’Never been for everyone’: Sad truth about Australian property market revealed

It’s never been easy, but a new analysis reveals a sad truth facing average households hoping to buy a slice of the Australian dream.

ANALYSIS

Across the breadth of our great southern land there are little things that divide us, like the age-old rivalries between the states or the long list of codes that all call themselves football. But despite our collective differences, one of the things that the vast majority of Australians have an interest in is property.

Whether it’s improving the family castle with a weekend pilgrimage to Bunnings or talking about the trajectory of the local housing market around a backyard BBQ, housing is very much intertwined with Australian life, seemingly by nature.

Former Prime Minister and Liberal Party founder Robert Menzies perhaps summed it up best in a radio address in May 1942.

“The home is the foundation of sanity and sobriety; it is the indispensable condition of continuity; its health determines the health of society as a whole …” he said.

During Menzies’ second tenure as Prime Minister between 1949 and 1996, the rate of home ownership saw a steady but strong increase, rising from 52 per cent in 1951 to 73 per cent in 1966.

Since then, that peak has never been reclaimed, with the latest census recording a home ownership rate of 67 per cent.

This illustrates quite aptly that home ownership has never been for everyone.

Even amid a backdrop of strong economic growth, lower interest rates than today and robust real wages growth, it was still a challenge.

Today, we’re going to explore how that challenge has evolved over time and how it may change going into the future.

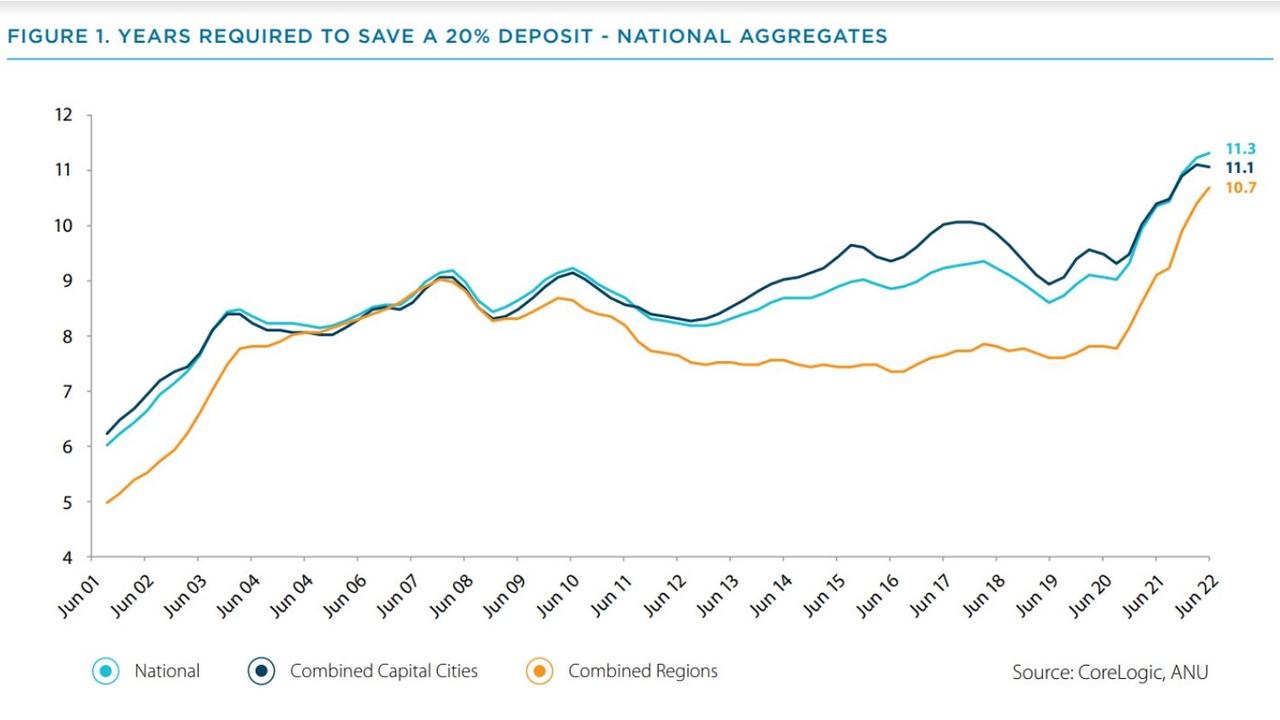

According to an analysis from ANZ, it takes 11.1 years for the median household nationally to save a 20 per cent deposit for the median dwelling. This is up significantly from 6.0 years in June of 2001.

