Homebuyers crying out for a stamp duty tax shake-up

A 20 per cent deposit is always touted as the magic number needed to score your own home — until you’re hit with another huge cost.

ANALYSIS

Imagine getting to the end of a marathon — tired, sweaty, bruised and nearly broken — only to be told you’re not really finished at all.

That you’ve still got to do another 20 laps around the stadium. You’d feel like collapsing on the spot.

Well, it’s the same deflating feeling that first homebuyers get when they discover the hidden truth about stamp duty.

After years of scrimping and saving to get even remotely close to a 20 per cent deposit, they find even that won’t be enough. That they’re going to have to pay tens of thousands more in stamp duty.

It’s money they just don’t have, and it’s money that a bank just won’t lend. It’s a tax on dreams. The stamp duty slug has go to go.

My wife and I have recently endured the highs and lows of buying our first home.

Like many, in the early stages, we were a little naive as to how much stamp duty would obliterate our savings.

RELATED: Chris Urquhart: Russia’s ‘war on Australia’ has already begun

RELATED: Chris Urquhart: Why so many criminals are loose in our suburbs

RELATED: Chris Urquhart: Australians just want politics fair dinkum

Of course, we knew it existed, but the focus in the media, in advertising and elsewhere, is always on saving the magic number for a deposit: 20 per cent if you can.

But that figure is rubbish. Having to pay stamp duty means you need a lot more saved. A hell of a lot.

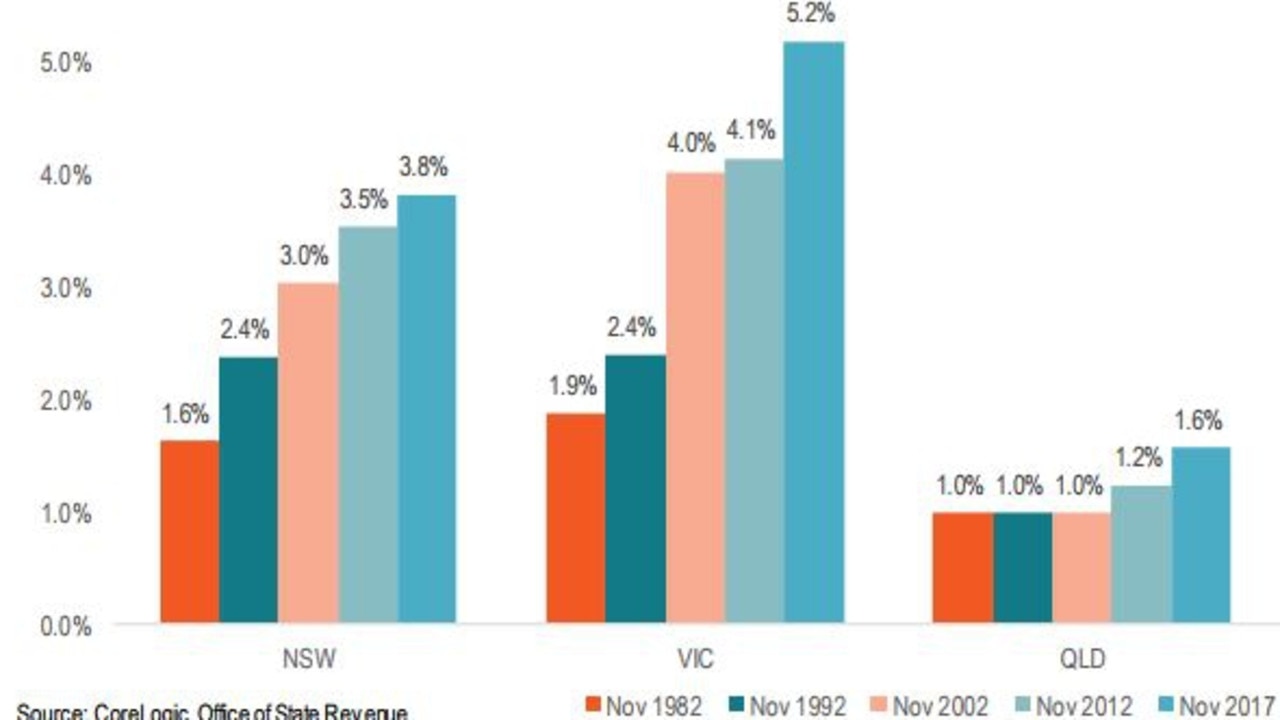

Stamp duty is a state tax that varies around the country but generally ranges from about 3 to 5.5 per cent of the purchase price.

Sure, there are some concessions for first homebuyers in some places, which reduce or eliminate it, but these certainly don’t help everyone and cut out once a property price hits a certain amount.

So, in Sydney, for example, on an $800,000 home — a price still well below the median — you’ll pay $31,490 in stamp duty, whether you’re a first homebuyer or not.

That’s 4 per cent. Four per cent wiped off your deposit savings. Enough to put the property out of reach.

And it’s not just first homebuyers who are affected. Folks who’ve already had a ride or two on the property merry-go-round know the stamp duty slug all too well.

Not wanting to pay it is one of the reasons they don’t move often, if at all — especially older Australians.

How many retirees and empty nesters are rattling around in enormous homes, refusing to downsize because they know they’ll be slugged the stamp duty tax on whatever home they buy. Who can blame them for wanting to stay?

But staying in those homes locks the properties out of the market for younger families who could desperately use the space.

It’s not just state governments who win big out of stamp duty. It’s a boon for banks and insurance companies too. How?

Well, because homebuyers need outright cash in order to pay stamp duty upfront, their money available for a deposit dwindles.

They thought they had 20 per cent deposit, but stamp duty has brought it down to 15 per cent.

Or a 15 per cent deposit has become 10 per cent.

Who comes to the rescue? Banks! With their enormous mortgage insurance premiums!

Or for those who are upsizing, who already have some equity, they might dip into that to make up the shortfall.

Banks write bigger mortgages as people agree to go into greater debt. Their insurance companies make tens of thousands in mortgage insurance. Banks win. Insurance companies win. Homebuyers lose (again!). And the economy loses as well.

Of course, we can’t just abolish stamp duty altogether. States absolutely rely on it. It funds our schools and hospitals. It’s worth about $19 billion annually, nationwide.

But isn’t there a better way to collect it so it doesn’t become such an enormous hit to homebuyers right at the beginning when they need every last cent they can muster? And so it doesn’t keep people locked in place, refusing to move houses, suburbs or cities because of the extraordinary expense if they do?

What if instead of an upfront hit, we were able to pay an annual or quarterly levy, effectively paying stamp duty off over time?

The idea is instead of paying many tens of thousands of dollars as a stamp duty, you might pay a few thousand a year in land or property tax.

The government would still get our money, it’s just that they’d get it over time instead.

People accept they have quarterly or annual commitments like council rates, strata fees, water rates, utility bills or other government bills, and they budget for them accordingly.

Surely, this would be just like any of those that property owners would build into their budgets over time.

Changing to a new system isn’t a pipedream.

The ACT has already made a change, gradually introducing a policy to replace stamp duty over time with broad- based property taxes.

The ACT is doing it over 20 years, phasing out one form of tax and phasing in another. The Grattan Institute argues other states should follow the ACT’s lead. It says doing so “could make Australians up to $17 billion a year better off, while also making housing more affordable”.

Of course, if you’d already purchased a home and paid stamp duty on it, especially if you’ve done so recently, you’d be ropeable with the idea of paying the ongoing tax as well.

No one wants to pay a tax twice. But you wouldn’t have to.

An alternative to phasing taxes is applying it only to purchases from a certain date onwards, or purchasers could be given the choice to pay a lump sum upfront as an alternative if they wished.

There are a range of possible options, all of which are worthy of some consideration.

One other factor to take account of is retirees who own a home not having a big enough income to afford an ongoing property tax or levy.

There could be an option for them to defer the payments and have the government recoup it when the property is sold down the track.

Many economists agree changing stamp duty would be great but admit the difficulty is the political minefield that would create.

If states were to shift, they’d face an initial shortfall in revenue in the early years of the change, and they’d need a bit of help from Canberra to top it up. There’s also a reluctance for any politician to introduce a new tax, even if it’s replacing an old one, because people don’t like an annual bill as a reminder from politicians that they’re paying more. But the saving of many tens of thousands of dollars off the cost of any property purchase would make it worthwhile. It would be good for the economy and makes sense for homebuyers.

Chris Urquhart is a columnist for news.com.au. As a television reporter, he covered some of the biggest stories around Australia and around the world.