Big bank’s huge rates call amid property confidence spike

Aussies have had a massive upswing in property confidence, as one of Australia’s biggest banks tips a return to pandemic era rates.

Aussies have had a massive upswing in property confidence after three quarters of falls the latest survey found, as one of Australia’s biggest banks tips a return to pandemic era rates.

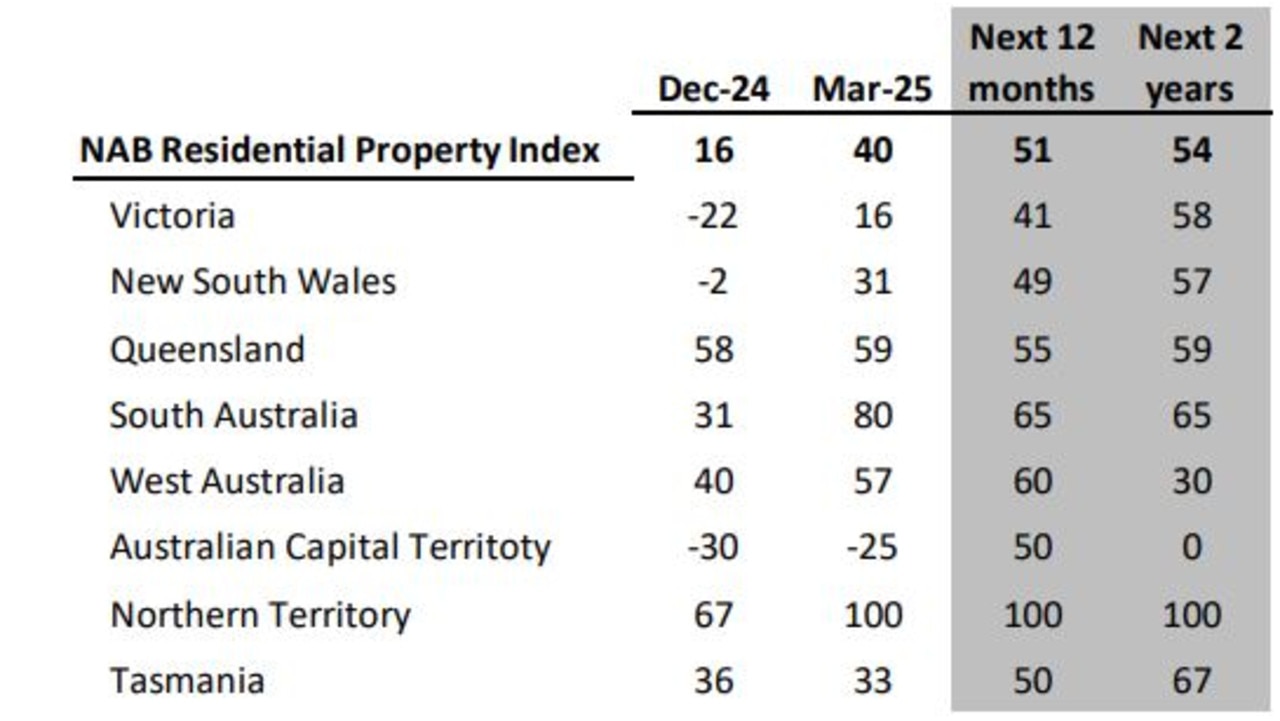

The NAB Residential Property Index, released Friday, surged to ‘well above average +40 in March, after moving lower in the previous three quarters” - with the expectation that it will hit 51 in the next 12 months and 54 in two years.

MORE: Shock: Brisbane prices to smash Sydney

Greater Brisbane land values pass Melbourne for first time

MORE: Four cuts: Aus bank’s huge move before RBA

May interest rate decision already made for Reserve Bank

NAB executive chief economist Sally Auld expects easing interest rates to support growth and the economy to have a “soft landing” with inflation settling around the middle of the RBA’s target band by the second half of this year and unemployment staying below 4.5pc.

“That said, there are building headwinds in the global economy and shifts in US trade policy are likely to be net disinflationary for Australia. Consequently, the RBA will need to normalise rates quickly to ensure policy is appropriately calibrated. We now see the RBA cutting to 3.1pc by August and then taking the cash rate to 2.6pc by early-2026.”

The cash rate target was last at 2.6pc in October 2022 - which was at the tail end of pandemic lockdowns.

MORE: See the Aussies who put their pets first when buying a house

Australia’s biggest political property moguls revealed

The latest survey found house price growth expectations for the coming 12 months had almost doubled, at 2.3pc (1.2pc previously) while property professionals were also expecting rent growth to accelerate in the coming year (2.2pc vs 1.6pc previously).

NAB head of home lending Denton Pugh said “house prices are on the rise again, with the market picking up across most of the country over the March quarter”.

“The NAB Residential Property Index rose to +40, showing that people are feeling much more positive about the housing market,” he said.

“With the Reserve Bank cutting interest rates in February, we’re seeing lending activity pick up across the board encouraged by improved conditions and lower interest rates.”

“We expect more buyers to return to the market throughout 2025 and prices to continue their modest gains into the winter months – especially in capital cities where homes are still in short supply.”

MORE: Un-beer-lievable: SEQ costlier than Melbourne for housing, food, grog

Mr Pugh said housing affordability and supply were long-term challenges that needed long-term solutions.

“It’s encouraging to see governments prioritise housing, but there’s still a long way to go,” Mr Pugh said. “There’s no simple fix, solving Australia’s housing challenges will take collaboration across the board.”

“Business, government, and community groups need to work together to create more opportunities for Australians to find affordable homes.”

Originally published as Big bank’s huge rates call amid property confidence spike