But housing prices don’t stay still and neither do household incomes.

So how long would it take with these variables added to the mix for a household on the median household income to save for a home?

A real life approach

In the ANZ Housing Affordability Report, the calculations assume that a household is saving 15 per cent of its pre-tax income to put toward a house deposit.

For the purposes of today’s exercise, we will be assuming the same.

However, where the approach of this analysis will differ, we will include rising housing prices, wages growth and growth in the deposit via interest on savings.

For the purposes of today’s scenario, the following settings will be used:

â— Wages growth – 3.0 per cent year on year

â— Housing price growth – 5.0 per cent year on year

â— Savings growth – 2.0 per cent per year after tax

â— Required deposit – 20 per cent of total purchase price, not including stamp duty and other transaction costs

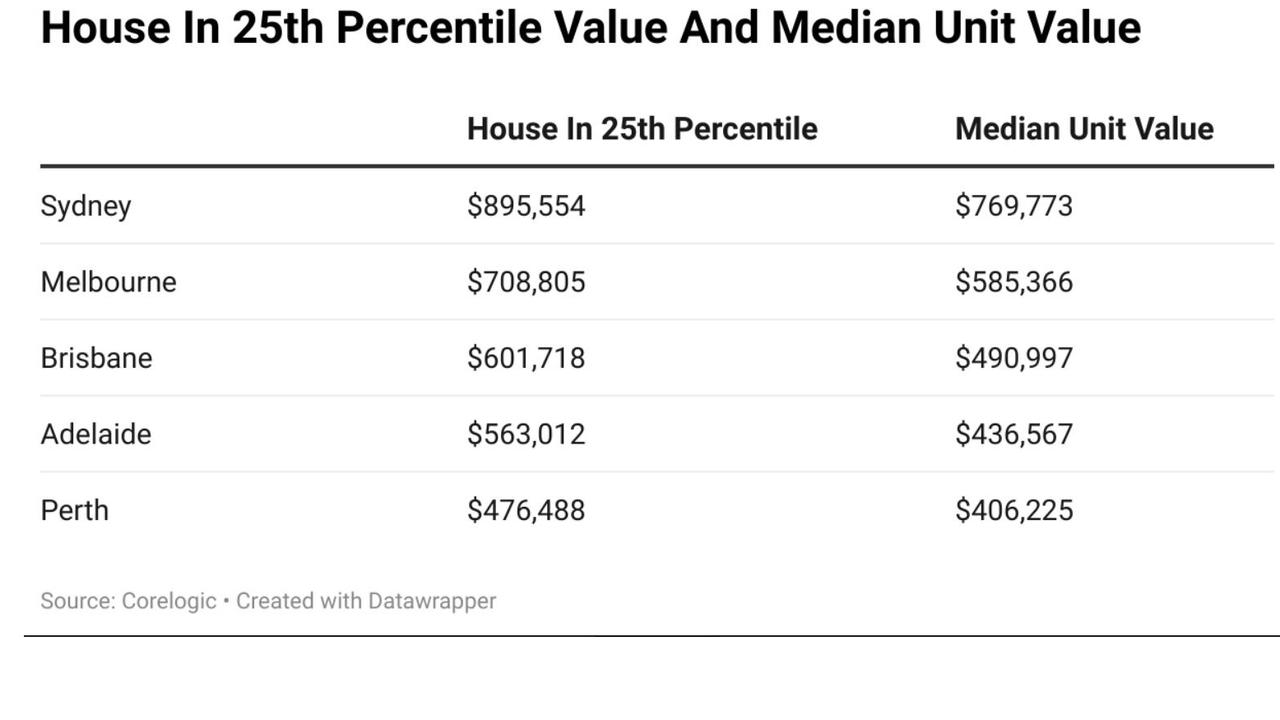

The prospective first home buying household will also not be purchasing the median house. They will instead be looking to purchase the median unit or a house in the 25th percentile (75 per cent of houses are more expensive) to reflect this hypothetical household pursuing a ‘starter home’.

The level of income has also been adjusted for each individual capital city that will be examined in order to get a more realistic picture of the varying challenges faced by prospective buyers in each locale.

