From $40k to 38 homes: how to build a $14m property empire

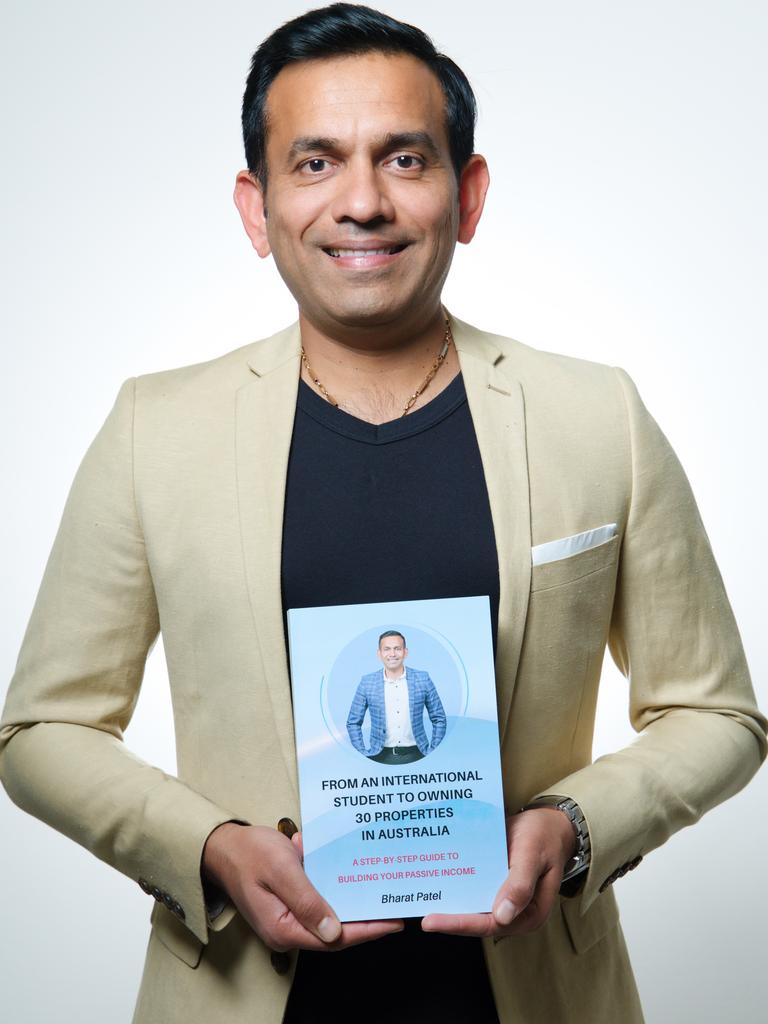

A former uni student who turned a measly $40K into a staggering 38-property empire is revealing his secrets to help battlers break into Australia’s brutal housing market.

An Aussie property mogul who turned a measly $40K into a staggering 38-property empire is revealing his secrets to help battlers break into Australia’s brutal housing market.

A standout among property investing peers, Bharat Patel was once a cash-strapped international student at the University of Technology in Sydney and now sits on a jaw-dropping $14m asset base – buying five properties so far this year alone across Queensland, Tasmania, and Darwin.

His bold claim is that even if you’re scraping by on $50k a year right now, you can still buy property in Australia.

MORE: Tradie’s colossal 5.5m find in Aus backyard

Million-dollar shock: Most Aussies now priced out of house market

MORE: 56 suburbs where Aussies suffer most

Inside slumlord’s crumbling empire: derelict, unliveable, worth millions

Mr Patel, who set up Cashflow Properties to help others repeat his success, believes a mindset change is required for his shockingly simple strategy of starting small but thinking big, leveraging the bank’s money, zeroing in on growth markets – rinse and repeat 40 times.

“A strong mindset is important, even if you are someone who is currently on a low income $50,000 or $60,000, you can still you can buy property in Australia as long as you know where to buy your first property. If you have $30,000 to $40,000 yes, you can still buy property in Australia in 2025.”

“It’s all about buying the cheaper property first, leverage from the bank, and you have to be ready to buy the next property where market is moving so you are buying in a growing market.”

“Your equity will be there to support you for the next property as long as you buy the right property at the right time with the right price tag.”

MORE: Property shake-up: Big bank flags surprise trends since rate cuts

Shock twist as former Virgin CEO to tear down $17m mansion

For him it is all about buying cheaper first and then snowballing rather than going for $2-4m home first off and being stuck with it.

“Start small scale, and don’t just sit back and relax. Use your opportunity if you have it.”

“It was extremely challenging for me to buy 10 properties initially in 10 years, and then it started getting easier because I knew the success, the resources, the markets which are going to boom, so that I made decisions quite easily.”

His book called “From an international student to owning 30 properties in Australia” is a step-by-step guide to building a passive income stream for retirement, and available from Amazon, Apple store, Google and in bookstores like Booktopia and Dymocks now.

“I’m purchasing my 38th property as we speak, but in the book I just mentioned my first 30 properties and how I started with almost nothing after my university degree at UTS, and then, slowly, one property at a time, I just built my property.”

MORE: Aus cities break into global top 10

Inside new liberal leader’s property portfolio

“The main purpose of the book is to give confidence to people who may be on a low salary, and are thinking that in Australia, they cannot buy any property – which is false. As long as you understand where your position allows you to buy something as a stepping stone, you can always build your property portfolio later.”

He used a combination of purchase vehicles to lock in his last few five homes, buying one via superannuation, and four in personal names and a family trust he created.

”It depends on which property it is, where I am buying, and what the purpose is out of that property as well. The one I purchased in Darwin was from our family trust. Noone was buying in Darwin, but I can see there are lots of opportunities in Darwin nowadays.”

He used superannuation to buy a Gladstone property in Queensland. “It’s doing extremely well, similar to what happened growth-wise in Townsville, also Rockhampton is also moving up as well.”

Mr Patel said the affordable stock of properties across Queensland made it a strong target for investors.

”Obviously the whole of Queensland is on the next horizon in terms of infrastructure because of the Olympics coming, not only Brisbane but the majority of the regionals are also experiencing the boom. So because of the affordability, because of the low stock, and because not many properties are going to be available due to the construction crisis, it’s definitely a growth corridor.”

Mr Patel said he was now looking to diversify state-wise too, looking at Northern Territory and maybe one more in Tasmania, as well as commercial properties.

”My ultimate goal is to hit 50 properties, the sooner, the better. I will try. I will work on my debt consolidation strategy as well because obviously every property brings you debt. At some stage you have to consolidate your debt again, it is all good debt so depending on my age and retirement plan, I will start consolidating my debt after hitting 50 properties.”

Originally published as From $40k to 38 homes: how to build a $14m property empire