Australian businessman proposes bold solution to housing crisis

Australians locked out of the housing market have been delivered hope by a businessman who is convinced he has a solution to the crisis.

A new approach to entering the housing market in Australia has been proposed by one of the country’s leading entrepreneurs and finance executives.

It’s a structure already being used in 50 other countries and would take about five years to introduce locally, Talal Yassine OAM told news.com.au, revealing it provided a far easier pathway into home ownership than Australia’s current systems.

The businessman, who will present his ideas at TEDxSydney on Friday, detailed the Islamic banking structure, which has existed successfully in global markets including the UK, Singapore, Luxembourg and South Africa for years.

The Islamic model, which Mr Yassine stressed was for everybody not just the Muslim community, was essentially a scheme that allowed people to “rent to own”.

“The bank is actually your partner,” he said, as opposed to the standard Australian system where most buyers were reliant on loans from banks, which have a sole interest in money and not the properties themselves.

“The bank makes money off the interest and when things go bad, it has no interest in the property, it just wants its money back,” Mr Yassine said.

The roles and responsibilities with an Islamic banking approach were slightly different, he explained.

“It’s like a joint venture,” he said, offering an example where the bank puts $1 million towards a home while the buyer contributes $200,000.

“The buyer then agrees to rent the house long-term, and the tenant pays rent on the property and pays their loan back over a pre-agreed period of time,” he said.

“And as you pay off the rent, which would be equivalent to the interest so to speak, and you pay back some of the principal, then your portion of the property changes over a period of time.”

He explained how an agreement that may start as an 80/20 split may, after about 10 years, be closer to 50/50.

“Then if you sell the home, the bank shares in the price of the property … you share the profit,” Mr Yassine said.

He said the approach meant the bank’s and the buyer’s interests were aligned, unlike under Australia’s typical home loan system.

Mr Yassine argued the Islamic system meant banks were more invested in the condition of the property and were less likely to “kick you out after three months”.

“And there’s no interest rate rises or decreases. It’s a real deal, it’s not charity, the bank makes and loses money with you on the property,” he said.

Australia’s federal government has been recommended an Islamic structure for homeownership via “many reports” in the past, but none have been considered.

“Islamic financing or structuring is not just for Muslims, it’s just a structure for everyone. The word Islamic has been weaponised – it’s just a human-centred way of getting into the housing market,” Mr Yassine said.

“It’s a structure that is used by all people just different to the conventional model we have now.”

He stressed he was not pushing to replace the existing structure, only to have the Islamic structure be an option to Australians.

Aussie homeowners left worried

Rising interest rates are inflicting pain on stressed homeowners and investors, which could see a rise in distressed property sales this spring, according to new research by Finder.

A whopping 39 per cent of Aussie mortgage holders – equivalent to almost 1.3m households – said they struggled to pay their home loan in August, according to Finder’s Consumer Sentiment Tracker.

And two in five (40 per cent) of property investors are struggling to keep pace with soaring mortgage repayments and are worried they will have to sell their investment home.

Finder’s latest survey also found one in seven sole property owners are worried they might have to sell their family home — the equivalent of 515,000 households.

Latest lending indicators from the Australian Bureau of Statistics (ABS) show that the average mortgage size (for owner-occupier dwellings) was $580,000 in June 2023.

With thousands of fixed-rate mortgages starting to expire, repayments for many buyers have begun to bite, jumping by thousands of dollars a month.

“Borrowers are experiencing a huge financial shock after a relentless climb in interest rates over the past year and homeowners weren’t coping,” Finder home loans expert Richard Whitten said.

“Many borrowers have already pulled back on all non-essential spending — they have no money left to contribute to their mortgage.”

“They feel like they’ve got little choice but to sell up or lose their home.”

Mr Whitten urged borrowers to find out what hardship allowance they qualified for while they considered their options.

“Be upfront with your lender about your struggles before you start missing repayments,” he said.

“Your lender may be able to help you, with options like a repayment pause, a temporary reduction in your repayments, or financial counselling.”

A far greater number of property investors could look to exit the market this selling season as well, with the survey finding the equivalent of almost 900,000 investors that may have to put a property up for sale due to the rising cost of living.

“Two thirds (64 per cent) of people who own investment properties have an income under $80,000 per year, despite the assumption that property investors are high income earners,” Mr Whitten said.

“In fact, only the minority (7 per cent) earn more than $180,000 a year. While a property investor’s assets may be very valuable, they need cash to pay their mortgage each month.”

“Investors will try to pass some percentage of rising costs on to tenants but that is a delicate balance. The rental market determines what landlords can charge, and tenants can’t simply absorb all of an investor’s costs.”

Median rents for houses saw growth in all capital cities, with Perth leading the way at a 14.6 per cent year-on-year increase, followed by Brisbane at 13.1 per cent, and Adelaide at 11.1 per cent, property data shows.

In 2020–21, over 2.2 million Australians owned rental properties, according to the Australian Taxation Office.

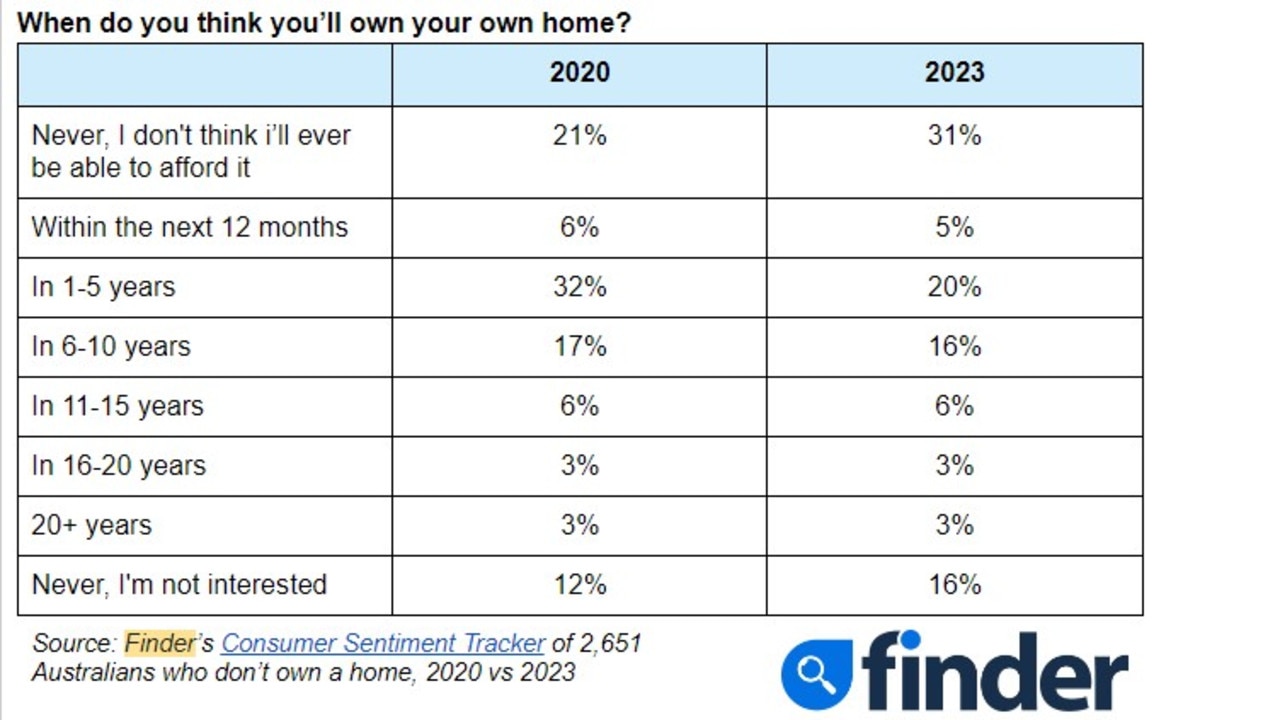

The research also found that the idea of home ownership is becoming increasingly out of reach for many Australians, with 31 per cent of non-homeowners surveyed saying they don’t think they will ever be able to afford a home.

The number represents a 10 per cent rise in sentiment since the same question was asked in 2020.

It comes as Victoria’s property market is primed for a record start to spring that could kick off one of the biggest selling seasons in history, which may be fuelled partly by owners struggling with rates.

More than 3000 homes are scheduled to go under the hammer in the next three weeks in a buyer bonanza that’s starting with 1060 properties going to auction this week in one of the busiest ends to winter to date.

“There’s probably a proportion of those sellers who are people who have been hit hard by interest rates,” said PropTrack economist Anne Flaherty told the Herald Sun.

More Coverage

While first-home buyers who made their move in the past two or three years were the “most vulnerable” in this regard, she noted it was likely investment properties and family homes would also be among the forced sales.

Ms Flaherty said with “every reason” to expect auction numbers to continue to grow, late spring could become a “real test of the depth of buyer demand” that could pause or even reverse home price growth in recent weeks.

— with Brendan Casey