Rate relief: Qld’s worst suburbs for mortgage stress

Close to one million Queensland households are living in mortgage or rental stress ahead of this week’s rates meeting. Here are the suburbs struggling the most.

Close to one million Queensland households are living in mortgage or rental stress, with a leading property analyst claiming interest rate cuts will not be enough to pull many families back from the brink.

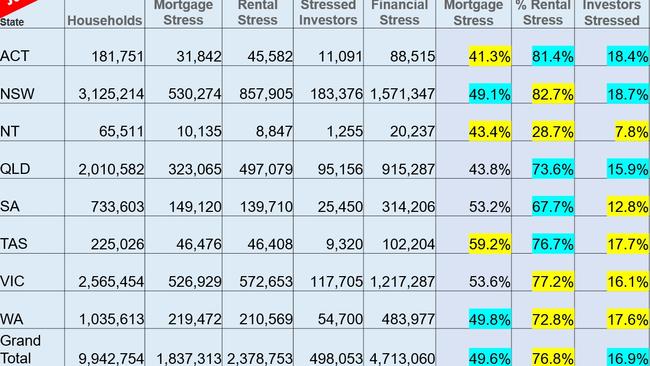

Exclusive figures released ahead of the Reserve Bank’s meeting on Tuesday show more than half of the state’s homeowners are struggling to keep up with mortgage repayments, and two-thirds are in rental stress.

RELATED: Worst suburbs for mortgage stress as new figures show tax cuts helping the rich

The data from mortgage specialist Digital Finance Analytics (DFA), based on more than 52,000 household surveys conducted until the end of January, reveals 35 Queensland suburbs where 100 per cent of households are in mortgage stress and 74 suburbs where every household is in rental stress.

Agents in the worst affected suburbs say they have “never seen more” people selling to release debt because of financial stress.

DFA founder Martin North said mortgage holders were giving up on essentials like dental treatment and healthy food, and even resorting to crime as they grappled with prolonged financial stress.

MORE: Footy star Corey Parker lists home full of Broncos memorabilia

Distress list: 34 homes set for forced sale

“In some cases, the pressure is sufficient to force homeowners to consider selling up,” Mr North said. “This includes some property investors too, which is one reason why listings are rising.”

Mr North said the pressure was most intense in high growth corridors around major urban centres, but it was also spreading into regional areas.

“Even a 50 basis point cut in mortgage rates would not be sufficient to solve their problem,” he said.

“Unless things change substantially, this higher-for-longer level of financial stress could well morph into social issues, with crime rates notably rising in some of the high stressed areas.”

The worst affected suburbs in Queensland for mortgage stress are Daisy Hill, Tanah Merah, and Loganlea in the Logan region.

Households in Wakerley, Salisbury, Rosewood, Thorneside, and Tully are also struggling to pay off their home loans.

Nathan Strudwick of Elders Real Estate, who operates in the Logan region, says homeowners who extended themselves during the onset of the pandemic are “feeling the pinch”.

“During Covid, everyone wanted more space to escape from the world and they leveraged themselves quite aggressively to get that,” Mr Strudwick said.

“A few years on, now they’re feeling the pinch of that increased loan they took out and increased rates.

“People are realising they’re going to have to cut back something in their lives... or sell their home to release some cash. Right now, I have never seen more people’s reasoning to sell a home than for the purpose of releasing debt.”

Mr Strudwick said many homeowners were resenting paying off big mortgages and deciding to downsize.

“Everyone will be off their fixed rates by now and it’s that sustained and prolonged period of higher interest rates that have caught up with them,” he said.

“What savings they did have...are really getting absorbed. It’s these big anchored mortgages that are enticing people to clear debts and downsize. Some people are going back to renting.”

The DFA analysis shows households are holding at high levels of financial cash-flow pressure, fired by high costs of living, mortgage and rental payments, but also supported from government by way of electricity subsidies, rental support, and greater subsidies for transport and medicines.

Over 76 per cent of those in the rental sector are still under pressure, and around half of homeowners with a mortgage are in the same boat.

Among mortgage holders, recent first-time buyers and younger families are also exposed, though other cohorts are being hit.

Mr North said households who were under pressure were more likely to spend less, raid savings, or take out more loans.

DFA defines households in mortgage or rental stress as those that have more outgoings — excluding one-off discretionary items — than income.

Originally published as Rate relief: Qld’s worst suburbs for mortgage stress