First home buyers’ ultimate dilemma amid falling house prices

House prices are plummeting — and they have further to fall yet. But with these falls comes an agonising choice for Australians.

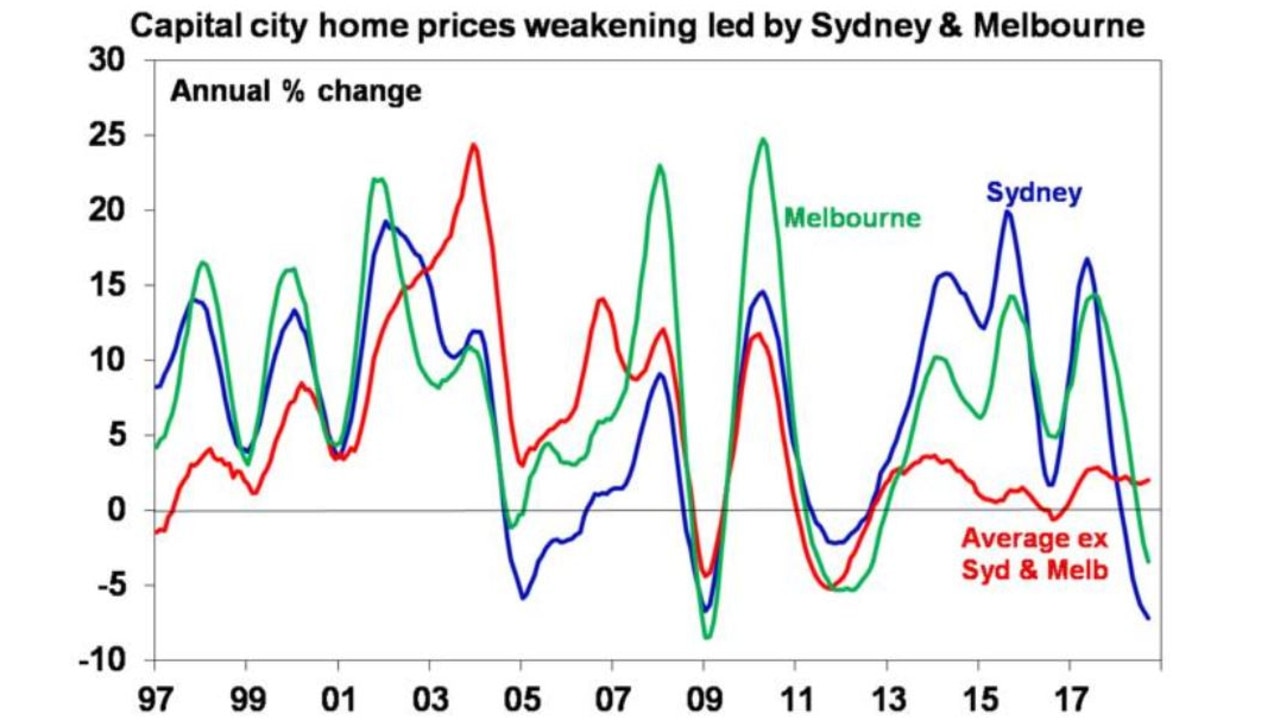

As house prices nationally reach a 6 per cent fall over the past 12 months, the resurgence of first home buyers has dominated the conversation.

After strong falls in Sydney (down 8.2 per cent) and Melbourne (6.5 per cent), first home buyers now represent about 18.1 per cent of the market, according to Australian Bureau of Statistics’ October figures.

That’s well up from the low of 12.9 per cent during the hottest years of the housing boom in 2015. But still a way away from the heights reached in May 2009 when first home buyer incentives helped an entire cohort into homeownership, pushing them to 31.4 per cent of new buyers.

