Australian suburbs with mortgages set to rise the most after RBA rate hike

It costs $32,000 a month just to live in this Aussie suburb — but only six years ago it was nearly half that amount.

Some suburbs in Australia are in for a whole load of mortgage pain as they could be about to pay more than double the amount on their home compared to just six years ago.

Homeowners are facing skyrocketing interest rates after the Reserve Bank raised rates in its May monthly meeting for the first time in 12 years.

Another meeting is scheduled for next week and economists predict by year’s end the cash rate will be sitting on 1.75 per cent.

Data from PropTrack found that new homeowners across the country are forking out as much as double that of their predecessors from 2016 to keep on top of mortgage payments.

And it could be about to get worse, if the interest rate continues to rise.

One standout suburb will have to cough up an eye-watering $32,000 to the bank every month to stay on top of their mortgage.

With the values of properties increasing by staggering levels in recent years, homeowners have been left to foot a hefty mortgage bill.

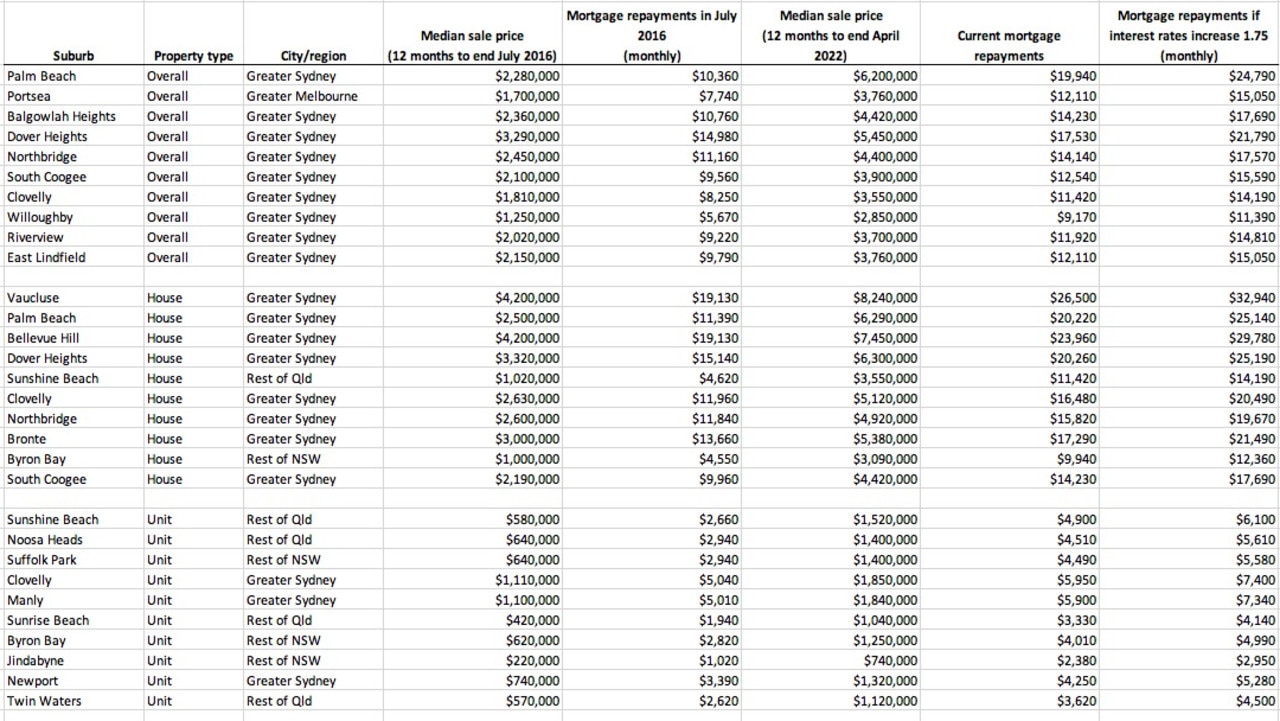

