Australian property post pandemic: Is it cheaper to buy or rent your next home?

With house prices across the country skyrocketing at their fastest pace since the 1980s, new data reveals where it is cheaper to buy than rent.

Despite house prices across the country skyrocketing at their fastest pace since the 1980s, new research has found it is still cheaper to buy than rent in more than half the homes in Australia.

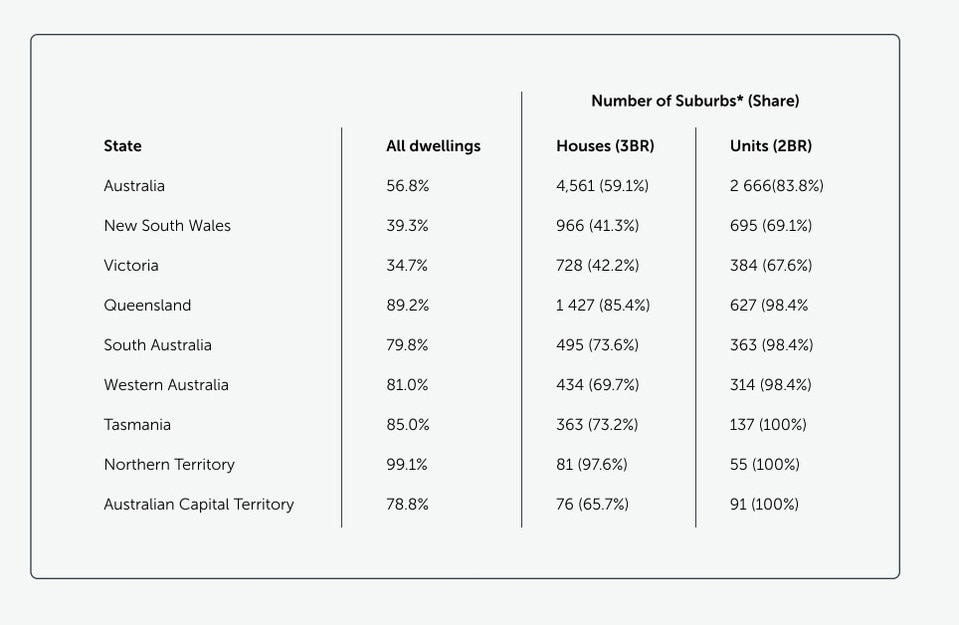

REA Insights’ Buy or Rent Report takes a snapshot of post-pandemic residential property trends and discovered that 57 per cent of dwellings would cost householders less to buy than rent.

RELATED: How much first-home buyers will spend

‘Hidden’ $6k cost home buyers have to pay

The bad sign coming for renters

“Considering how strong price growth had been in the last half of 2020 and throughout 2021 so far, it was somewhat surprising to see just how many dwellings remained cheaper to buy than rent at current prices,” REA Group economist Paul Ryan said.

“Given low intent expenses, moderate property price growth will likely offset the additional costs of owning,” adding that owning costs included transfer duty, ongoing costs such as maintenance, rates and strata fees as well as hiring an agent at the eventual point of sale.

Why buying still makes sense in a boom

Given the current boom time conditions, the study turned up unexpected results – even for the realestate.com.au researchers.

Low mortgage interest rates are attributed as a main driver behind favourable buying conditions as many home loans can currently be fixed below 2 per cent a year.

“This research shows that much of this boom has been driven by fundamental value,” Mr Ryan, who also authored the report, said.

“Borrowing costs are exceptionally low and the RBA has committed to keeping interest rates low for several years.

“Increased work-from-home flexibility, and a preference shift towards lifestyle locations has opened up many local property markets to wider audiences,” he added.

The report stated that buying conditions are particularly favourable outside of NSW and Victoria with more than 80 per cent of houses, and almost all units, outside those states estimated to be cheaper to buy in than rent.

“It shows how influential low borrowing costs and consumer sentiment are on property prices and points to continued strong property growth in 2021, particularly outside of Sydney and Melbourne,” Mr Ryan said.