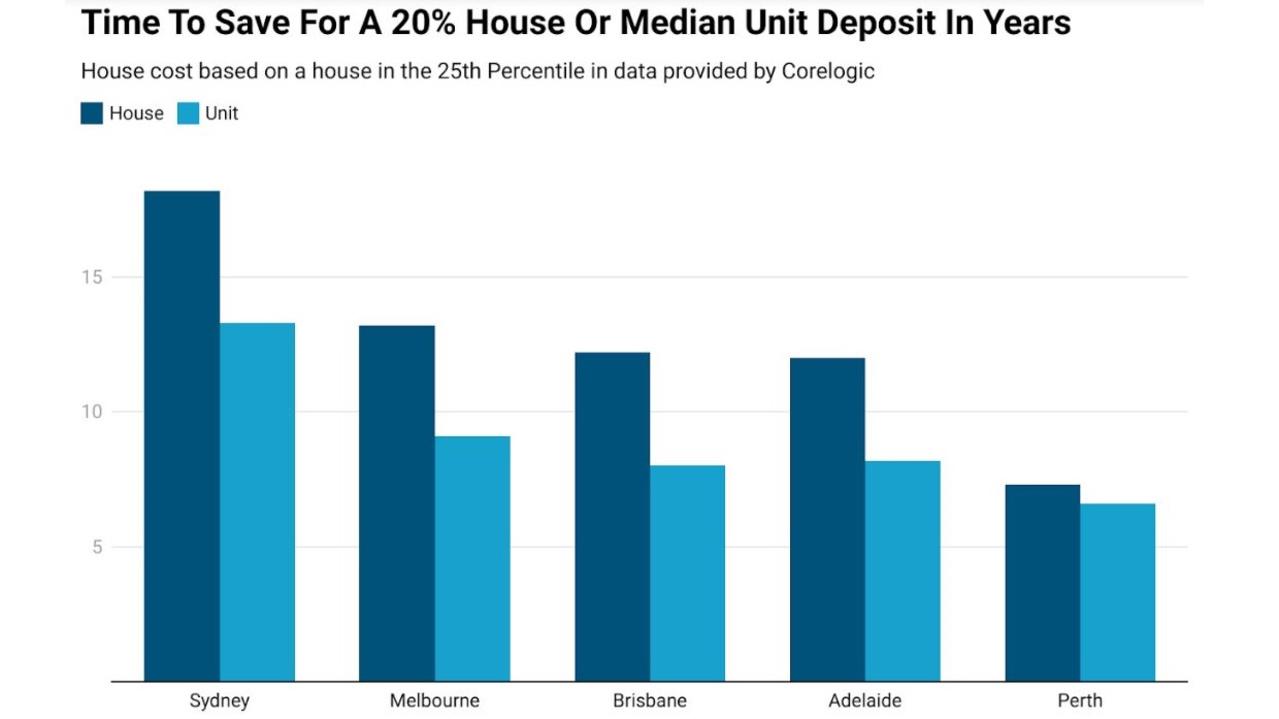

The title for shortest time to save for a capital city property is held by Perth units, with it taking 6.6 years to save for a 20 per cent deposit. For the shortest time to save for a house, Perth is also the winner at 7.3 years.

At the other end of the spectrum, it takes the median Sydney household 13.3 years to save for a deposit on a unit and 18.2 years to save for a deposit on a house.

It’s worth noting that while having lower prices is a boost to a household’s potential homeowning prospects, it needs to be balanced against the level of income that household holds.

For example, while an Adelaide house is 15.4 per cent cheaper than one of relative equivalence in Brisbane, it only takes an extra 10 weeks to save for one due to Brisbane’s significantly higher household incomes.

The outlook

One of the biggest issues faced by households attempting to save for a home deposit is the effect of compounding growth.

While the median Sydney house back in a time like, say, 1998 saw prices rising by

5 per cent add an additional $2500 to the total cost of a 20 per cent deposit, in 2023 it would add over $12,000.

With each passing year the growth in the deposit hurdle would grow ever larger if the trend of rising housing prices over the past 30 years were to be repeated.

Saving for a home deposit has always been challenging, but with a backdrop of potential compounding housing price growth, it is arguably harder than ever before over a long-term time horizon.

It’s not that housing prices haven’t generally grown this way in the past, it’s that the growth is significantly larger relative to the incomes of households attempting to save for their first home.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator