‘Multimillion-dollar profits’: One question Peter Dutton and Anthony Albanese won’t answer

Peter Dutton and Anthony Albanese have made a fortune in huge property deals while the rest of us struggle to scrounge together a deposit.

ANALYSIS

In the upcoming federal election, the issue of housing is once again set to be a major political battleground – perhaps to the greatest degree in recent memory – as the impact of unaffordable housing, higher interest rates and the rental crisis continue to bite.

In recent weeks, Prime Minister Anthony Albanese and Opposition Leader Peter Dutton have both been attempting to make the case that they are the best hope of prospective first home buyers.

Meanwhile, on the other side of the coin, there has been media coverage from a wide array of sources on the multimillion-dollar profits both Mr Albanese and Mr Dutton have made from the nation’s property market over the years.

MORE: Home loan trap taking years to escape

Which raises an interesting question – how does the home ownership journey of the Prime Minister and Opposition leader back in their day compare with the set of circumstances faced by prospective first home buyers today?

Housing market evolution

Before we get into the individual circumstances faced by the two respective leaders, we’ll look at how things have evolved in the 35 years since the 1989/1990 period during which both Mr Albanese and Mr Dutton purchased their first home.

Across that time, housing prices have risen by 599.6 per cent and median full-time earnings have risen by 269.6 per cent.

While falling interest rates have played a role in improving housing affordability in a vacuum, even without factoring in the much greater deposit hurdle, servicing a mortgage is more challenging today than it was during the days of 17 per cent rates.

MORE: Huge prediction for Aussie house prices

A potential game changer

Both the Prime Minister and Opposition Leader purchased homes during the last days of the Hawke government’s First Home Owner Scheme (FHOS), which provided assistance to eligible first home buyers between 1983 and 1990.

The FHOS provided a grant of up to $7000 for eligible first home buyers, representing an average of 6.8 per cent of the average capital city home price in 1989.

While the $7000 grant was a far more sizeable boost to a prospective first homebuyer’s fortunes when it was first introduced in 1983, in 1989 and 1990, when Mr Dutton and Mr Albanese purchased their first homes, it still represented a large proportion of a home deposit.

The offices of the Prime Minister and the Opposition Leader were contacted to clarify whether or not either received the grant or another form of government assistance to purchase their first home, but so far, neither has provided a clarification.

Peter Dutton

The Opposition Leader purchased his first home at the age of 19 in 1989.

It was an apartment in Yeronga, a suburb of Brisbane, which he purchased for $93,000.

At the time, the median Brisbane house price was $113,000.

For a first homebuyer today, purchasing a home that is a similar proportion of the median Brisbane house price, it would have cost $804,000.

To purchase this home today with a mortgage for 90 per cent of the property’s value, a household would need an income of $175,000 and additional savings to pay for stamp duty and other transaction costs.

According to an analysis by investment analyst and popular content creator Rachel Cole, if Mr Dutton received the $7000 first home owner grant and took out a mortgage for 90 per cent of the value of the property, it would have required a deposit of $3230.

This was equivalent to 19 per cent of the annual take home pay of a Queensland trainee police officer, which Mr Dutton was at the time.

Anthony Albanese

The Prime Minister purchased his first home at the age of 26 in 1990. It was a two-bedroom semi-detached home in the Sydney suburb of Marrickville, which he purchased for $146,000. At the time, the median Sydney house price was $184,600.

For a first homebuyer today purchasing a home that is a similar proportion of the median Sydney house price, it would have cost $1.16 million.

To purchase a home in a similar percentile today with a mortgage for 90 per cent of the property’s value, a household would need an income of $243,000 and additional savings to pay for stamp duty and other transaction costs.