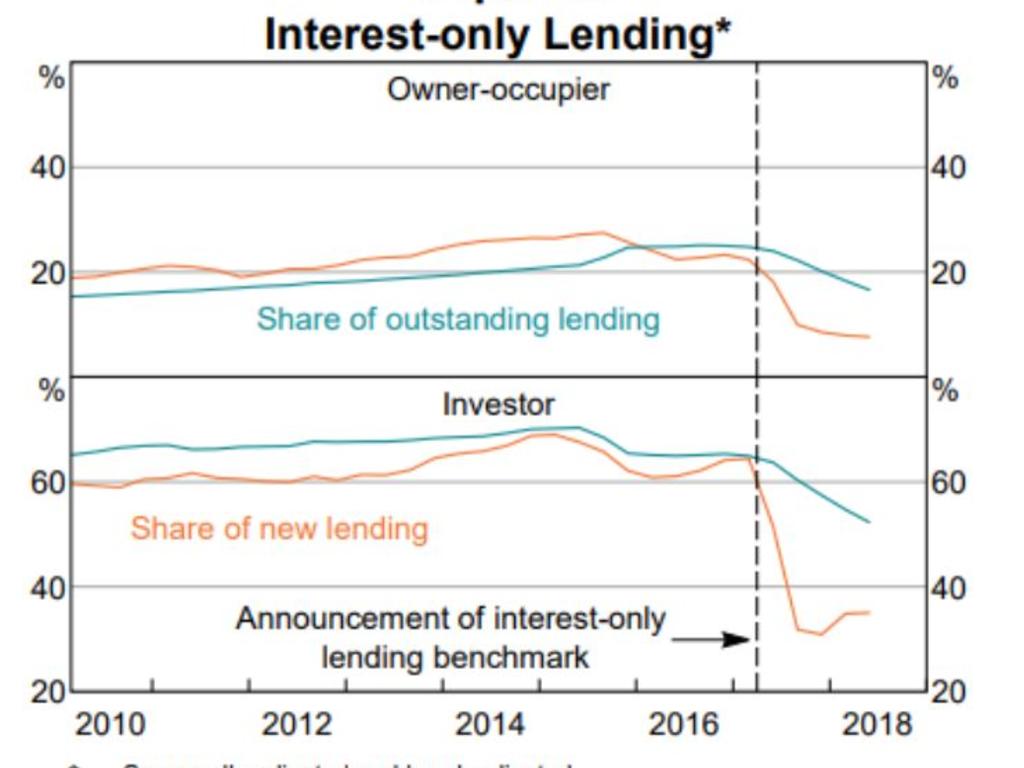

That’s not to mention the pullback in investor lending, which at the peak of the market accounted for more than 60 cent of new loans.

Real Estate Australia group senior economist Nerida Conisbee said first home buyers were benefiting from the investor retreat.

“First home buyers and investors both target similar price points,” she told news.com.au.

“Now that investors have pulled back, first home buyers have had the market to themselves.”

RELATED: Good news for first home buyers

RELATED: First home buyers’ renewed confidence

But, she said, the continued house price falls were leading some in Sydney and Melbourne to hold off, in the hope prices continue to fall.

“There’s not that urgency that we saw when prices were rising so rapidly,” she said.

“In Melbourne and Sydney the market is continuing to drop and when the market is falling people tend not to be in such a hurry.”

FIRST HOME BUYERS STILL CAUTIOUS

Lana Beverly and her partner have been looking for somewhere in the Ivanhoe area in Melbourne’s northeast and decided to make the leap after finding a dream place in their price range.

“We had the same dilemma as a lot of first home buyers have at the moment — do we buy what we want or do we sit and wait?” she said.

“But it’s not every day that you find the right property at the right price.”

But the 1950s-style brick apartment ended up going for almost $100,000 more than the expected $540,000, which put it totally out of their price range. The whole experience has left her unsure about what to do next — whether to wait and see if the market continues to fall or try again.

“I just think that no one knows what’s going on in the property market at the moment,” she said.

“We’re realising that it’s not going to be as easy as we thought, so we’re going to watch from a distance and think and hope and pray in six months time it might be more in our favour.”

First Home Buyers Australia director Taj Singh said many Aussies were unsure about what to do.

“If they wait, they may have to compromise and buy something that’s not their ideal property,” he said.

He said buyers who were looking at apartments were particularly cautious, with the issue of oversupply threatening to hurt values for anyone who bought now.

“Oversupply freaks out a lot of people. If they see oversupply they may not touch that area,” Mr Singh said.

MORE PRICE FALLS TO COME

AMP Capital’s Shane Oliver still thinks house prices are overvalued.

He recently predicted price falls of up to 20 per cent in Sydney and Melbourne, up from their earlier predictions of 15 per cent.

“By some measures, prices are still about 29 per cent overvalued,” he said.

Weak clearance rates, with less than half of properties taken to market selling, support Mr Oliver’s claim.

He said even if house prices continued to fall another 10 per cent in Sydney and Melbourne next year, they would remain overvalued.

Ms Conisbee said perspective was needed on recent price falls.

“Sydney from peak to trough will fall about 15 per cent; Melbourne will fall about 10 per cent,” she said.

“We do need to put in perspective (that) prices in Sydney and Melbourne doubled over a very short time period. Even if it does decline it’s a very minor decline”