Where the numbers stack up for houses

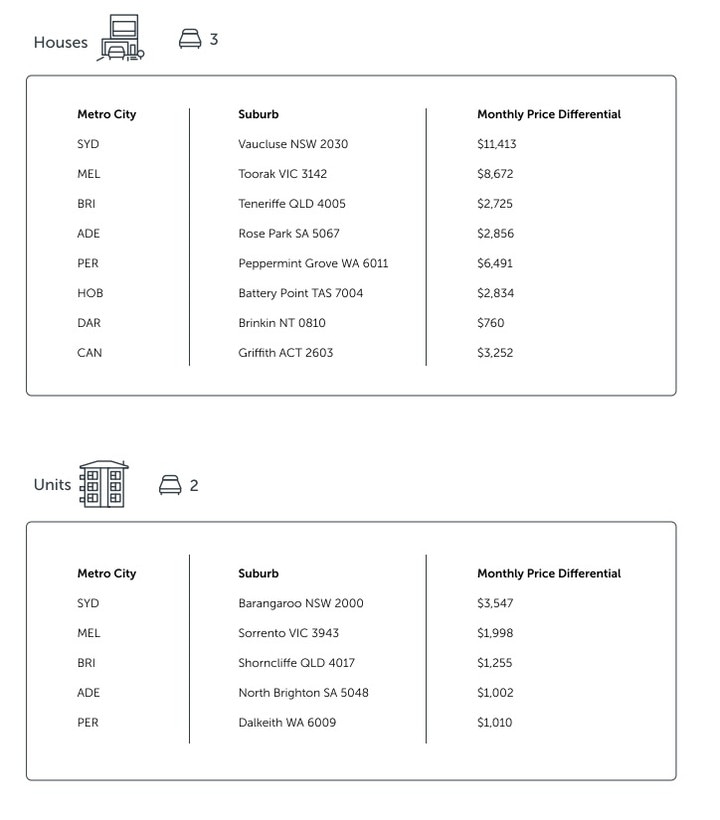

Capital city suburbs with the largest monthly saving for buyers (compared with renters) highlighted Tacoma in NSW with a $578 differential in favour of purchasing over renting. Waterford Park in Victoria at $472, Kilroy in Queensland at $1014, Elizabeth South in South Australia, Hilbert in Western Australia, Clarendon in Tasmania, Zuccoli in the Northern Territory and Coombs in the ACT all provided home buyers much better value than renting.

Conversely, suburbs that proved to have the largest monthly economies of scale for renters of houses were Vaucluse in NSW where tenants saved $11,413, Toorak in Victoria, Teneriffe in Queensland, Rose Park in South Australia, Peppermint Grove in Western Australia, Battery Point in Tasmania, Brinkin in the Northern Territory and Griffith in the ACT.

MORE: Australia’s cheapest waterfront just $99k

Homeowners using clever ploy to make millions

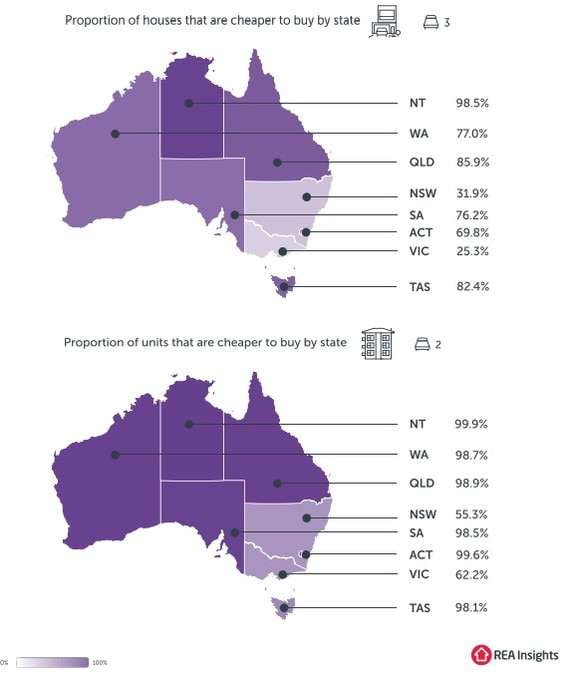

In a state and territory breakdown, the report showed that 98.5 per cent of houses in the Northern Territory would be cheaper to buy than rent, followed by 85.9 per cent in Queensland, 82.4 per cent in Tasmania, 77 per cent in Western Australia and 69.8 per cent in the ACT.

The unit market tells a different story

The REA Insights study also found that the buy versus rent equation varied greatly depending on the type of home.

“Just over half of houses are cheaper to buy over the next 10 years, but the share of units that are cheaper to buy is almost 75 per cent,” Mr Ryan said.

Suburbs where it proved to be cheaper to buy a unit, rather than rent one, appeared largely to be in the inner city areas of capital cities.

For NSW the greatest monthly differential was seen in Kangy Angy at $1206, Frankston North in Victoria at $794, Brisbane City in Queensland at $1162, Glanville in South Australia at $994, Wanneroo in Western Australia at $1363, Glebe in Tasmania at $1413, Darwin City in the Northern Territory at $1336 and City in the ACT at $1634.

Mr Ryan said the research provided insight for investors.

“They are driven by the same comparison between price and rents as home buyers, so the finding that many dwellings, units in particular, are cheaper to buy means they are likely profitable investments. On this basis, we expect investor activity in the housing market to pick up through 2021,” he explained.

What could turn it all around?

If Australia’s dwelling prices increase beyond the study’s predicted 3 per cent annually, Mr Ryan said the buy versus rent balance sheet could reverse.

“As prices rise, fewer properties will continue to be cheaper to buy than rent. The other factor potential buyers should consider is how long they’re going to stay in their next home. In this analysis we assumed a holding period of 10 years, which is roughly average for buyers. Shorter periods still incur the full fixed costs of buying, such as stamp duty and selling costs, and will make more dwellings cheaper to rent for those property searchers,” he said.

The research for REA Insights’ Buy or Rent Report is based on a modest projected house price growth of 3 per cent a year over the next decade (the average hold time of a home) and an annual mortgage rate of 3.25 per cent, with an assumption that buyers already have access to a 20 per cent deposit.