Rate cuts

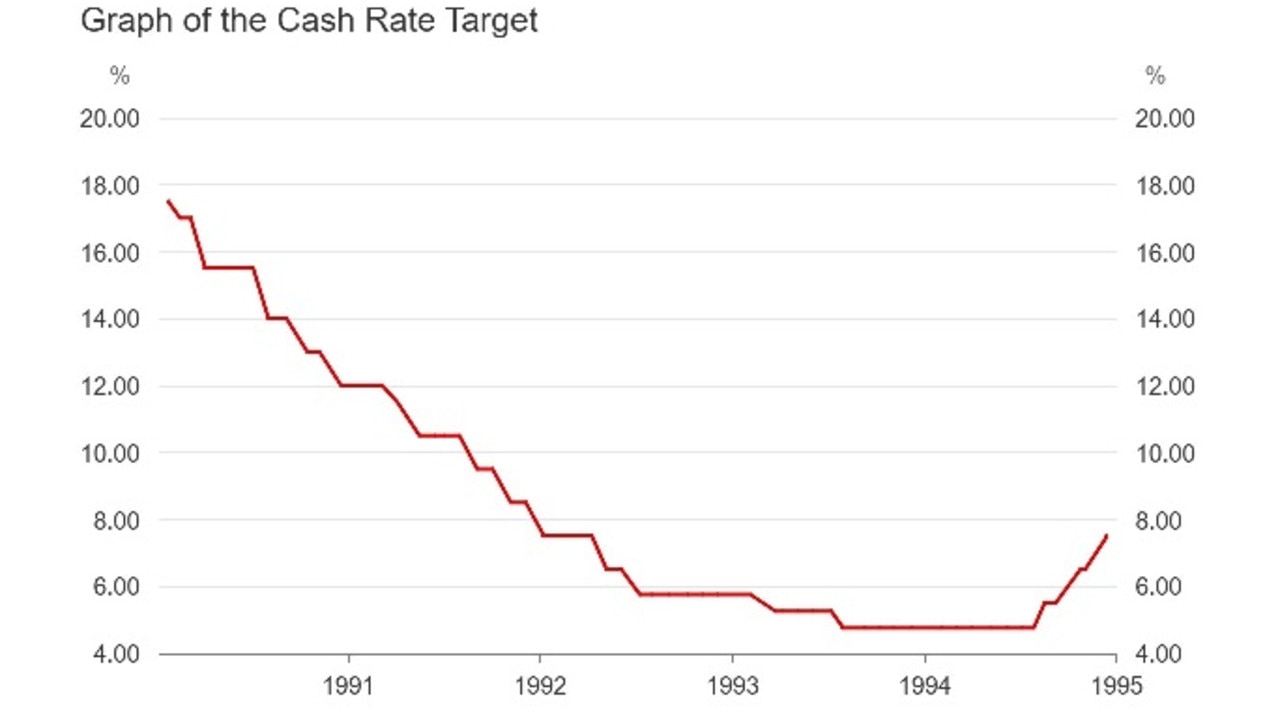

While the 17.5 per cent cash rate Australian mortgage holders found themselves staring down in 1989 and 1990 was extremely challenging, it also helped to deliver borrowers a silver lining.

After interest rates spent the best part of two decades rising from the benign and relatively stable status quo of the 1950s and 1960s, the period from February 1990 to July 1993 delivered a 12.75 per cent reduction to the RBA’s cash rate.

As things stand, nothing like that sort of relief is expected for the current crop of prospective first home buyers.

Current market pricing has 0.93 percentage points of cuts to the cash rate pencilled in, with a terminal cash rate of 3.42 per cent priced in.

Pollies’ property empires

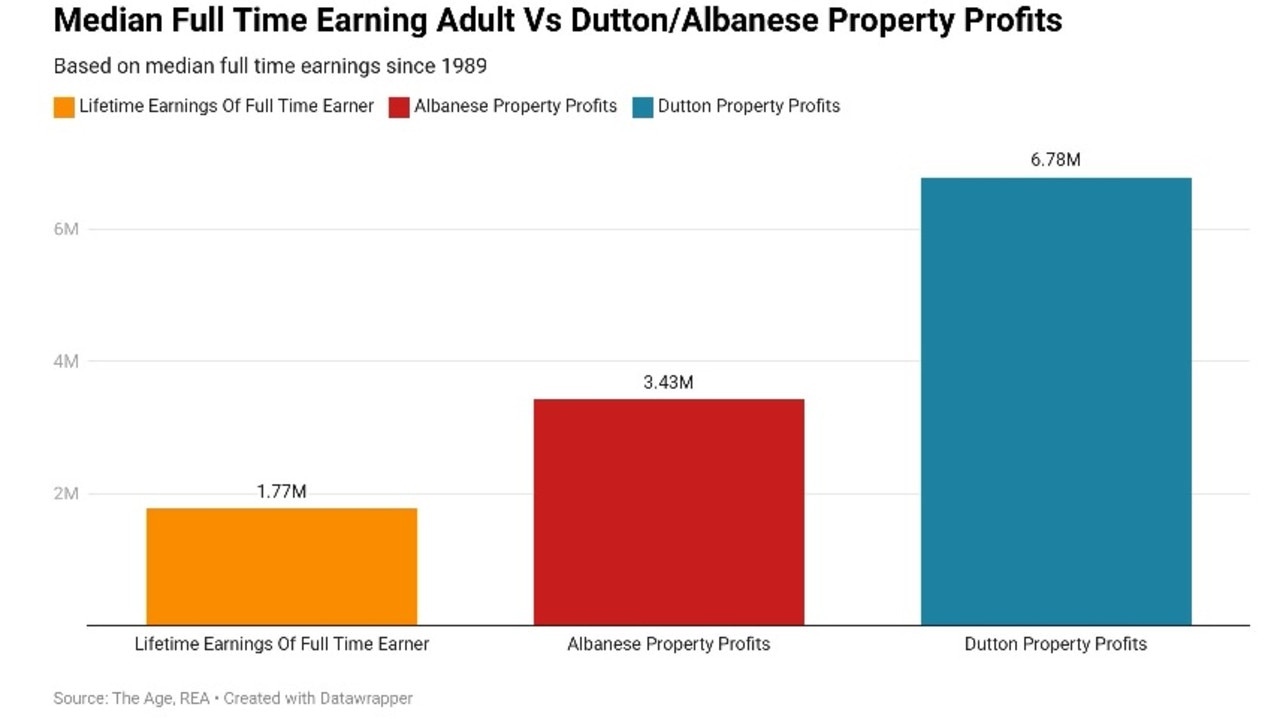

In the roughly 35 years since Peter Dutton purchased his first home, an individual earning the equivalent to the median full-time salary would have made approximately $1.77 million from their labour before tax.

