Australian property prices remain stubborn, cling to pre-Covid levels

Property prices are going down slightly but they still remain stubbornly high compared to pre-pandemic levels.

Property prices are going down marginally as cost of living pressures bite but they still remain eye-wateringly high compared to pre-pandemic levels.

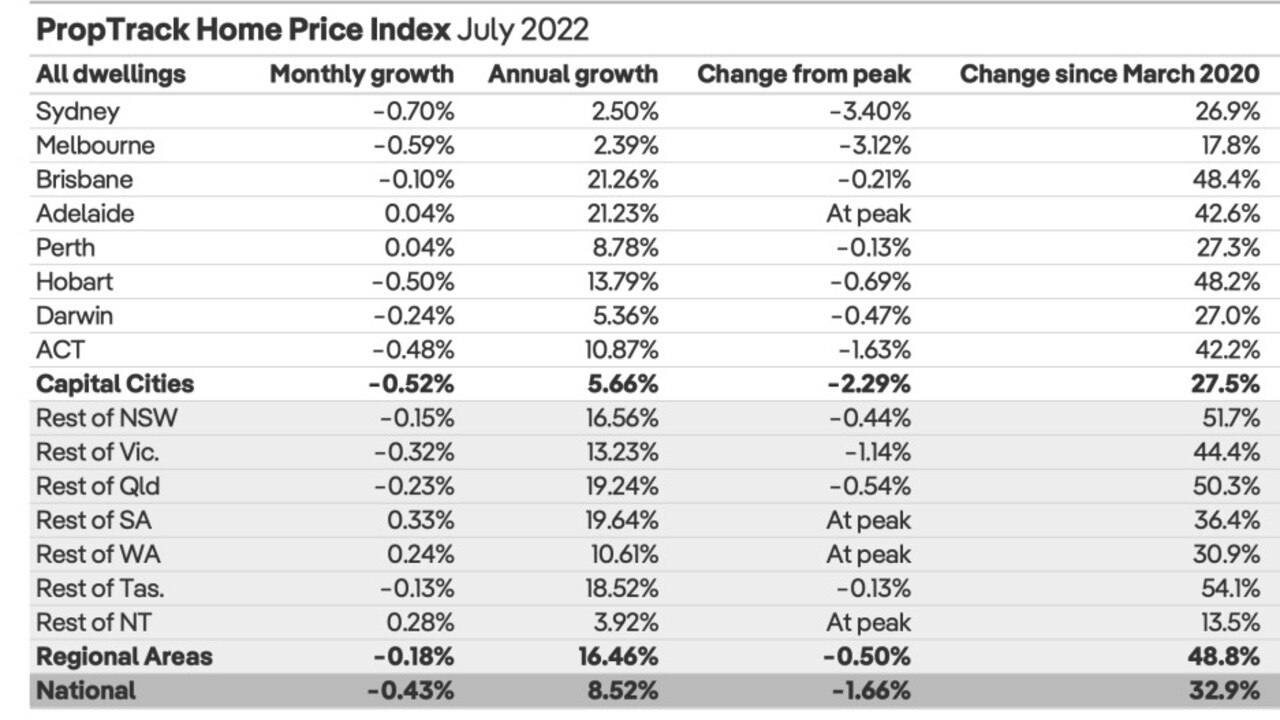

House prices are just 1.66 per cent below their peak in the later half of last year.

According to PropTrack’s Home Price Index, released on Monday, home prices dropped 0.43 per cent nationally in July.

However, they still remain way out of reach for the average person.

Nationally, house and unit prices remain 32.9 per cent above March 2020 levels.

That number was exacerbated in regional areas; properties are 48.8 per cent higher than before Covid-19 arrived on Australia’s shores.

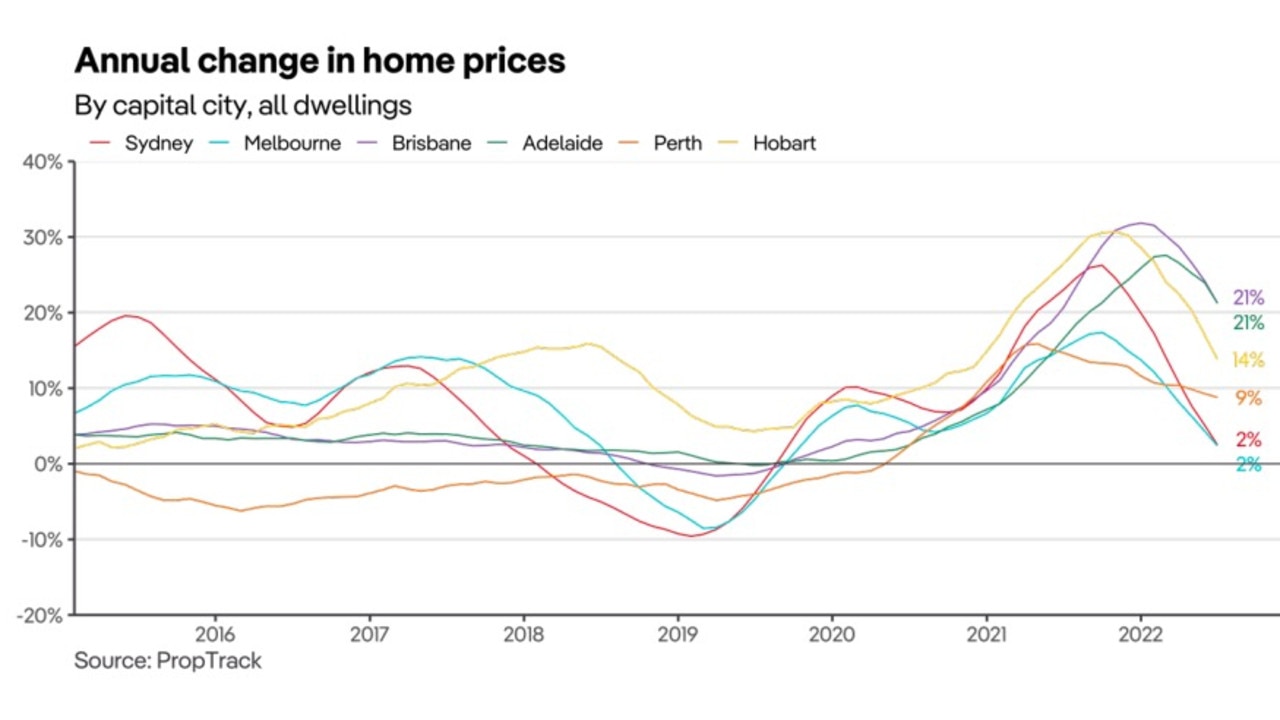

Sydney and Melbourne suffered the biggest falls this both, and are both down more three per cent for the year so far.

However, a handful of states were bucking the trend, as some capital cities and regional areas still experienced growth.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

According to the report, Sydney experienced a 0.70 per cent drop while Melbourne fell 0.59 per cent last month.

For Sydney, it was the fifth consecutive month of recording a price drop while it was the fourth month in a row for Melbourne.

The report said Australia’s two largest cities “continue to lead the falls”. They are both now more than three per cent below their price peaks.

Hobart was down 0.50 per cent, the ACT by 0.48 per cent and Darwin by 0.24 per cent.

Brisbane was only down by 0.10 per cent, which the report conceded was a “small amount”, especially considering overall the Queensland capital “remains the top performer over the past year”.

Prices in combined regional areas also fell 0.18 per cent in July.

Meanwhile, South Australia and Western Australia defied the trend after their capitals and regional areas continued to grow.

Adelaide was up by a very small amount — 0.04 per cent‚ but nevertheless it was still positive growth. Regional South Australia was up by 0.33 per cent and regional Western Australia was up by 0.24 per cent.

The report reported that “all [three] reached new price peaks”.

To top that off, Perth grew by 0.04 per cent.

PropTrack’s Property Market Outlook July 2022 Report, released last week, found that house prices could plunge by as much as five per cent in the next five months and are expected to be down by 15 per cent by the end of next year.

The report found that house and unit values will fall between two and five per cent nationally for the rest of the year.

But next year the results were even more extreme, with values forecast to plunge between seven and 10 per cent in 2023, with the report’s author noting that would “potentially bring prices down 15 per cent from current levels”.

Sydney and Melbourne are set to lead the falls, with prices declining between three and six per cent respectively, this year, and nine and 12 per cent for 2023.

Driving the downward trend was rising interest rates scaring buyers away from the real estate market.

PropTrack Director of Economic Research and report author Cameron Kusher said: “The recent run-up in prices, coupled with reducing borrowing capacities as interest rates rise, is likely to see price falls broaden and then accelerate further into 2023, with the more expensive cities expected to record the largest price falls.

“Nationally, we are forecasting prices to fall by between two and five per cent by the end of this year and by a further seven to 10 per cent by the end of next year.”