Homeowner loses $29k deposit amid bitter feud with vendor after bank bungle

An aspiring homeowner’s plan to purchase a property has gone so horribly wrong that she has lost her deposit and is counting down the days until she is homeless.

An aspiring homeowner’s plan to purchase a property has gone so horribly wrong that she has lost her deposit and is counting down the days until she is homeless.

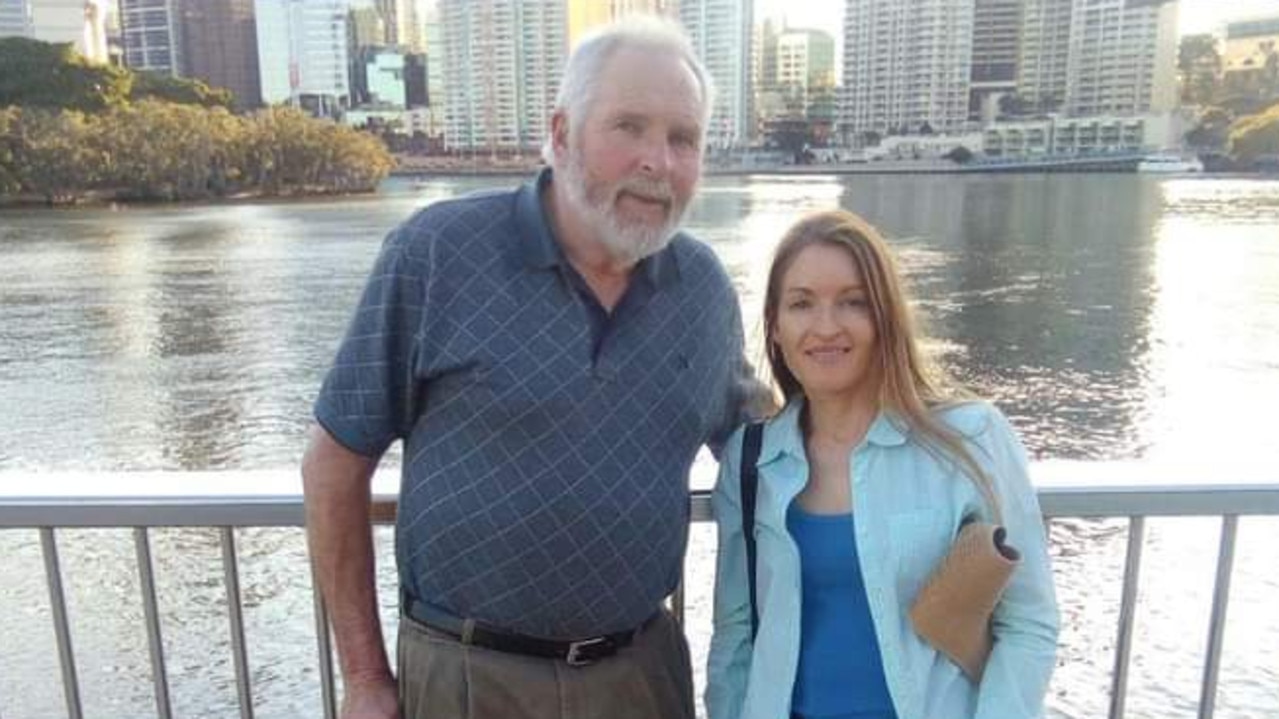

News.com.au has previously reported on Queensland academic Dr Loretta McKinnon missing out on her chance to buy a property in Brisbane after her bank was 13 minutes too late in finalising the settlement.

Negotiations with the vendor have broken down so drastically in the years since that the matter has landed in several courts, in what she claims is a David and Goliath battle.

Last month, the Supreme Court of Queensland ordered that her $29,000 deposit be paid to the vendor, declaring the deposit “forfeited”.

The deposit – which was largely made up of a loan from Dr McKinnon’s dad – had been held in a trust by the real estate agents handling the failed sale since the dispute began in 2021.

To make matters more complicated, Dr McKinnon is currently renting at the property she was supposed to buy, which means the vendor doubles as her landlord.

Also in August, the Queensland Civil and Administrative Tribunal (QCAT) ordered her eviction and gave authority for police to enter the premises to remove her if she is not gone by mid October.

“I am feeling extremely low,” Dr McKinnon said, adding she has no idea where she will be living next month.

Earlier this year, news.com.au reported the vendor also slapped Dr McKinnon with a bankruptcy notice for $448,000 over the failed deal.

She was able to turn the bankruptcy order over due to a discrepancy.

The epidemiology expert was renting a three-bedroom house in the Brisbane suburb of Windsor and made a winning bid of $580,000 for it at auction in late 2021.

Dr McKinnon claims her bank, the Commonwealth Bank of Australia, was 13 minutes too late to finalise the settlement because an incorrect box had been ticked on the documents.

The seller then refused to grant an extension, allowed under Queensland contract rules at the time, and ended the contract.

She believes they did not wish to grant an extension as the sale took place at the height of Australia’s property boom, and the house next door sold for $200,000 more than what Dr McKinnon had won the auction with, just two weeks later.

Since then, Dr McKinnon has been in several drawn-out legal battles trying to take back the property which she claims is rightfully hers.

“It’s disadvantage upon disadvantage,” Dr McKinnon previously said. “So horrendous.”

Do you have a similar story? Get in touch | alex.turner-cohen@news.com.au

The owner of the Windsor property in dispute is Nancy Lee from the prominent Lee family, who have amassed a fortune through a portfolio of more than 50 properties in the Queensland area from Brisbane to Toowoomba since the 1960s.

The family group is headed by Mr Chui Fan Lee. It’s previously been reported that Nancy Lee is his daughter.

However, ASIC documents seem to indicate they have a different relationship. They are only eight years apart in age. Mr Lee is 91 while Ms Lee is 84.

The Lee family have previously made headlines for being involved in other property feuds.

In 2012, the Lee family was caught up in a private property feud with another Brisbane landlord over the maintenance of a 20 metre long overpass in Fortitude Valley connecting to the local train station.

While both sides refused to come to the party, 50 small business owners along the overhead walkway claimed they were slowly going broke with no foot traffic coming their way.

In the end, the state government was forced to intervene and licence part of the walkway.

News.com.au contacted Ms Lee for comment via her solicitor.

Dr McKinnon claims the issue at the centre of her curdled dreams is the fact that a 90-day settlement period was originally granted so she could get enough money together to fund the purchase.

However, during this three-month period before settlement, property prices in Windsor boomed, and the house next door sold for $200,000 more than what Dr McKinnon had won the auction with, just two weeks later.

This was during the 2021 housing boom sweeping Australia which saw the national average of property prices jump by 25 per cent.

As a result, Dr McKinnon claims the vendor wanted significantly more for the property and decided to end the contract over her late settlement.

Previously, the vendor’s solicitor pointed out their client was not legally obligated to grant the extension.

A CBA spokesperson said that the bank “was not a party to the proceedings” between Dr McKinnon and Ms Lee.

In most other Australian states a two-week grace period is given if a settlement goes under, but not in Queensland at the time the settlement was happening. This rule has since changed – but not in time for Dr McKinnon’s plight.

alex.turner-cohen@news.com.au