‘The property market is now essentially broken’: One third of Aussies ‘priced out’ of their own home

THIS mum bought her home for $365,000. It’s now worth $2 million. She not complaining — but it shows why the market is “broken”.

WHEN photographer Rose Le Febvre and her husband bought their house in Putney, a leafy suburb on the Parramatta River about 10km northwest of the Sydney CBD, “no one wanted to live there”.

In 1999, they paid just $365,000 for their battle-axe with water views of the river.

Last year, it was valued at $1.8-$2 million.

According to CoreLogic, the median sales price in Putney is now $2.4 million.

“We were very, very lucky,” the 53-year-old said. “Our friends bought down in Francis Road near the river, their house would be over $3 million — they paid $450,000.”

With prices skyrocketing since the late 2000s, Ms Le Febvre is one of more than a third of Aussie homeowners who are “priced out” of their own home.

New research by comparison website Mozo has found 35 per cent of homeowners say they are now living in properties they could no longer afford to buy if they were to try to make the purchase today.

Since 2009, prices in Sydney and Melbourne have risen by 105 per cent and 93.5 per cent respectively. Over the last three decades, property prices have risen by 600 per cent, far outpacing growth in incomes.

“I feel like (even) if we sold we couldn’t buy around the market, we’d probably have to look at another area,” she said. “If we wanted something equivalent we’d probably have to go another $300,000-$400,000.”

Ms Le Febvre, whose three children are still at university, said most of her family had moved up to Newcastle because they had simply been priced out of the Sydney market.

“It tells me the property market is now essentially broken,” said Mozo property expert Steve Jovcevski.

“If one third of Australians basically can’t afford the property they own today, what hope is there for people who currently aren’t in the market?”

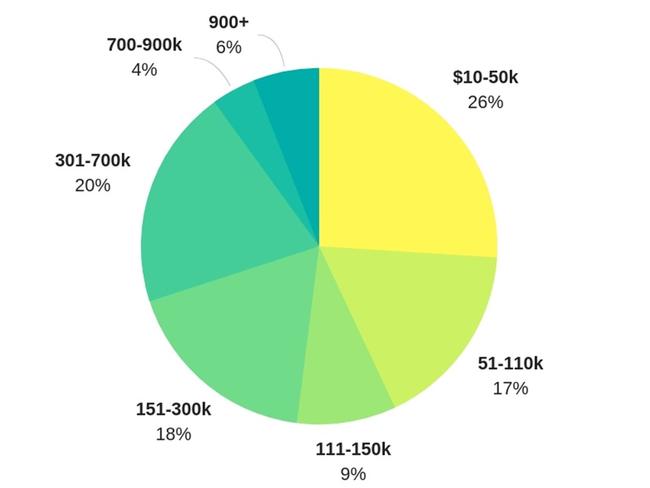

Unsurprisingly, 95 per cent of homeowners said they had no regrets about purchasing their property. One in five estimated their home had increased in value by up to $300,000 since purchase, 20 per cent estimated growth of up to $700,000, while 6 per cent placed their gains in the staggering $900,000-plus range.

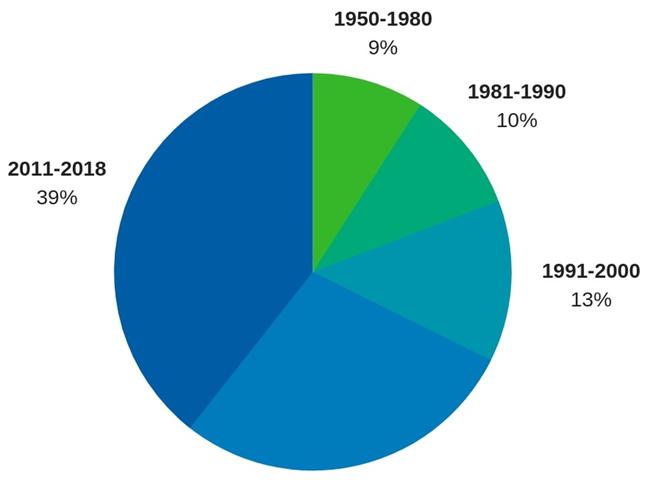

According to the survey, 40 per cent of Australians purchased their home between 2011 and 2018, while a further 28 per cent bought between 2001 and 2010.

“Some people have earned $900,000 without doing much except paying off their mortgage,” Mr Jovcevski said. “Some of these people have become millionaires over the last few years simply by holding their property.”

While the property market has begun to cool — Sydney and Melbourne are down 5.6 per cent and 3.5 per cent from their respective peaks — Mr Jovcevski believes there is little chance prices will become more affordable any time soon.

“Even if they came down 15 per cent from top to bottom, they would still be where they were around 2016 when prices were still high,” he said. “If they do correct and stay there for a few years, maybe wages will catch up, but that’s a big if.”

The introduction of stricter lending criteria by the banks may dampen investor demand and reduce some upwards price pressure, but it is a double-edged sword that also hurts first homebuyers, he added.

Mr Jovcevski believes the message is clear — the Australian dream of owning a home is simply “over for a lot of people”.

“Many Australians who once dreamt of owning a home are now looking at alternative solutions to financially safeguard their future as they come to face the reality that owning a home may no longer be possible,” he said.

“Also, a lot of those people that did buy realise it’s fine for them, but what about their kids? How are their kids going to be able to afford a home? Sure, I’m going to have more equity, but how much of that will I need to give to my kids to help them get a foot on the property ladder?”

Ms Le Febvre agrees. “My biggest concern is my children,” she said. “We’re going to encourage them to buy a property between the three of them, but they’re all still at uni so that’s not going to be possible for a couple of years.”

She hopes house prices come down “for my kids, yes, but for our future, maybe not”. “That’s a double-edged sword,” she said. “Definitely for my children to break into the market.”