can expect to see some of the gloomier headlines tailing off now, which leads us to believe that ‘peak fear’ has now passed for this market cycle,” he said.

“With the borders open and permanent migration ramping up again in tandem with the return of international students and other temporary visa holders, we expect to see the resident population of Australia increase by one million over the next two to three years.

“Naturally, we do expect lower borrowing capacity to impact some buyer cohorts, including first home buyers, some investors, and particularly upgraders who are really stretching themselves to buy the best home they can. However, the doomsday scenarios favoured by some media outlets are looking increasingly unlikely.”

CoreLogic reported the highest preliminary auction clearance rate since May, suggesting demand is strong and the market is more balanced between buyers and sellers.

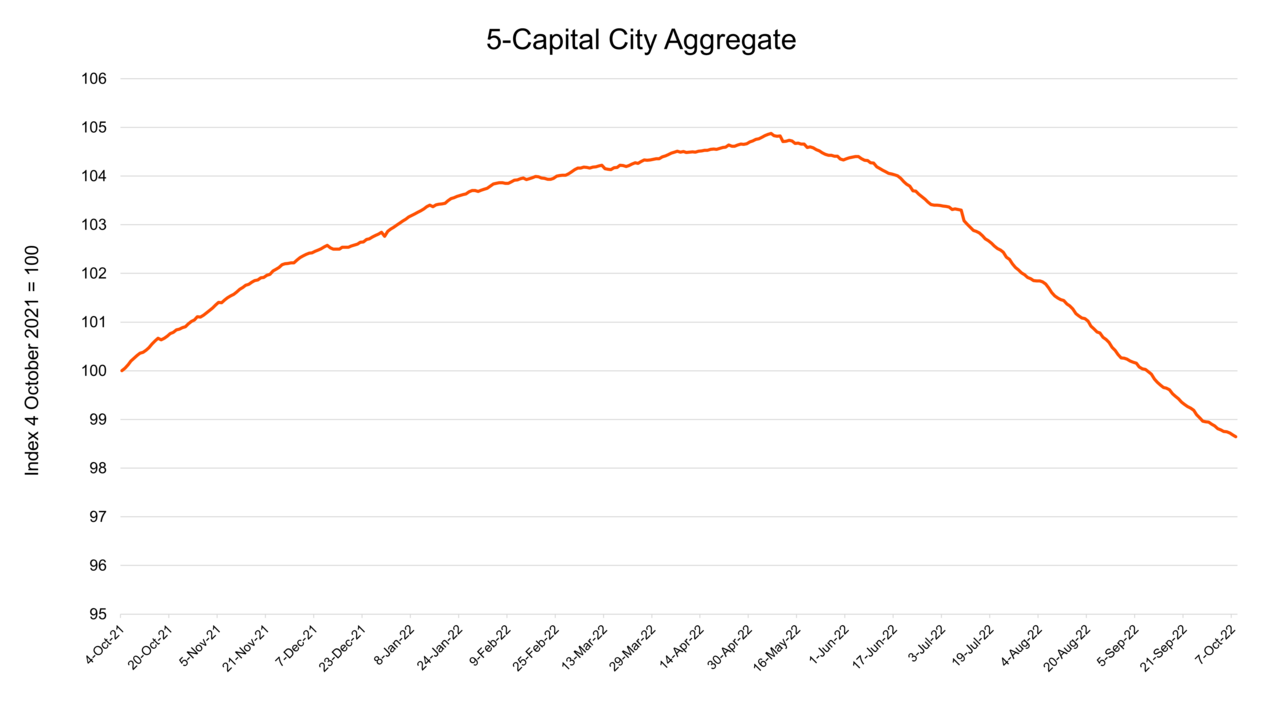

Capital city prices are also now 6 per cent below their peak on CoreLogic’s home value index, making it easier for buyers to purchase a home.

But with interest rates currently sitting at 2.6 per cent, their highest level since 2013, Australians are still dealing with economic difficulties.

“There’s no question that the series of interest rate hikes knocked the stuffing out of the housing market earlier in 2022,” Mr Wargent said.

“There hasn’t been a tightening cycle of this pace and magnitude since 1994, when the cash rate target went from 4.75 per cent to 7.50 per cent between July and December, so most young borrowers have never seen anything like this before and it had a very significant impact on consumer confidence.”

While the Reserve Bank of Australia increased the cash rate for the sixth time in a row earlier this month, it ended the streak of monthly interest rates hikes of 0.5 per cent.

Mr Wargent said the smaller 25 basis points increase has had “something of a soothing impact on buyer confidence”.

“Although there will likely be further hikes to come, it does add to a general feeling that we are getting closer to the terminal cash rate target for this cycle,” he said.

“After months of gloomy headlines, eventually consumers tend to tire of hearing the same old messages and move on, particularly in the absence of a major property price correction, and a lot of buyers are doing just that now. At some point, you just have to choose to get into the market.”