Across that time, the Opposition Leader has made approximately $6.78 million in profits on various property deals.

The Prime Minister, on the other hand, has made $3.43 million in profits on buying and selling various properties over the years.

It’s worth noting that in a sizeable proportion of cases, the profits were derived from the sale of what were at the time family homes and were therefore not liable for taxation.

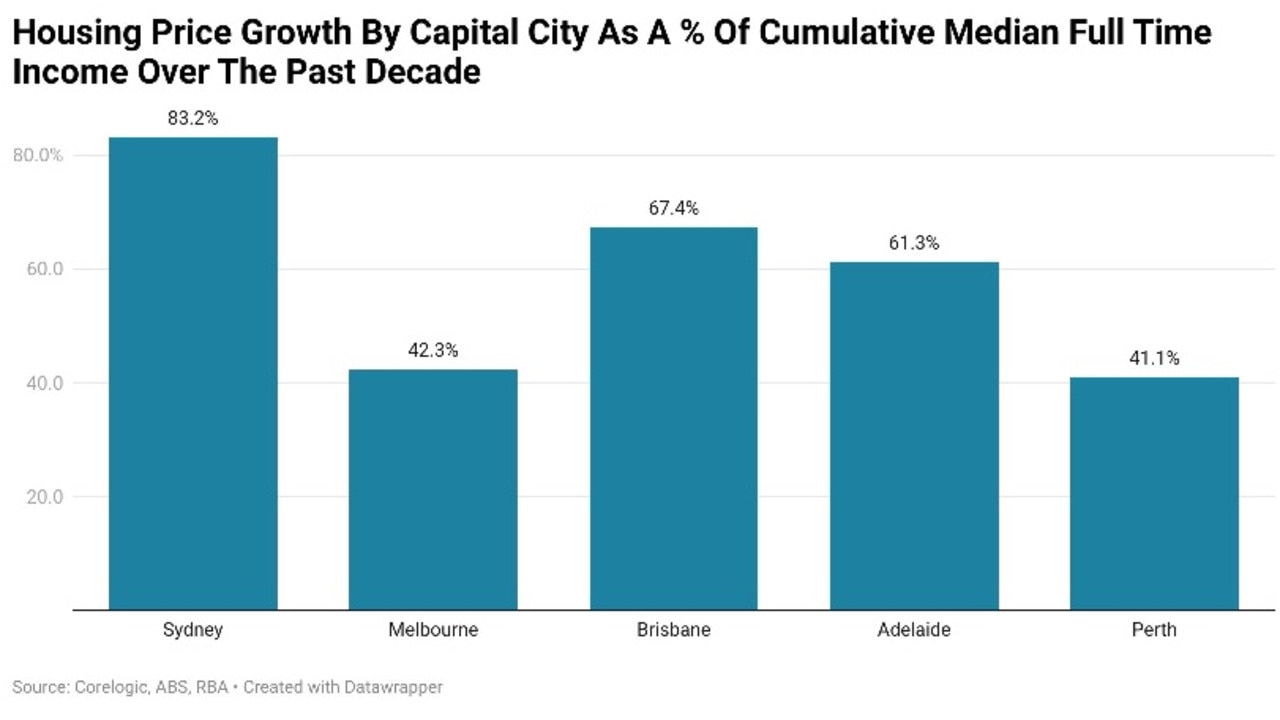

Over the past decade, the housing prices in the nation’s five biggest capital cities have risen by an amount equivalent to 59 per cent of the cumulative earnings of the median full-time worker over the same time period.

The performance of the various locales has varied dramatically, with Sydney rising by 83.2 per cent of cumulative median full-time earnings, with Perth at the other end of the spectrum rising by 41.1 per cent on the same metric.

Age difference

By today’s standards, the ages that the PM and Opposition Leader purchased their first homes would be considered very young.

While it was relatively normal in 1990 for a 26-year-old like the Prime Minister to be purchasing a first home, today, that is becoming increasingly rare, particularly in the nation’s capital cities.

According to figures from the University of New South Wales, half of all first home buyers at a national level are 36 years of age or older.

Given that significant first homebuyer grants for existing homes are no longer on offer and the deposit hurdle has increased dramatically, it’s perhaps unsurprising it’s taking a lot longer for prospective first home buyers to get into the market.

Whether or not the electorate believes the Prime Minister or the Opposition Leader can relate to the challenges faced by prospective first home buyers is in the eye of the beholder.

But what is clear is that the experience of today’s first home buyers is quite different to that the two men vying for the leadership of the nation came up against 35 years ago.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator