Harrowing figures show reality of Australians’ mortgage status

One of Australia’s top banking executives has given new insight into the grim future for countless homeowners.

The number of Australians defaulting on their mortgages could reach previously unseen heights, according to one of the country’s top bankers.

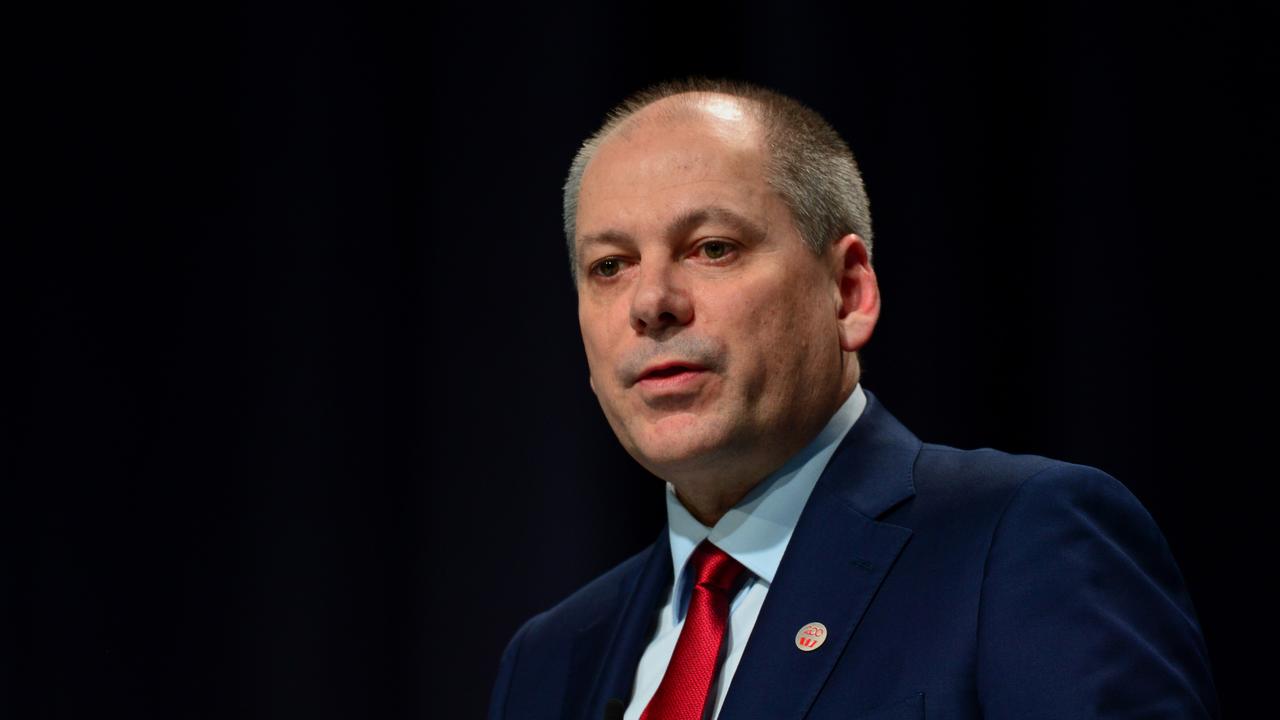

Westpac chief executive Peter King told a told a business summit on Tuesday the next year will result in a spike in the number of customers unable to make their home repayments.

Mr King said this can be largely attributed to the 10 consecutive interest rate hikes over the past 11 months.

“Interest rates are a blunt tool. What we’re looking at in our portfolio is who might need help,” Mr King said.

“The part of the portfolio we’re watching very closely (is) high debt to income — that’s people who borrowed to their maximum debt capacities.”

Research from SQM revealed as of March 2023, the number of properties selling under “distressed conditions” had increased to 6220 from 5917 the month before.

“The increase in distressed selling activity was mainly driven by a rise in New South Wales, Victoria and Queensland,” a statement released on Tuesday said.

From March 2022 to 2023, distressed listings in NSW surged by 68 per cent.

“These trends indicate that the Australian real estate market is still grappling with the impact of economic uncertainty, with an increasing number of residential properties being sold under distressed conditions,” the SQM statement said.

The Reserve Bank board left the cash rate on hold, for the first time in a year, at 3.6 per cent when it met last Tuesday.

But homeowners hoping it could spell the end of the RBA’s tightening cycle could be in further pain later in the year.

“The board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target,” governor Philip Lowe said.

“The decision to hold interest rates steady this month provides the board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty.”

Mr Lowe said the bank would be paying close attention to trends in household spending, inflation and labour market data ahead of its next meeting just before the May budget.

“The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that,” he said.

Since May last year, the RBA has aggressively lifted rates from a record low of 0.1 per cent in a bid to curb high inflation.

Inflation rose to 6.8 per cent in 12 months to February, falling from 7.4 per cent annual growth in January and down from the peak of 8.4 per cent in December.

But it is still well above the bank’s target range of two to three per cent.

ANZ boss Shayne Elliott said challenges for Australian homeowners were far from being over.

“The world is different when you’re living in a world with rising interest rates. To paraphrase a quote from economist JP Morgan, ‘When the Fed put the brakes on the economy, somebody always goes through the windscreen’,” he said.

More Coverage

“So we should remain alert, not alarmed. I don’t think we’re heading for another huge crisis but that doesn’t mean there isn’t turmoil and that won’t impact people.”

The central bank’s board lifted the cash rate in March to its highest level since June 2012.

Mr Lowe said inflation could be brought back within the target range of 2 to 3 per cent by mid-2025 and tempered predictions there would be multiple rate rises to come, in a move away from his previous analysis of pending rate hikes.