First home buyers: how to save for a house deposit

Saving for a house deposit is no easy feat. But one couple have proven that sticking to a budget can reap huge results.

When Miraz Rossy and his wife Dippanita Mushfiq decided to jump on the property ladder, they saved an impressive $120,000 in three years under a strict savings system.

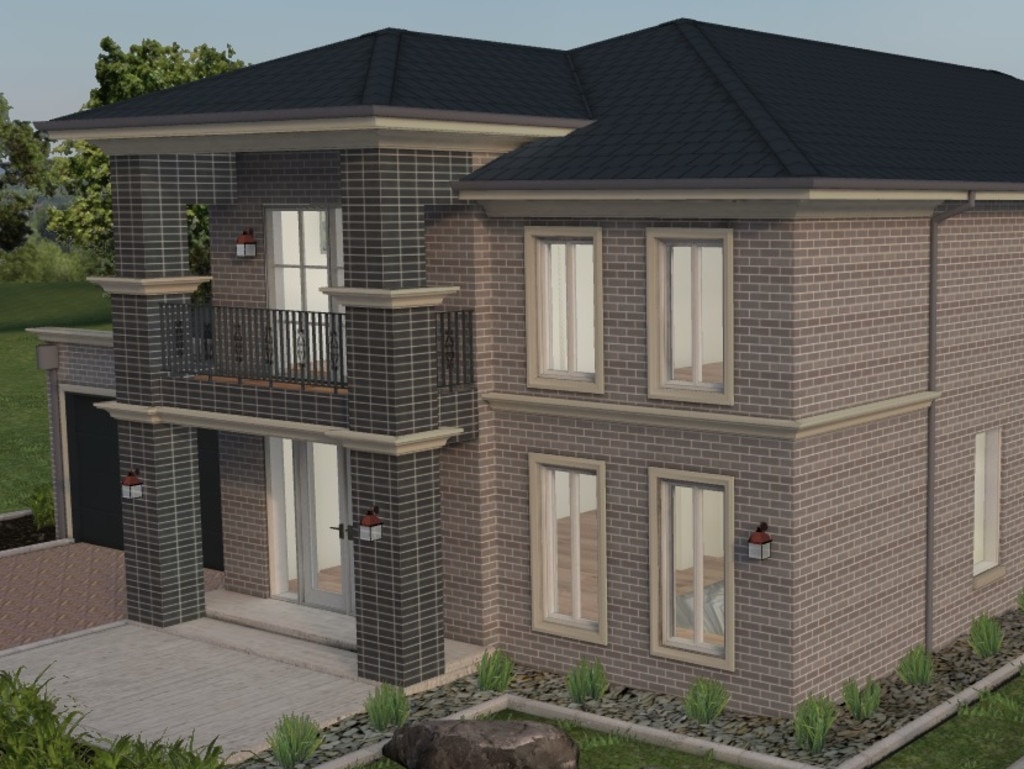

Rather than purchasing an existing house, the couple decided to build their family home in south west Sydney.

The couple, who work full-time in the heath and engineering sector, bought a 380sq m corner block for $400,000 after a chance visit to the office of property development company Stockland, back in December last year.

Want to save for a home deposit? Read about how much you might need on Compare Money >

“We didn’t have much hope that we’d get the land but luckily we went in that day and they released four blocks of land,” Mr Rossy said.

“Right away we put down our 15 per cent deposit and our journey started.”

The pair eventually settled on a $360,000 basic home building contract with additional fencing, landscaping and a spa.

The couple’s five bedroom home started construction almost two months ago, but has paused due to current Covid restrictions – with an expected completion of January 2022.

Mr Rossy said they were able to save for their deposit through a “strict budget”.

“My wife saved all her money in a bank account for the house and I took care of our needs by spending my income,” he said.

Despite renting an apartment while saving for a home, Mr Rossy said their budgeting was “pretty comfortable” to manage by dividing their money into three separate accounts.

“The first was the joint main savings account for our house and the second account was for saving a little bit of my salary,” he said.

“The third everyday account was for any leftovers at the end of the month … so if we need to spend that money we can or we can move it back into the main savings account.”

They also stored some of their money in a term deposit account for a year so they “weren’t tempted” to spend their hard-earned savings.

The mechanical engineer added he’ll continue to use their savings method to pay off the mortgage for their two storey, double garage home.

Mr Rossy said their bank applied for the first home buyers grant on their behalf, but are still waiting for approval. Once given the green light, the bank will repay the couple the $10,000 – which will be used for their deposit to “save on some interest”.

While it can seem daunting to start saving for a property, Mr Rossy said buyers need to remember budgeting is the most important step.

“They need to set a goal of how much they’re going to save for their house each month and they need to be strict on that,” he said.

If you have a salary of $5000 and your goal is to save $1500 per month, Mr Rossy advises to immediately save and play around with any money you’re left with.

“They have to save that amount no matter what. So whenever they get their salary they need to transfer it straight into the savings account.”

He also advises home buyers to keep track of where their money is being used when purchasing a house and land package.

“Expect to spend another $20,000 to $50,000 on top of the initial building price and check all documents and drawings for the home closely,” Mr Rossy said.