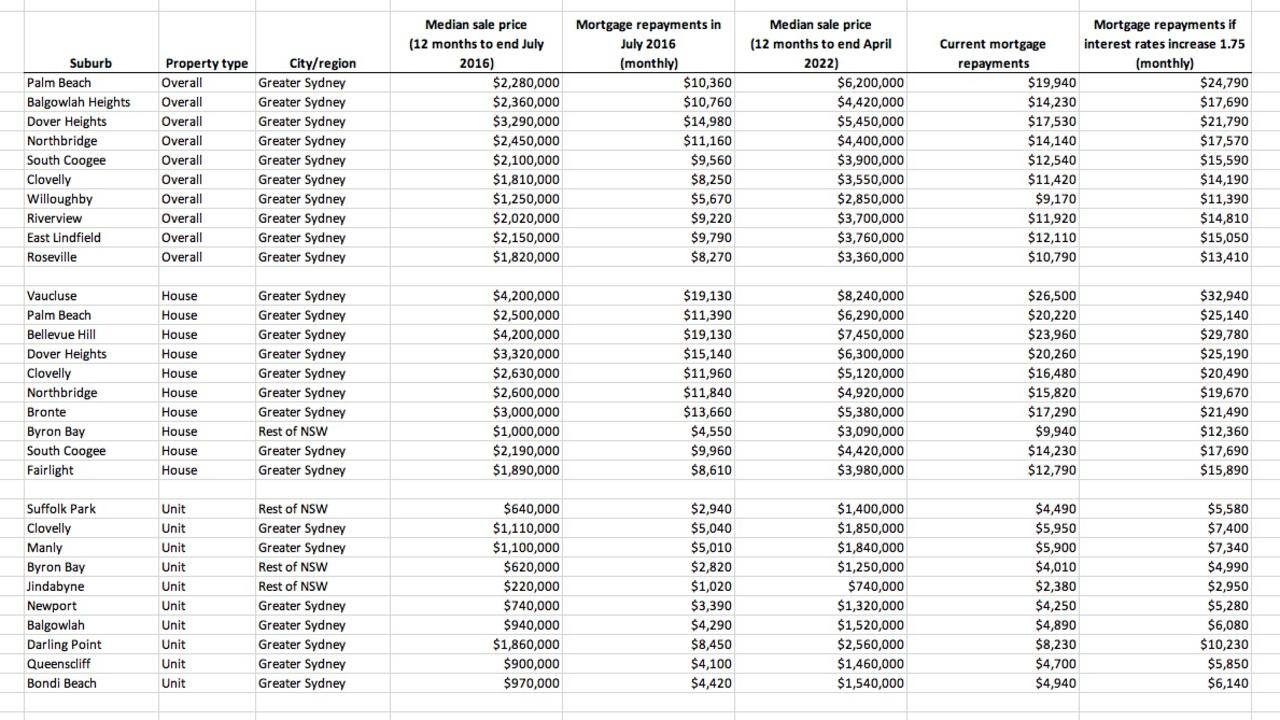

Unsurprisingly, nine worst suburbs in the country in terms of overall mortgage repayments were in Sydney, with just one in Melbourne.

Sydney as well as regional NSW and regional Queensland also topped the charts when it came to houses and units with the largest monthly debts to pay.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Nationally, Vaucluse, in Sydney’s eastern suburbs, came out as a clear loser in terms of mortgage repayments for houses.

By the end of the year, the average person living in a house in Vaucluse will be paying nearly $33,000 every month to their bank for the privilege.

Currently, Vaucluse residents are paying an average of $26,500, far outstripping every other state in the country.

It isn’t too hard to see why — the median sale price for that suburb is a whopping $8.2 million.

That’s compared to the average mansion being worth $4.2 million in 2016, with mortgage repayments standing at $19,000 per month.

Other houses in suburbs in Sydney’s east, including Bellevue Hill, Dover Heights, Clovelly, Bronte and South Cooggee, scraped their way into the list.

Two northern Sydney suburbs — Palm Beach and Northbridge — also got an honourable mention.

