Australian housing affordability: What different incomes can buy in the property market right now

What career path you follow could determine where you live, and what type of home you can buy, as Australia’s property prices continue to soar and affordability tumbles.

What career path you follow could determine where you live, and what type of home you can buy, as Australia’s property prices continue to soar and affordability tumbles.

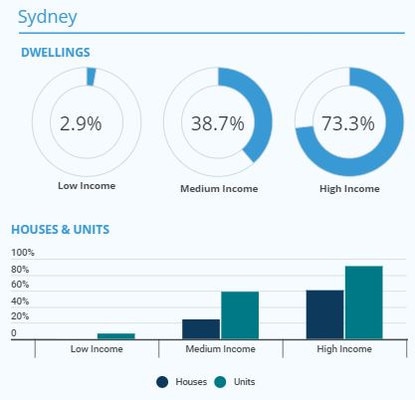

New research conducted by CoreLogic comparing national dwelling values and average incomes demonstrated that low income workers are only able to afford 17.6 per cent of available housing stock in Australia – or just 2.9 per cent in Sydney and 4.2 per cent in Melbourne.

RELATED: How much the average Aussie has saved up in the bank

Australia set for its biggest home building year of all time

Region that is now more expensive to buy than Sydney

Young couple’s 200+ housing fail streak

Not only are low income earners restricted from freely choosing where they want to live, but are left out of accumulating wealth through homeownership, according to Effie Zahos, money expert and editor-at-large for financial comparison site Canstar.

“Property is basically the number one asset vehicle for most Aussies to actually build their wealth, and this is why we have a lot of gender discrepancy in wealth too,” she said.

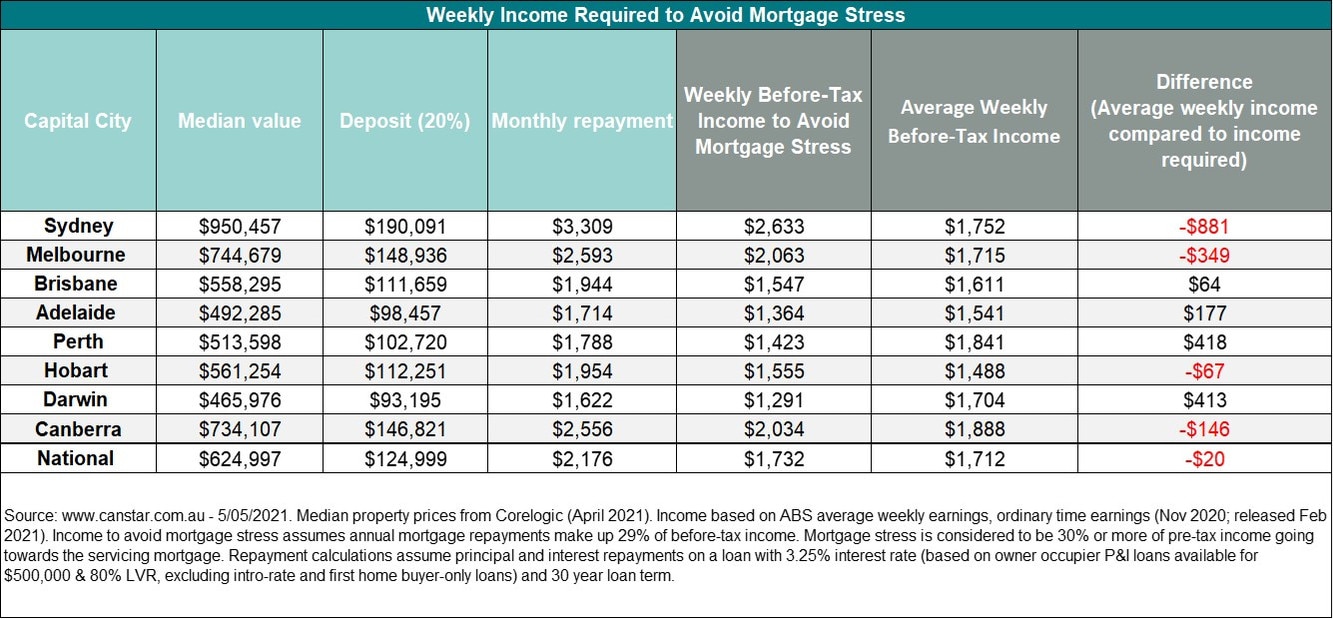

Canstar calculated how much an Australian needs to earn to afford a modest home in each capital, and concluded that buying a home then maintaining a loan in more than half of our cities would plunge home buyers on average salaries into mortgage stress.

“It really does put things in perspective as to how hard people are fighting to actually get into this asset class since it’s experienced such ridiculous growth over the past couple of years. It’s surprised everyone,” she said.

On the flip side, CoreLogic’s study showed that top earners can afford a whopping 85.1 per cent of Australian homes including 93 per cent of all units and 82 per cent of houses.

The analysis used household incomes modelled by the Australian National University including low (25th percentile), middle (50th percentile) and high (75th percentile) income estimates to September 2020, which amounted to weekly income estimates of $905, $1654 and $2760 respectively.

Most industries don’t pay enough to give home buyers choice

Employees in the mining industry, who earn an average of $2633 a week according to the latest ABS Average Weekly Earnings statistics, are the closest group to that top tier. Typical weekly earnings for 15 other common industries were significantly below that $2760 weekly figure.

Medium income earners (making $1654 a week) could only afford to buy 57.1 per cent of homes.

Industries where the average salaries are between the high and medium tiers include; electricity, gas and waste services at $1944 a week; transport and warehousing ($1685); media and telecommunications ($2033); financial and insurance ($2032); professional, scientific and technical ($2001); public administration ($1824); education ($1838) and healthcare by just a few dollars at $1675 a week.

Mining $2633

Manufacturing $1555

Electricity, gas waste services $1944

Construction $1629

Retail $1289

Accommodation & food $1161

Transport & warehousing $1685

Media & telecommunications $2033

Financial & insurance $2032

Property $1539

Professional, scientific & technical $2001

Admin and support $1526

Public administrative $1824

Education $1838

Health care $1675

Arts & recreation $1464

*ABS Average Weekly Earnings statistics, February 2021

Infographic: See how much of the market different incomes can buy

Essential workers have the most meagre property pickings

When broken down by individual roles, the housing affordability challenge becomes clearer, particularly for those essential workers most relied upon during the pandemic.

According to recent Australian salary data compiled by job site indeed.com, the average weekly base salary of primary school teachers is $1611, paramedics at $1434, registered nurses ($1411), entry level police officers ($1212), wait staff ($1154) and childcare workers ($1063).

Jobs that slip into the third tier, where low income earners make around $905 a week, can only afford to buy 17.6 per cent of Australian homes on the market right now.

These include cleaners at $975 a week, supermarket checkout operators at $962, and hospital porters at $956.

Lenders look through their own lens

Ms Zahos said that battling buyers should be aware that although interest rates are at record lows, banks are crunching their own numbers to see who can afford to take on a home loan.

“Depending on which bank you go to, the serviceability or floor rates, can be as high as 5.10 per cent, or as low as about 4.95 per cent,” she said.

“You may say, ‘I’m on a good income’ but the banks have to do their job with their floor rates and rightly so. So it could be a case where you think you may be able to afford a certain amount, but the reality is because you have to borrow so much now, the serviceability could throw you.”

She said potential borrowers should consider ways to increase their serviceability.

“Reduce your credit card debts, consolidate personal debts, close in-store finance accounts, include all your income, and pick the right lender. Everything and anything impacts the amount you can borrow from the postcode to the number of kids – you’d be surprised what lenders look at.”

No surprise Sydney offers the least choice

CoreLogic’s research revealed that those in the low income tier could only consider buying 2.9 per cent of Sydney’s housing stock, while medium earners could look at 38.7 per cent and high earners could afford 73.3 per cent of listed homes.

To put the affordability equation under the spotlight for Sydney, Canstar revealed that with the median dwelling price at $950,457, Sydneysiders would need an average weekly income of $2633 and a $190,091 deposit to avoid mortgage stress.

Realistically, the average weekly earnings in the city are $1752 — which amounts to $881 less than required.

Melbourne

In the Victorian capital, low income earners can only buy 4.2 per cent of property, according to CoreLogic’s calculations, while those on a medium income could buy 43.7 per cent of property, and high earners 79.4 per cent.

Given that the median property price in Melbourne is $744,679 – Canstar demonstrated that a buyer would need a deposit of $148,936 and a weekly wage of $2063 to comfortably afford a typical home.

The average weekly earning of Melburnians is currently $1715 – which is $349 less than necessary.

Brisbane

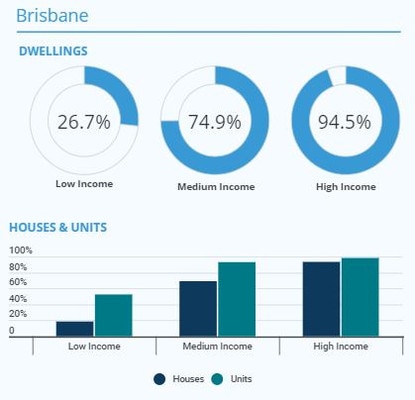

It is a different story in the capital of the Sunshine State where low income earners can afford 26.7 per cent of properties, medium earners can buy 74.9 per cent of stock and high income earners can choose from 94.5 per cent of homes.

Canstar places Brisbane buyers in a better position, estimating they would need a $111,659 deposit to purchase a home at the local median of $558,295.

The weekly income needed to avoid mortgage stress in Brisbane would be $1547 — $64 under the average wage of $1611.

Originally published as Australian housing affordability: What different incomes can buy in the property market right now