Gen Z, Millennials confirm sad truth about Australia’s future

Australians have confirmed a grim truth about our country that can no longer be ignored – and it hints at a bleak future for our youngest generations.

For many Australians, owning a home is still considered one of the key things to strive for, but for our youngest generations home-ownership is increasingly being viewed as nothing more than an unattainable dream.

Different generations love to argue about who had it harder when getting into the property market, but there is no denying that first home buyers face today face very different circumstances than their parents and grandparents.

In 1984, the average Australian could buy a home that cost 3.3 times their annual income.

But in 2023, the average person is facing house prices that are 10 times their annual salary.

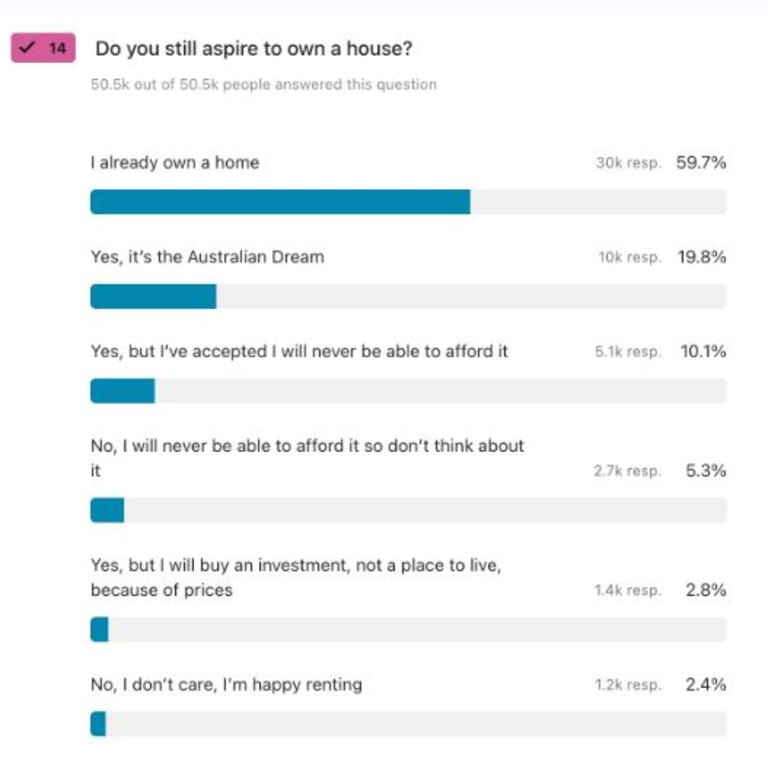

More than 50,000 Australians participated in news.com.au’s Great Aussie Debate survey. Participants answered 50 questions, revealing their opinions on everything from work and politics to using your phone on the loo and wearing shorts in the office.

One of the questions Aussies were asked is whether they still aspired to own a house, giving a telling insight into how young people really feel about entering the property market.

The majority of respondents to this question said they already owned a home, with over 70 per cent of people aged 60 and over choosing this option.

Gen Z and Millennials were far less likely to already own property, with just 26 per cent saying they owned their own home.

Of the respondents, almost 20 per cent – or more than 10,000 people – said they still aspired to own their own home, labelling it “the Australian dream”.

However, people in the 18-29 age group were more likely than other Aussies to say they wanted to own a home but had accepted they will “never be able to afford it” and therefore “don’t think about it”.

People in NSW were the most likely to agree that they wouldn’t be able to afford a home, with 12 per cent of people choosing this option, which was two times higher than people from Western Australia.

Aussies were less likely to buy an investment property rather than a place to live in due to house prices, with 2.8 per cent of people choosing this options.

Of the more than 50,000 people who completed the survey, 2.4 per cent said they didn’t care about owning a home and were “happy” renting.

Young people haven’t been quiet about the growing sense of disillusionment they feel about achieving their homeownership dreams.

As a result, there is an increasing number of Gen Zers pushing the idea that they should just enjoy their money while they can, seeing as they will never be able to afford a house anyway – with this sentiment reflected in a growing number of social media posts and videos.

Bella Clinton, a popular TikToker, recently shared a video of her on holiday explaining she spent her house deposit on a European trip because Sydney house prices are “overpriced and the weather is sh*t anyway”.

Another couple that recently came to this same conclusion decided to spend the money they were saving for a house and travel around the world.

“POV: You hit your late 20s and decide to spend your house deposit on travelling the world instead,” they wrote over videos of their travels.

“We’re six months in and we wouldn’t change a thing. It was a scary decision but so worth it.”

One young Twitter user explained the reason they spend their money on travelling and seeing friends is because they know they’ll “never own a house in my lifetime”.

“I spend it on travelling to friends, because some day that money will disappear to rent/bills anyway, and I may never have that amount again,” they said.

Another person claimed that they “have money in the bank for a house I’ll never afford”, adding that they should probably just go on a holiday instead.

Richard Whitten, home loans expert at Finder, told news.com.au that younger Aussies face the biggest hurdle when it comes to home ownership.

“It’s a sad reality for young Australians in particular who are faced with the prospect they may never be able to own a home,” he said.

“It’s understandable that some young Australians are simply giving up on the home owning dream. Saving a deposit looks like an impossible goal, let alone handling loan repayments.”

He said that, while it is not necessarily a wise attitude, it does make sense that young people would be giving up on owning property and instead spending their money on things they enjoy.

“It makes sense that some young Australians, having given up on property, focus instead on spending what they have and enjoying themselves,” he said.

“If property is out of reach, then there’s nothing to sacrifice for financially. So you might as well enjoy your disposable income and live it up.”

University of Sydney economist Gareth Bryant, recently told news.com.au that the problems facing Millennials and Gen Zers wanting to buy their first home are very different from the ones faced by Boomers.

High interest rates, recession and wage stagnation were all very real challenges in the late 1980s and early 1990s when a lot of Boomers were getting into the property market.

“The increase in interest rates briefly saw mortgage repayments on new loans hit on average 30 per cent of income – a common measure of housing stress. That is now the norm, and not a temporary spike in costs,” Dr Bryant said.

“But we are talking about two very different problems. In the late 1980s and early 1990s it was an income problem of people being able to afford repayments. But because house prices were much lower, it wasn’t so much of a wealth problem.

“In the late 1990s house prices were around 2-3 times average incomes depending on where in Australia you were. Now that figure is 7-10 times, meaning the problem is having enough wealth to get into the property market in the first place.

“Many Millennials could actually make mortgage repayments, but struggle to get the deposit.”