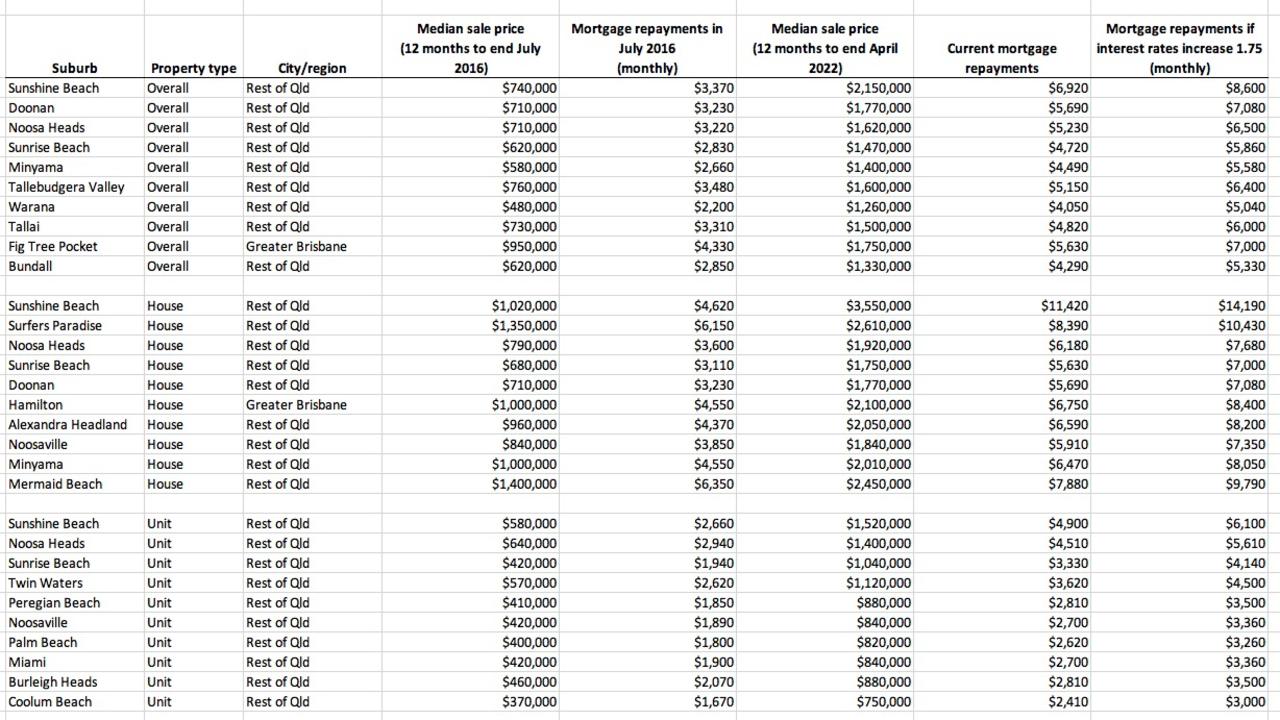

Sunshine Beach in the Queensland locality of Noosa was the only non-NSW suburb to make it into the top 10.

Byron Bay in northern NSW also scraped into the top 10. Homeowners in the controversial beachside town will pay $12,000 every month in mortgage, on average, by the time the rates rise to 1.75 per cent.

Another plush Sydney suburb in the Northern Beaches, Palm Beach, also didn’t come up too good in the data.

It topped the charts for all the wrong reasons — for being the most debt-intensive suburb out of all the houses and units in the country.

Currently, residents are paying nearly $20,000 a month towards their mortgage — but that is set to rise to nearly $25,000 by the end of the year if the rate rise follows industry forecasts.

New homeowners have to scrape together $6.2 million to enter the suburb, going off its average price, compared to just $2.28 million in 2016.

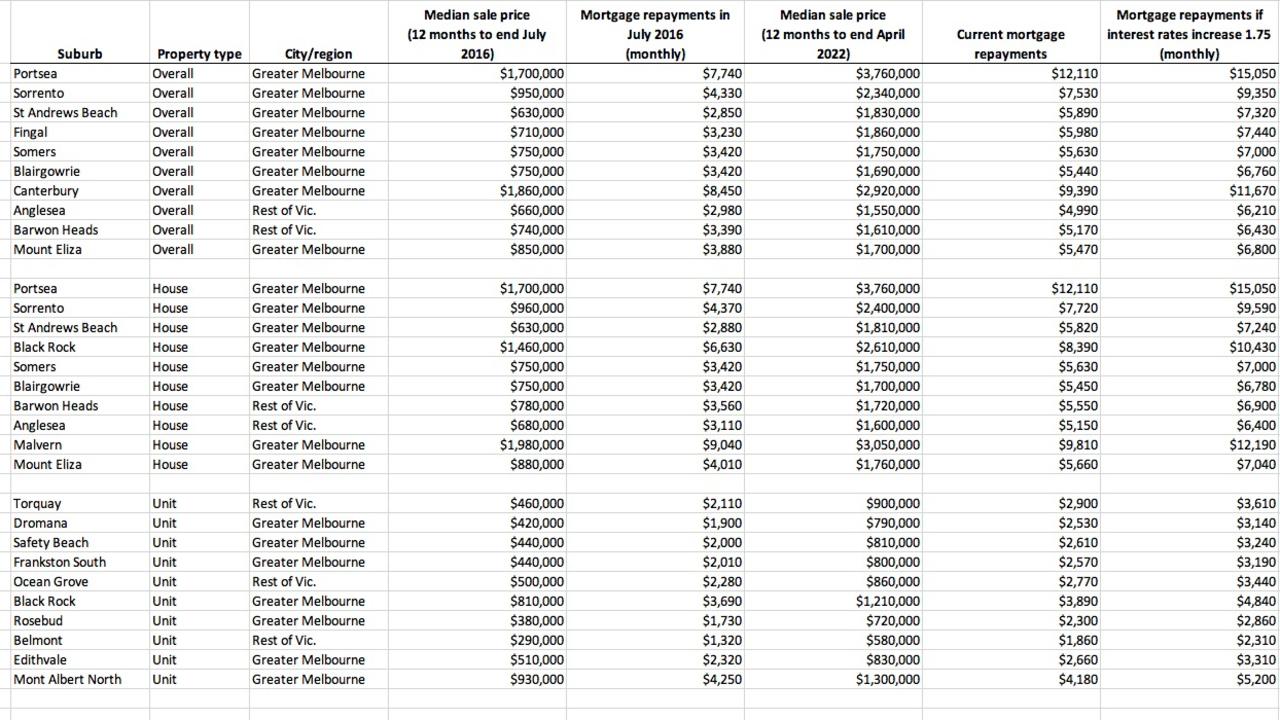

Portsea along Melbourne’s Mornington Peninsula came second on the list from the sheer amount that mortgage repayments have risen in the space of just six years.

In mid-2016, the mortgage cost $7,700 every month on units and homes in Portsea.

Currently, the mortgage is $12,000 but it’s expected to surge to $15,00 — which is nearly double its 2016 amount.

Sydney’s eastern locale of Dover Heights will also feel the sting of the rising rates, with units and houses in the area hit with average monthly payments of nearly $22,000 by the end of the year.

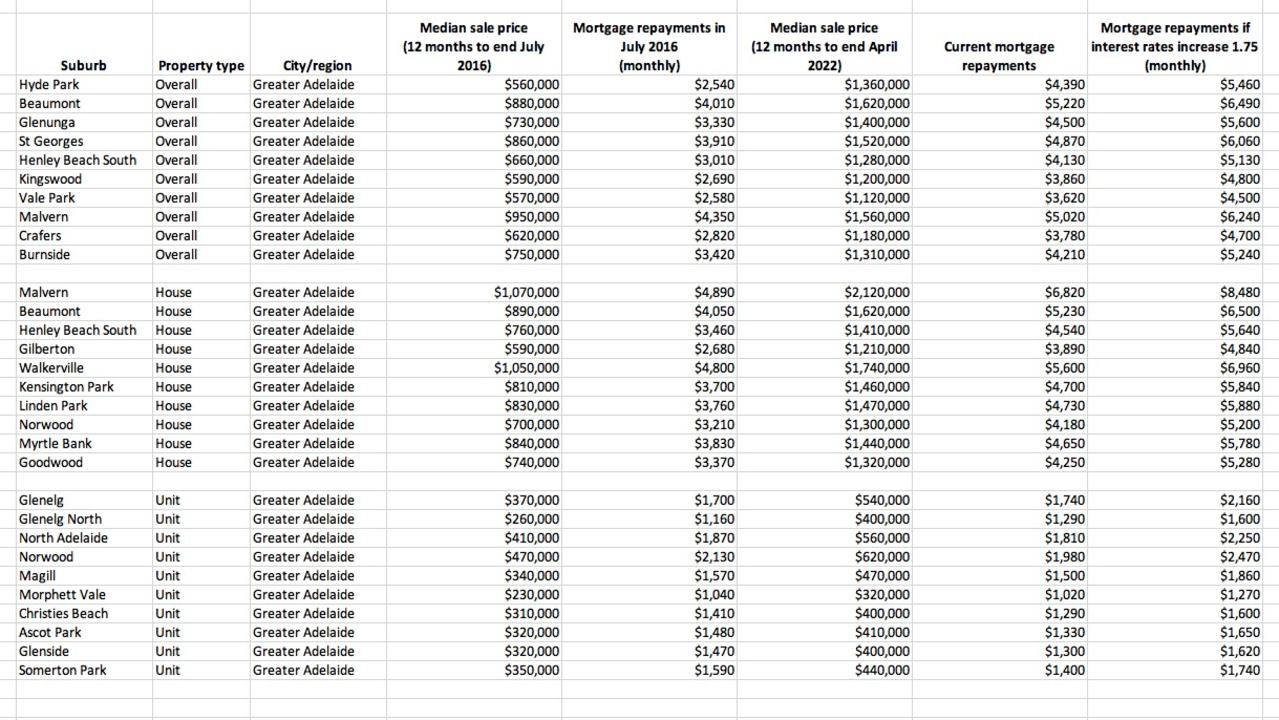

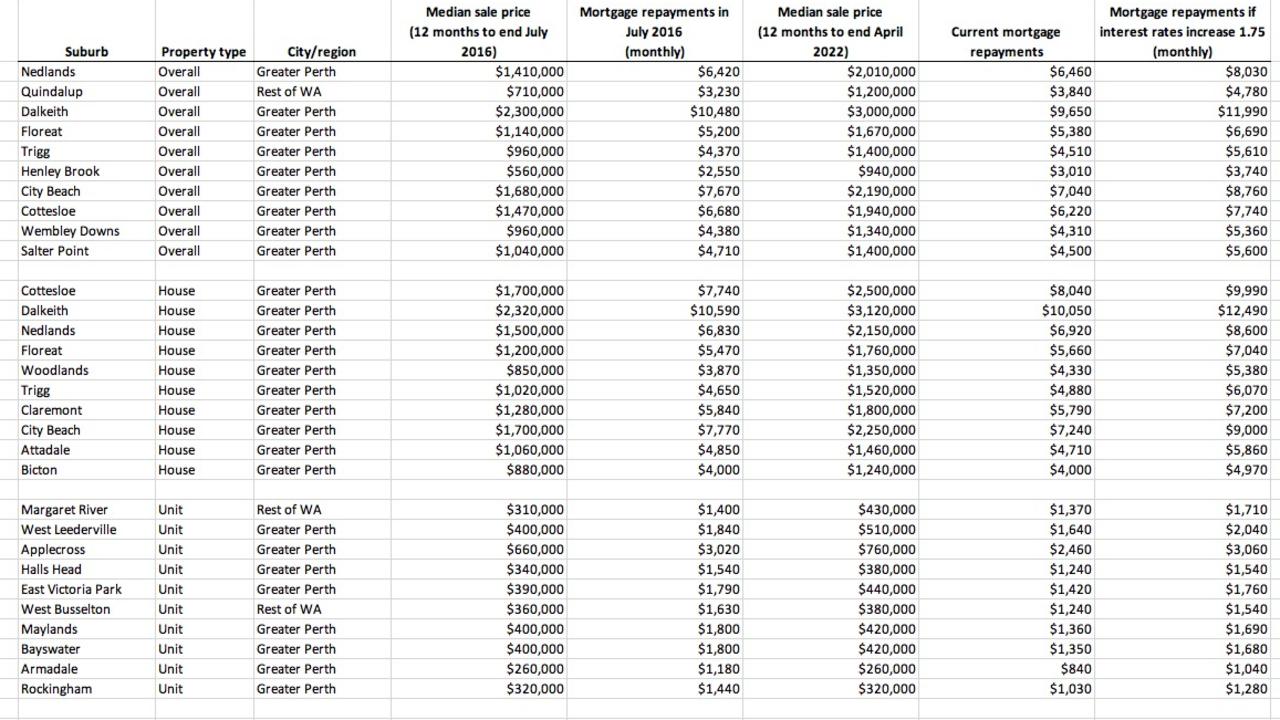

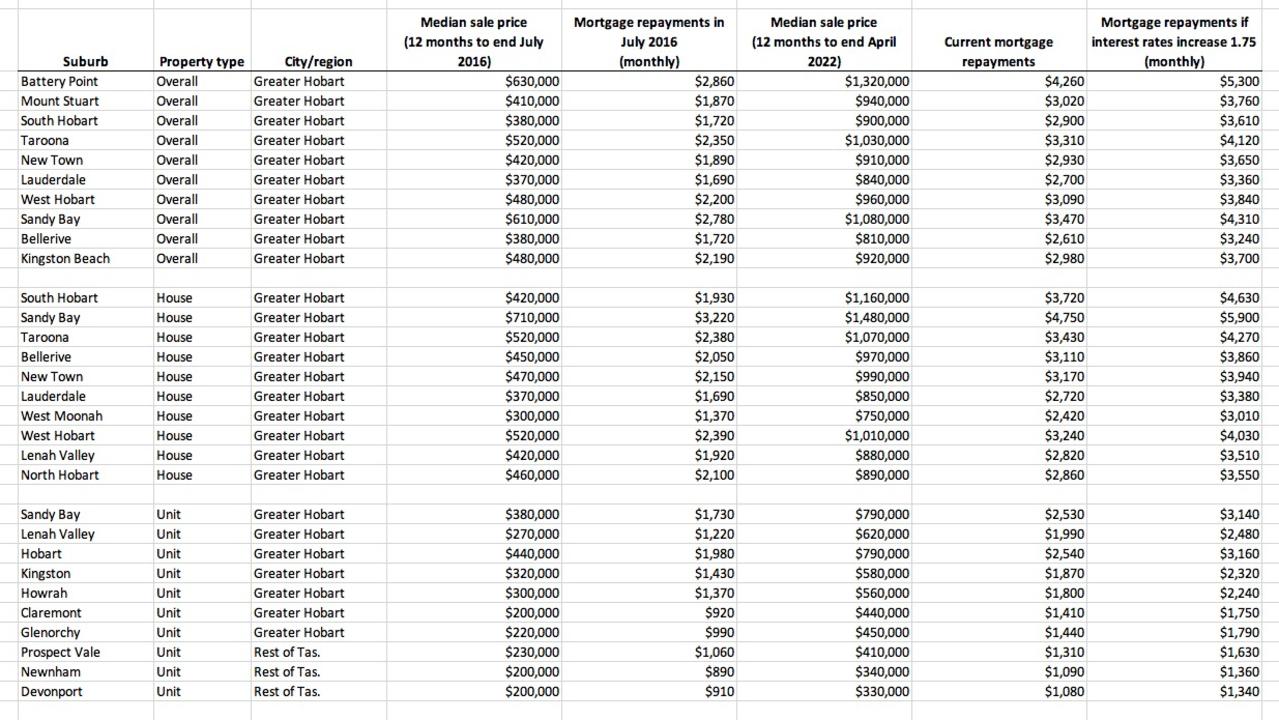

Elsewhere, other suburbs around the state also are in the firing line for hip pocket pain.

In NSW, Palm Beach had the most amount of mortgage payments for overall dwellings, while Vaucluse topped for houses. Suffolk Park in Byron Bay has the most expensive units in the state.

Over in Victoria, Portsea topped the overall dwellings and houses.

Melbourne’s Mont Albert North has units that cost $4000 a month in mortgage.

In Queensland, Sunshine Beach owed the most to banks for both its houses and apartments — $11,400 and $4900 respectively. Those numbers will rise to $14,000 and $6000 once interest rates hit 1.75 per cent.