Australian family devastated after freak accident four days after buying new home

An Australian family have almost been financially ruined after their new home was struck by lightning, just four days after they bought it.

An Australian family have almost been financially ruined after their house sustained severe fire damage in a freak accident.

Emily* and her husband bought a three-bedroom house at the end of 2020 for $575,000 but in an incredible stroke of bad luck, just four days after buying the property, the home was struck by lightning.

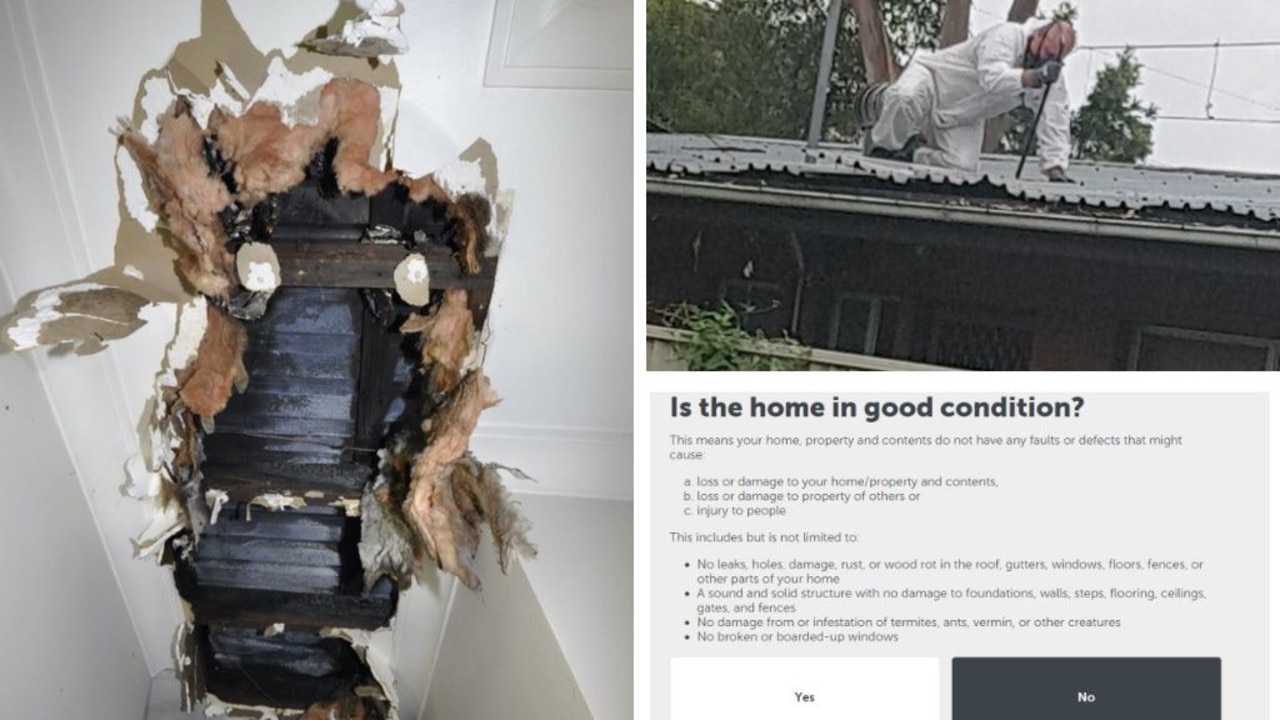

This led to a fire, damaging the house, with the repairs expected to cost in excess of $60,000.

Their insurance company, Budget Direct, with Auto & General as the underwriters, initially accepted the claim.

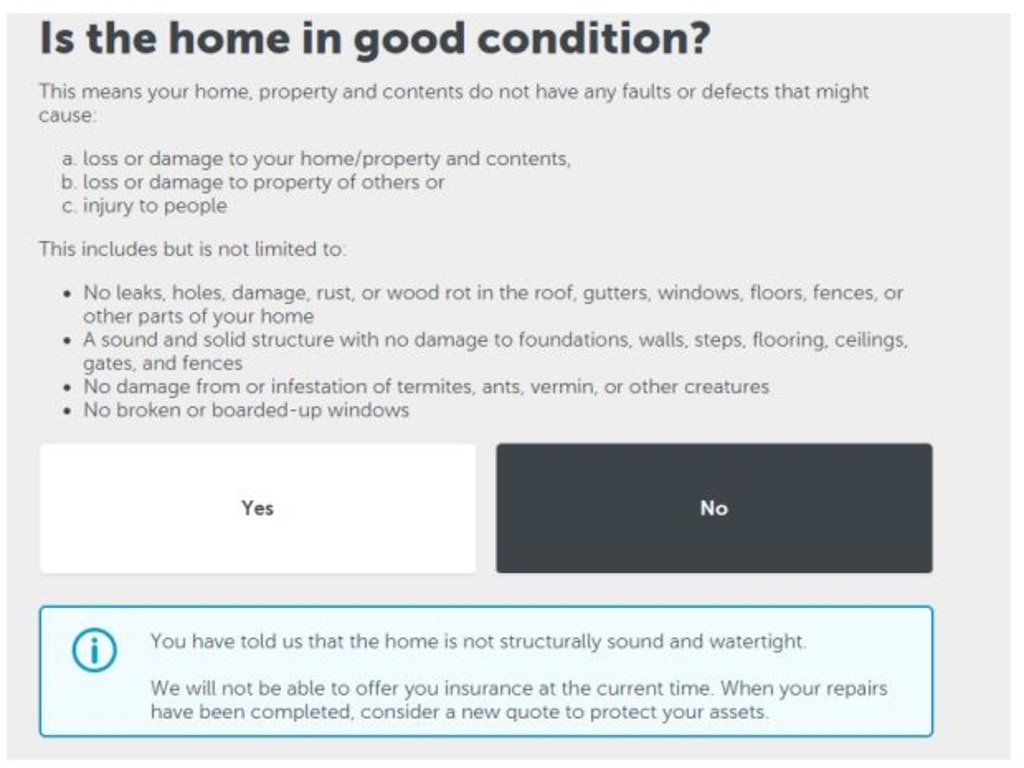

Four months later, however, the claim was rejected and the couple’s insurance policy was terminated, with Auto & General claiming Emily had misrepresented the condition of the property when she took out insurance.

Independent ombudsman, the Australian Financial Complaints Authority, ruled in favour of this decision when Emily made a complaint, saying: “Had the complainant disclosed the true condition of the property, the insurer would not have commenced the policy and would not have been at risk when the claim event occurred. In these circumstances where the insurer complied with its statutory obligations, it would not be fair to require it to pay the claim.”

The Aussie family have since found it impossible to secure other insurance companies willing to take them on as customers and the property has remained uninsured since then.

News.com.au has chosen not to name Emily or reveal her whereabouts in Australia as she is in breach of her mortgage obligations due to the lack of insurance, which could see the bank repossess her properties.

For the past two years the house has been sitting in a state of disrepair, with Emily and her husband fixing what they can out of their own pockets.

“It’s just devastating,” the mum-of-two told news.com.au.

An Auto & General spokesperson said the insurer had behaved fairly in this case.

Emily and her husband at first thought it would be a straightforward process to claim their insurance.

Up to 25 per cent of the property had sustained fire damage, while a further 50 per cent of the property was damaged from water due to the storm and with an exposed roof, according to the fire brigade’s incident report.

“I called the insurance company straight away,” she recalled.

“They accepted the claim on the spot (and) confirmed in the email. For the next four months they behaved as if this claim was going ahead.”

But in early 2021, Auto & General rejected the claim and cancelled her policy, claiming she had misled them about the original condition of the property.

Disappointed with the process, Emily cancelled her insurance policy with them for a second property she owned at the end of last year when it was up for renewal.

She was then also unable to insure the other property with anyone else due to her claims history, coupled with the fact she had to disclose an insurance company had terminated her policy.

Currently, both properties are not insured.

Emily and her partner fixed what they could of the damaged property but it’s come out of an emergency fund supposed to be used for her two children, who have chronic illnesses.

Originally the family planned to get renters into the house to cover the mortgage, but without insurance, this is now impossible.

They were paying off their two properties on fixed term mortgage repayments but this expired at the end of last year. They are now on a variable interest rate that sits around five per cent as a result of multiple cash rate rises.

“Our repayments have almost tripled,” Emily lamented.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Auto & General claimed the family had misrepresented the condition of the property when they took out insurance, and that they would never have taken them on as clients if they had all the facts.

The “claim has been rejected due to a nondisclosure issue,” a document from Auto & General, shared with news.com.au, informed Emily.

“During the course of the claim, questions were raised in relation to the condition of the property, prior to the claimed event.”

The dispute hinged on a pre-purchase report that the couple paid for before signing the property contract. The independent report found that the house, which had been built in 1970, was in “average” condition.

The report defined ‘average’ as: “The overall condition is consistent with dwellings of approximately the same age and construction. There will be areas or items requiring some repair or maintenance”.

However, the insurance company, when outlining why they had rejected Emily and her husband as customers, said the home’s list of defects was too exhaustive to be considered in average condition.

“It was an old house, we did all our homework,” Emily said.

“This property came up at a reasonable price. There were some areas of concern (but) no major defects. The minor ones were what to be expected of a house that age in that area.”

There was water damage in the kitchen – although Emily said the leak had been resolved prior to their purchase.

The insurance company also argued that it wasn’t a lightning storm that caused the blaze, a short circuit in the roof.

A report from the fire brigade, obtained by news.com.au, found otherwise.

“Ignition source: Lightning discharge,” the fire report read.

A forensic investigator visited the property to assess the claims.

Emily engaged in a long legal process to dispute the outcome of her claim, including hiring a lawyer and spending $10,000 on legal fees.

Emily eventually took the matter to the Australian Financial Complaints Authority (AFCA) but they ruled in the insurer’s favour.

An Auto & General spokesperson said that the AFCA panel found that the outcome was “fair”.

“It is not required to take any further action in relation to the claim or complaint. (AFCA) in this matter found completely in favour of Auto & General, that we had acted fairly on the matter,” the spokesperson added.

There is no appeals process after an AFCA decision.

“We were out of money, then we gave up,” Emily said.

Now Emily’s only plan is to wait for five years until this incident is long behind them, and will mean they don’t have to declare this incident to other insurers.

In the meantime, she just has to hope nothing happens to either of her properties as there will be no insurance to fall back on.

*Not her real name

alex.turner-cohen@news.com.au