Australian house prices: 54 new suburbs around the country break the $1 million barrier for the first time

A million dollar median house price is fast becoming the norm, not the exception, for many suburbs around Australia. Find out if your suburb has cracked $1 million yet.

A million dollar median is fast becoming the norm, not the exception, for many city suburbs – and not just across Sydney’s skyrocketing postcodes.

54 Australian suburbs hit the million dollar milestone for the first time during the year to February, according to new data from REA Group.

RELATED: What house prices will cost in 2030

30-year price explosion created wealth ‘we didn’t have in 80s and 90s’

53 western Sydney suburbs hit million-dollar mark

Buyer pays $4 million for old house he ‘doesn’t want’

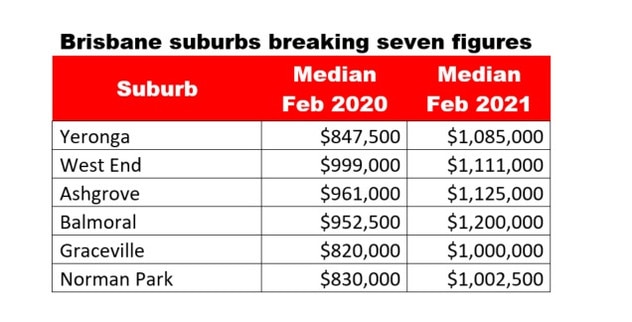

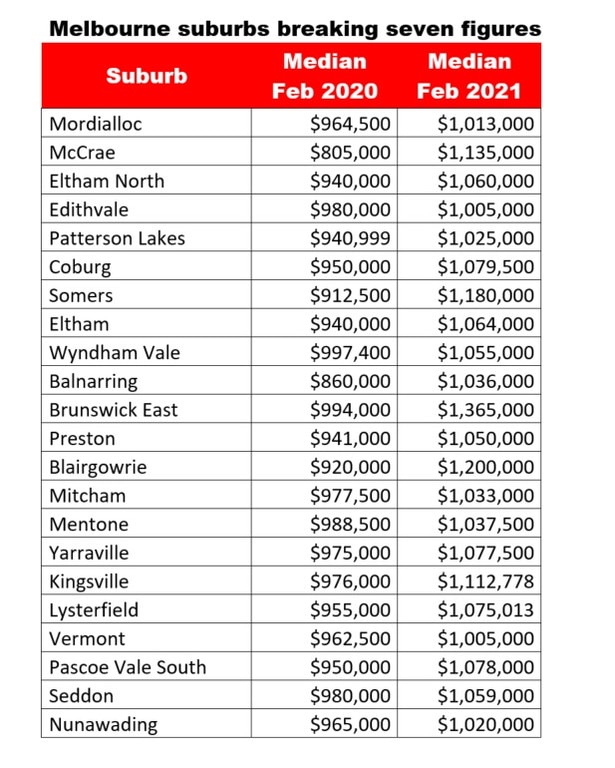

Surprisingly, more than half of those locations were outside of the Harbour City, with Melbourne and its surrounding regions accounted for 22 suburbs on the million dollar list, six were located in Brisbane.

Four of our new million-dollar ‘burbs were on NSW’s Central Coast, with Copacabana prices growing a whopping 68 per cent to $1.425 million. The remainder of the new suburbs were in metropolitan Sydney.

Cameron Kusher, REA Group’s director of economic research, said a growing number of suburbs outside of Sydney had been gradually reaching the benchmark before the COVID-19 pandemic began.

“The majority of $1 million suburbs nationally are in Sydney, with Melbourne home to the next largest share of million-dollar suburbs. Prior to 2020, there were still plenty of suburbs outside of these cities with a $1 million median, with them almost exclusively located in southeast Queensland, Adelaide and Perth,” he said.

Mr Kusher added that the newcomers might not had reached their new price points had the pandemic not shifted Australians’ lifestyle demands.

MORE: Photos of mum’s home makes her $23k per post

Homes of 2021’s richest Aussies revealed

Where to buy Sydney’s cheapest houses

“Just how rapid the rebound has been is surprising. When prices started rising, it became apparent that higher-priced housing markets were seeing strong growth and more suburbs were going to have that million-dollar price-tag,” he said.

“Before the pandemic there were positive signs that market activity was returning, but we didn’t expect such strong price growth for some time, particularly outside of Sydney and Melbourne,” Mr Kusher added.

Norman Park on the Brisbane River recorded a $1.0025 million median in February after several homes sold well over seven figures during the month.

While data for March is yet to be collated, that median is tipped to rise with seven homes already selling for more than $1 million according to CoreLogic.

A modern four-bedroom house on Power St in Norman Park fetched a whopping $2.1 million on March 20.

Yeronga, a riverside suburb in Brisbane’s south had its median shift from $847,500 to $1.085 million in the year to February. And in nearby Graceville, prices surged from $820,000 to $1 million.

Outside of the capital cities, the race to $1 million has been fast and furious.

“We’ve seen really strong price growth in regional markets over the past year, which has created more non-capital city suburbs with a million-dollar median than we’ve seen in the past,” Mr Kusher added.

Suburbs on the Central Coast of NSW and the Mornington Peninsula in Victoria also saw unprecedented price growth. Copacabana, which is 100km from Sydney, had its median house price jump from $850,000 in February 2020 to $1.425 million 12 months later.

McCrae, which is located 89km outside of Melbourne, moved from a median of $805,000 to $1.135 million over the same period.

These new highs are not just a post-pandemic anomaly according to Mr Kusher, who expects the million dollar club to only grow in 2021.

“Low borrowing costs and near record-high demand is likely to continue to drive prices higher this year and we do expect the suburbs that have hit a $1 million median to remain in the seven-figure club,” he said, adding that multiple forces working together would be the only way prices could fall.

“Higher interest rates, or the introduction of macroprudential policies that may lead to price falls, are likely to be the main factors that could force prices lower,” he said.

Originally published as Australian house prices: 54 new suburbs around the country break the $1 million barrier for the first time