Aussie house prices booming despite pandemic bloodbath predictions

Homeowners have been bracing for a bloodbath, with many predicting house prices could fall by up to 30 per cent – here’s what actually happened.

Predictions of a COVID-19 property crash have been smashed despite extraordinary volatility in the market in a shock to doomsayers who forecast house values would be slashed.

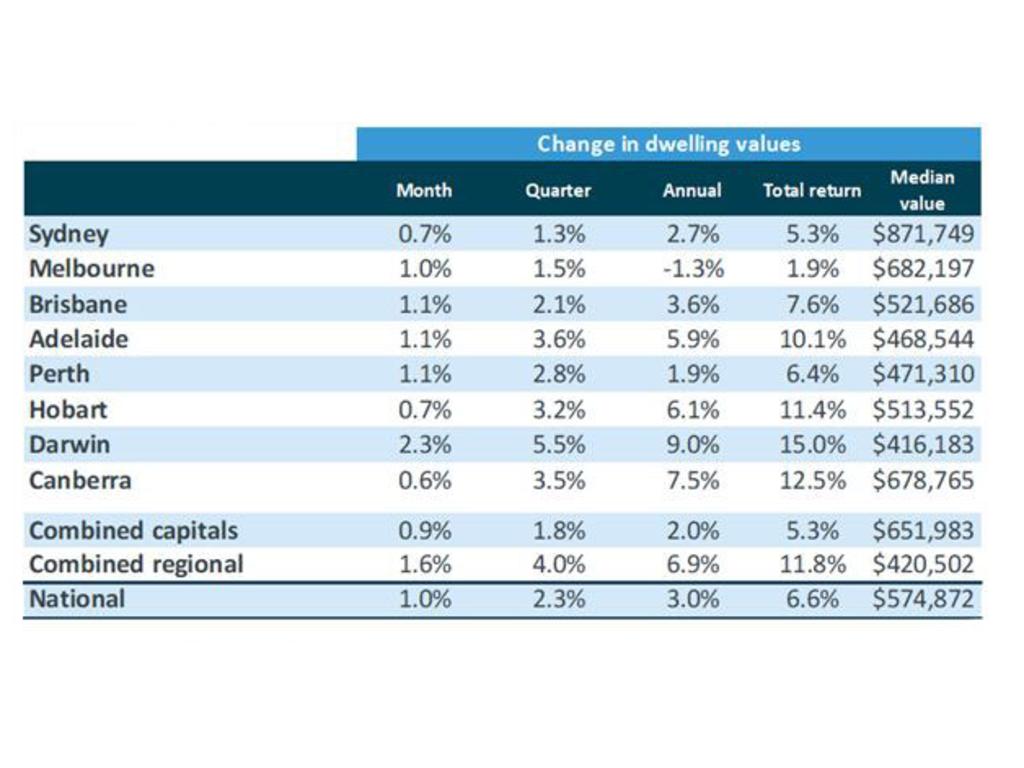

CoreLogic’s national home value index has found that Australian home values finished the year 3 per cent higher than the same time last year.

That’s despite doom and gloom predictions from the Commonwealth Bank in March that property prices could tumble by up to 30 per cent.

Much of the growth has emerged in regional areas, with first home buyers taking advantage of new work from home arrangements to purchase a family home further away from the big cities.

RELATED: Three states winning at house prices

According to CoreLogic, Melbourne home values are still -4.1 per cent below their March 2019 peak and Sydney dwelling values need to recover a further 3.9 per cent before surpassing the previous July 2017 peak. Perth and Darwin values remain -19.9 per cent and -25. per cent below their 2014 peaks.

CoreLogic’s research director, Tim Lawless said that while the number of homes for sale was in free fall when the pandemic first hit, property values were holding up.

“The number of residential property sales plummeted by -40 per cent through March and April but finished the year with almost 8 per cent more sales relative to a year ago as buyer numbers surged through the second half of the year,’’ he said.

“Despite the volatility, housing values showed remarkable resilience, falling by only -2.1 per cent before rebounding with strength throughout the final quarter of 2020.”

CoreLogic argues that record low interest rates were the big factor in the resilience of property values.

However, the Morrison Government’s interventions in the economy including JobKeeper which helped thousands of businesses stay afloat and also encouraging first home buyers to enter the market also played a role.

“Record low interest rates played a key role in supporting housing market activity, along with a spectacular rise in consumer confidence as COVID-related restrictions were lifted and forecasts for economic conditions turned out to be overly pessimistic. Containing the spread of the virus has been critical to Australia’s economic and housing market resilience,” Mr Lawless said.

“As remote working opportunities became more prevalent and demand for lifestyle properties and lower density housing options became more popular, regional areas of Australia saw housing market conditions surge. “Regional housing markets had generally underperformed relative to the capital city regions over the past decade, but 2020 saw regional housing values surge as demand outweighed supply,” said Mr Lawless.

Regional housing values rose by 6.9 per cent, propping up far more modest increases in capital cities where far fewer houses were on the market.

Way back in March, Australia’s biggest lender forecast house prices could tumble by up to 30 per cent in the wake of the coronavirus pandemic and Sydney and Melbourne could be the hardest hit.

The predictions could wipe up to $300,000 from a $1 million house in Sydney.

All four of the nation’s big banks were also predicting double-digit falls in house prices as unemployment rises sharply. Westpac is forecasting a 20 per cent fall.

The Commonwealth’s Bank’s chief executive Matt Comyn has described the 30 per cent prediction as a ‘worst-case scenario’.

“We need to be prudent and consider a realistic downturn but also plan for a worst-case scenario, and that would see a sustained increase of unemployment,” he said.

Under the CBA scenario that value of that home would have crashed by $242,700 to just $566,300.

That didn’t happen but the big question now is the impact of near zero immigration rates on property prices in Sydney and Melbourne.

While the market proved this year it’s full of surprises, the lack of new migrants looking for houses is likely to keep growth in property values pretty flat.