‘No chance’: Extraordinary steps worried Aussie parents are taking so young kids can one day buy a home

Getting a job and working hard no longer guarantees Aussies a secure life, so a growing cohort is taking extraordinary steps so future generations can survive.

Australian mums and dads are taking extraordinary steps to ensure their young children escape the worst of what looks to be a bleak financial future.

A growing number of worried parents are establishing savings and investment accounts for their kids – some on the day they’re born – to help fund major life events, like buying a first home.

So in demand are such modern interventions that major financial firm Australian Unity has created an investment bond specifically for this purpose.

In the few years it’s been on the market, 6000 mostly Millennial customers have signed up and accumulated a total of $115 million in managed funds for their kids.

Melbourne marketer Emilia Rossi turned to her financial planner for advice on how to give her son Herclue, six, and daughter Olympia, four, the best start in life.

“What we’ve done is set up a portfolio for each of the children, using a product offered by our superannuation fund,” Ms Rossi said.

Each was established before the children turned one.”

The portfolios invest predominantly in Australian and US shares, but there are property and cash bonds mixed in for diversity.

“Absolutely, I worry about their financial futures,” Ms Rossi said.

“I never could’ve imagined that median house prices would hit $1.2 million. I don’t know how young people will have enough to buy a home. They’ll have no chance without help from their families.”

Ms Rossi said she benefited from a similar gift from her mum, who set up investments in her name when she was a child.

It meant she had about $30,000 to go towards the deposit on her first property when she was ready to buy.

“It absolutely meant I could buy my first property when I was 25. But on top of that, mum had works hard to always instil the idea of financial literacy and investment know-how.

“I want to make sure my children are financially savvy. This isn’t just about giving them a pot of money – this will all be part of a learning experience, to give them a financial IQ about investing, budgeting, saving and the value of money.”

Based on projections, when each of her kids turns 18, they should have a portfolio worth between $80,000 to $100,000.

“It’ll be an amazing head start,” she said.

“Time is on our side. The early we could get in, the better chance we’d have of making the most of compounding interest.

“When they’re adults, they’ll have a nice nest egg to leverage for their first investment.”

A 40-year experiment

Media professional Jarrod Partridge, editor of the magazine F1 Chronicle, set up savings accounts for both of his children on the day they were born for two main reasons.

“The first is on their 18th birthday I want to be able to hand them a cheque with an amount that should give them a leg up with whatever it is they want to do in life, whether that’s travel, live overseas, buy a car, go to uni, buy a house,” Mr Partridge said.

“Whatever it is, it is none of my business, but I’d love to be able to help them achieve that dream.”

The second was to begin their financial education, particularly when it comes to the power of compound interest.

“I thought we could show them how it works with an 18 year-long experiment. If in 18 years they’re able to see proof of compound interest in action, it might inspire them to start saving at a young age and become passionate about investing and financial literacy.

“These are two things I didn’t have, which meant that at 18 I got a credit card then a personal loan for a fast car and spent the next 23 years in debt. Living debt-free is true freedom, and a lesson I can pass along.”

With weekly deposits, combined with gifts from family along the way, the worst-case scenario is that each child receives a projected $19,720 when they turn 18.

“And hey, I might even top it up to $20,000,” he laughed.

“But if the markets stay strong and compound interest does its thing, online calculators suggest it should be around $40,000 [each] in total.”

With the world changing quickly, Mr Partridge said he worries some opportunities are at risk of slipping away for his son, five, and daughter, one.

“However, there is plenty of time before they get to adulthood, so assuming the pendulum swings back the other way, we can work with them to set goals and make plans to achieve the things they want to achieve financially, then support them to achieve those goals.”

The dream is slipping away

According to the Australian Institute of Health and Welfare, homeownership rates among people 30 to 34 have slipped in recent decades, from 64 per cent in 1971 to 50 per cent in 2021.

For younger people aged 25 to 29, the proportion who own a home was a healthy 50 per cent in 1981 but has collapsed to just 36 per cent as of the 2021 Census.

And over the past 25 years, the median age of a first-home buyer in Australia has risen by a decade, from 24 to 34, property market analyst John Lindeman, director of Property Power Partners, said.

That’s thanks to a growing disparity between home prices and incomes, Mr Lindeman said.

“The rate of house price growth has averaged ten per cent each year, far exceeding wage and salary increases,” he said.

The latest PropTrack Housing Affordability Report, measuring the share of homes that an average household could afford to buy, paints a stark picture.

“Housing affordability is now at its worst level in at least three decades,” it found.

“This deterioration has been driven by a dramatic rise in mortgage rates, combined with rising home prices over recent years.

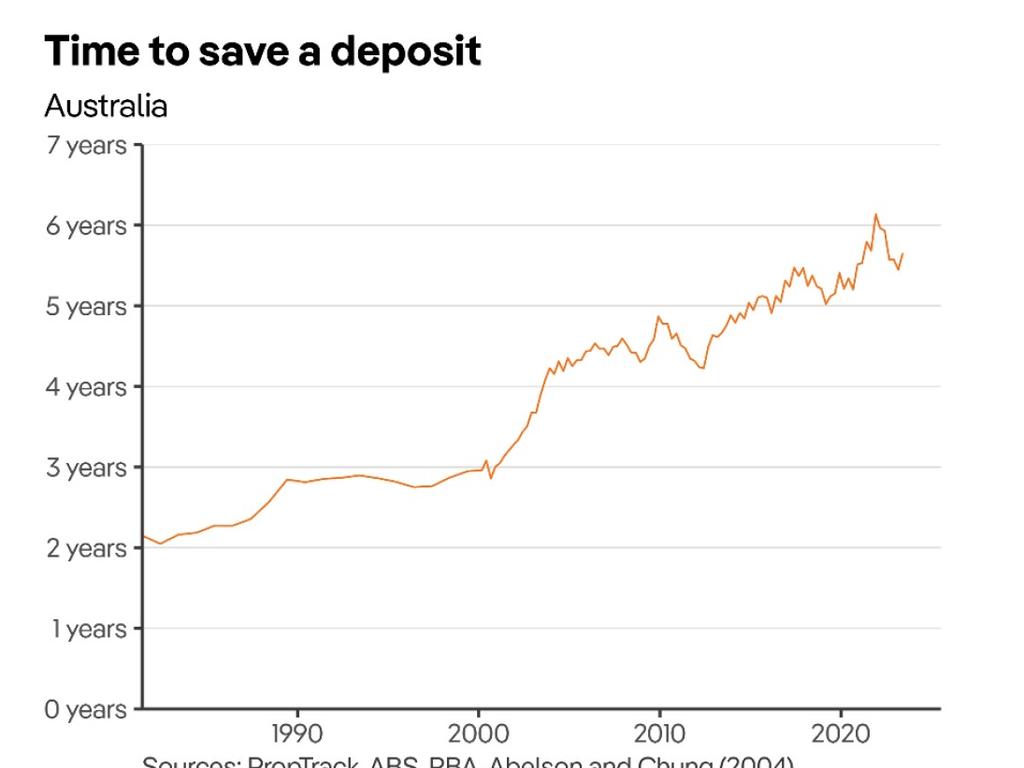

“At the same time, sharply higher price growth throughout the pandemic has meant housing accessibility – how long it takes new buyers to save a deposit – remains incredibly challenging.”

For first-home buyers, a couple with average incomes will need to each put away a fifth of their salary for about 5.5 years in order to scrape together a 20 per cent deposit.

Financial coach Dionne Lee, chief executive of A Woman Inspired, doesn’t believe the so-called Great Australian Dream is dead.

“I believe that there may be a need for a shift in the approach to entering the property market for younger generations,” Ms Lee said.

“However, with proper education and understanding of the many property options available, homeownership remains attainable for future generations.”

Down the track, young Aussies might opt to rent the home they live in, where they want to be, and instead invest in real estate elsewhere.

“The key is to ensure that these investments align with their financial goals, whether that’s generating high cash flow or buying for capital growth,” Ms Lee said.

“By adopting this strategy, individuals may find opportunities to enter the market at a lower affordable price point within their budget, in areas outside of where they need to live for work or family reasons, yet still live where they need or want to be for work or personal reasons.”