Aussie homeowners standing on $24k mortgage precipice as fixed rates set to expire

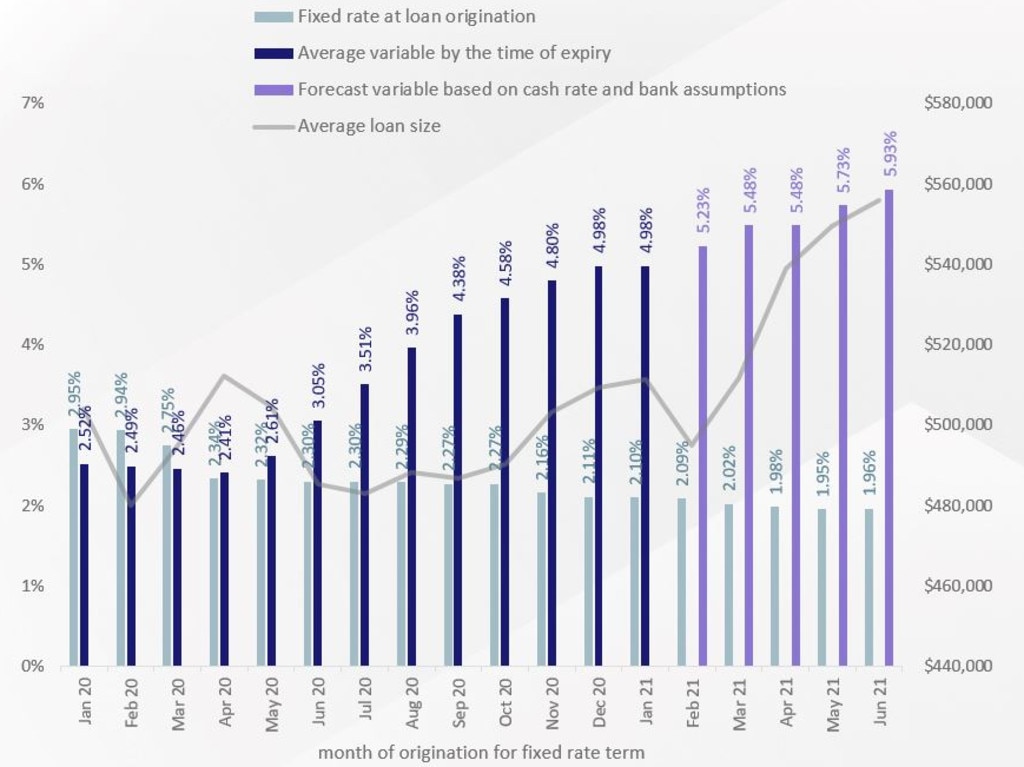

Hundreds of thousands of Aussies are bracing to fall off a ‘mortgage cliff’ which could cost them as much as an extra $24,000 a year.

Hundreds of thousands of Aussies are bracing to fall off a ‘mortgage cliff’ which could cost them as much as an extra $24,000 a year.

On Tuesday, Australia’s central bank increased interest rates for the 12th time in the past 14 months, with warnings of more to come.

Now a growing group of Australians are facing being suddenly plunged into debt when their fixed mortgage expires.

In the next six months, a whopping 880,000 homeowners will have to switch from fixed to variable property loans.

Next year, a further 450,000 loans will expire.

Data from property analysis firm CoreLogic has found that 35 per cent of all outstanding fixed mortgages will expire this year, meaning 23 per cent of all home loans will be repriced.

On current rates, a household with a $1 million loan will need to scrounge together an additional $2000 a month, or $24,000 per year, in order to keep their bank happy.

According to Eliza Owen, CoreLogic research principal, the mortgage drop off would cause “hurt” for homeowners and shows how much interest rates have “deteriorated” since Aussies started fixing their home loans three years ago.

“It’s really a bit of a double whammy,” she told news.com.au.

Areas in particular distress are those on the fringes of big cities, like the western suburbs in Sydney and Melbourne, as those owner occupiers have bigger mortgages.

“This is where we tend to see a bit more hurt,” Ms Owens said.

The latest figures show the average Sydneysider would have to spend 52 per cent of their income to afford a new mortgage at current borrowing rates.

“That gives you an idea of how exorbitant mortgages are,” Ms Owens added.

Prior to mostly back-to-back interest rate hikes starting from May last year, the average mortgage cost 44 per cent of a Sydneysider’s income.

However, it’s not all bad news.

Despite the rising cost of home loans, most Australians have managed to keep their heads above water, in a sign that those standing on the mortgage precipice will also be able to scrape by.

“You don’t always fear a cliff you can see coming from a mile away,” Ms Owens said.

Many have been saving in anticipation of the hefty mortgage debt headed their way.

Just 0.7 per cent of homeowners are more than 90 days behind in their mortgage.

Although this is up slightly from the previous quarter, when the figure sat at 0.6 per cent, Ms Owens said it’s still “a really low level”.

“Variable mortgage holders have been coping without excessive levels of distress listings,” she added.

In a further aid to struggling homeowners, the property market is experiencing a slight uptick of 2.3 per cent since hitting a low in February.

That means many have experienced property growth. Just two per cent of homeowners have had their properties go backwards in value, according to the Reserve Bank of Australia.