‘Don’t hate the player’: 24yo landlord’s big rental claim

A 24-year-old landlord has revealed why you shouldn’t “hate the player” and why it is “easy” being a landlord in 2024.

Australia’s housing crisis has led to landlords being seen as divisive figures, but one young Aussie has explained why he isn’t too bothered by it.

Mortgages are rising across the country and the cash rate is currently sitting at 4.35 per cent. There are also record-low vacancy rates, with the national average 0.7 per cent.

Plenty of tenants have expressed fury at their landlords increasing their rents to cover their ballooning mortgages and there’s been a never-ending stream of young people going viral for revealing their various housing dilemmas.

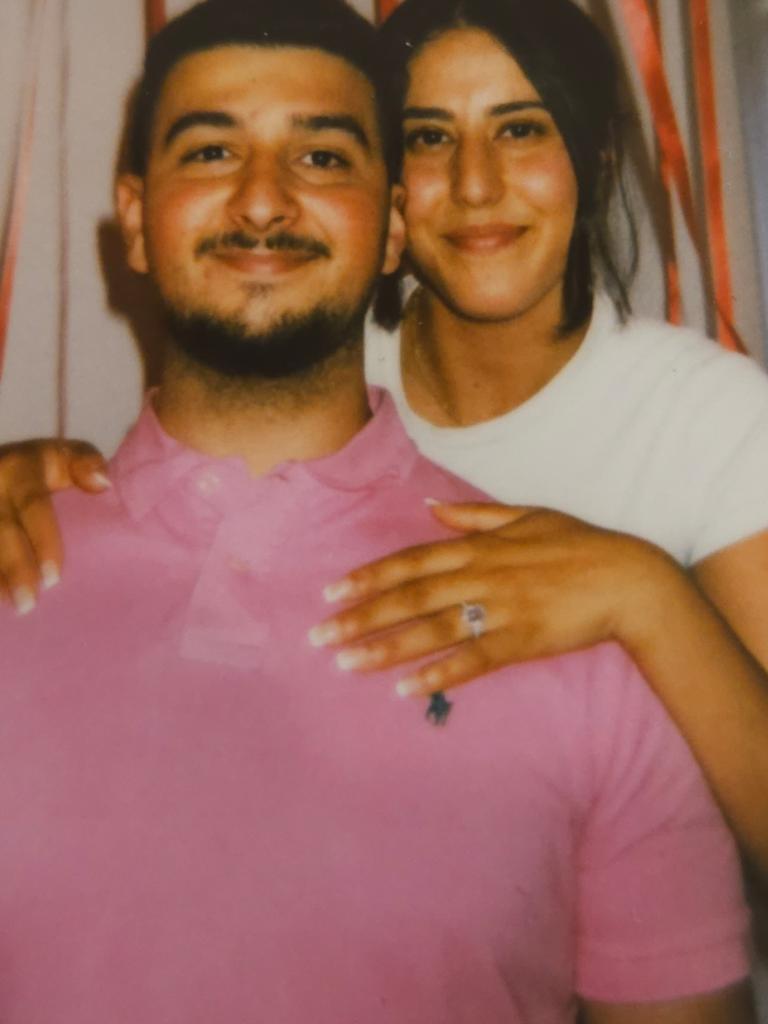

While their peers might be complaining about rental rises, Terry and Monique haven’t even hit their mid-twenties and have already amassed a property empire.

Terry, 24, and Monique, 23, own three properties together: a three-bedroom house in north Melbourne, a four-bedroom home in Melbourne’s northwest, and a block of land in Ballarat.

Terry isn’t concerned about the stigma of being a Gen Z landlord.

“I’m unsure of a better way to phrase it other than don’t hate the player hate the game,” he said.

He said that the banks were passing on interest rate increases and therefore property owners “have to pass it on to the renters”.

The couple have amassed their property empire while earning average wages. Terry works in management and takes home $85,000 and Monique is earning $50,000.

The pair bought their first place with the help of two government grants. They received $10,000 from the First Homeowner’s Grant and an extra $25,000 from the Home Builder Grant, which they combined with their $50,000 in savings.

They were able to buy the second property because Monique had $100,000 saved. They were able to purchase the land by putting down a 10 per cent deposit of $30,000, and they will look to build a home on it after their wedding.

The 24-year-old said he saved up the bulk of his money during the pandemic lockdowns because he “couldn’t leave the house” and he also took on second and third jobs to make up the rest.

The couple rent out their second home in northwest Melbourne, but their tenants still aren’t covering the mortgage yet.

“The mortgage on all the loans is around $8000 a month, while the interest rates are at the highest I’ve seen in my lifetime,” Terry told news.com.au.

Terry said that the couple is “roughly $2000 a month out of pocket now”, but the plan is to eventually generate a passive income from being landlords.

So far the most surprising thing about being a landlord for Terry is “how easy it is” and that it hasn’t involved much stress.

“The real estate agent does most of the work the most important step is the tenant screening process. I’ve heard nightmare stories from co-workers that helped me realise how important the screening process is,” he said.

The couple were able to amass their property empire because they weren’t afraid to look further afield.

“I understand that proximity to the CBD is a huge factor for some people for various reasons, like work, but for Monique and me, it is important to be focused on the future and building our portfolio,” he said.

“We looked outwards to areas with high capital growth and rental yield and low vacancy rates.”

Despite Terry’s success, he still believes it is very difficult for young people to get into the property market.

“It is extremely difficult to own a house, for not only young people, but for everyone. Just looking at the cost of property compared to the average wage 30 years ago.”

Property investment adviser Anissa Cavallo said her best advice to young people who are desperate to get on the property market but can’t afford to buy in an area they want to live in is to embrace “rent investing”, buying a property solely to rent it out and then continue to live in a suburb that works for your lifestyle.

“Rent vesting is getting more prevalent and attractive as people give up on owning their dream home,” she said.

“Find areas that you don’t want to live but that you can afford. It’s only going to get more out of reach so my advice is to find a way to get in.”

Ms Cavallo said that the biggest mistake she sees young people make is sticking to a central suburb rather than making a smart investment.

“Buying where you want to live and not doing the numbers” is the most common mistake, and when it comes to real estate, don’t let your “heart guide”, she recommended.

“Do the maths,” she said.