Aussie renters are facing the worst affordability crisis since the global financial crisis

It’s the issue causing thousands of Aussies to struggle and, for many, the worst is still ahead. Now, experts are calling on the government to do more to address it ahead of the election.

Australian renters are forking out hundreds more each month as rent hikes outpace inflation — and experts warn the crisis is far from over.

New figures from Money.com.au show national rents have surged more than 14 per cent over the past two years, with further increases expected.

The last time rents grew this steeply was during the global financial crisis, but this time the pressures are even more complex — record migration, ultra-low vacancy rates and a shortfall in housing supply are fuelling a surge that’s catching millions in its wake.

RELATED: Government gives up on one million renters in latest budget

Rental option many tenants don’t know about

Aussies now more confident they’ll escape mortgage prison in 2025

Money.com.au property expert Mansour Soltani said renters were now facing a very different economic reality to mortgage holders.

“Inflation is easing and the RBA is moving closer to rate cuts, but renters are being left behind,” Mr Soltani said.

“There’s a growing divide between homeowners who are set to see some relief, and renters who are still copping steep price increases.”

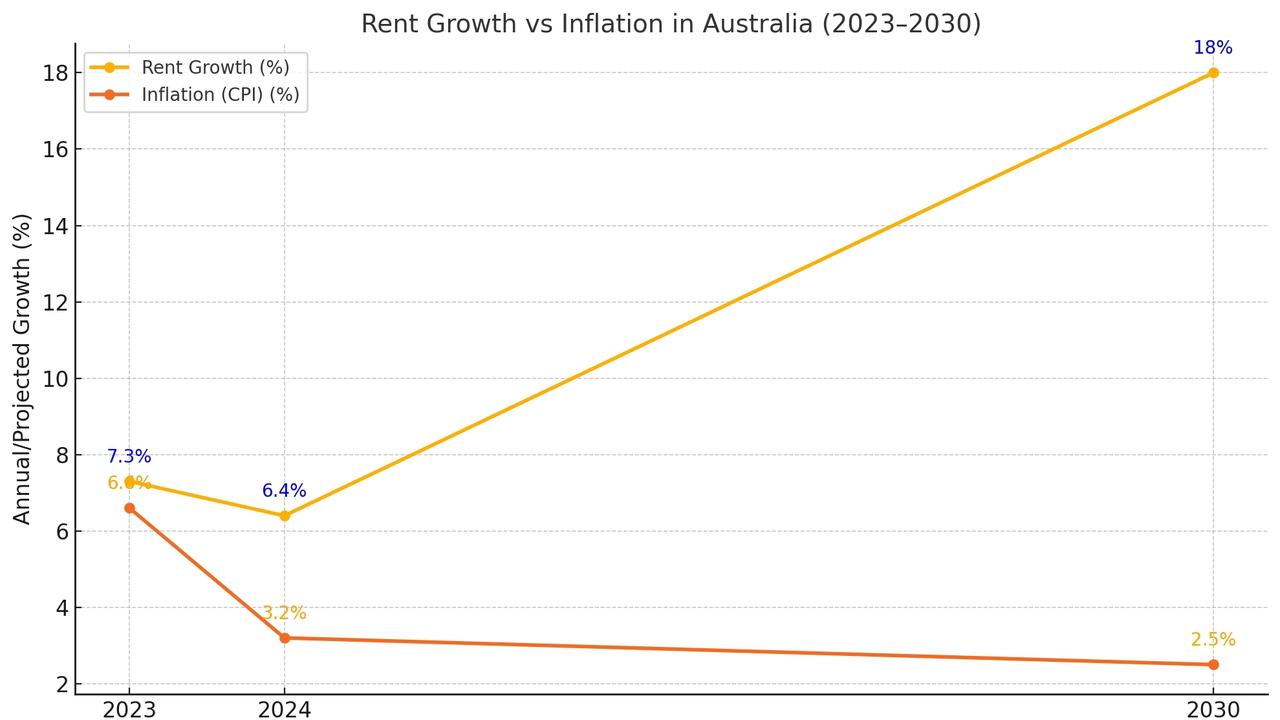

Money.com.au analysis shows rents rose 7.3 per cent in 2023 and a further 6.4 per cent in 2024 — far outpacing the overall CPI rate of 6.6 per cent. If current conditions persist, rents could jump another 18 per cent by 2030.

While landlords prepare for interest rate cuts, renters are bracing for more financial pain.

A separate report released by PropTrack showed the national share of affordable rental listings has collapsed to its lowest point since records began in 2008.

A typical household earning the national median income of $116,000 could afford just 36 per cent of advertised rentals in the second half of 2024 — down from 60 per cent only three years earlier.

For renter households earning below the national median, the situation is even worse. Just 19 per cent of homes advertised were affordable to them, based on the standard rent-to-income benchmark.

Young Australians are among the hardest hit.

Only 19 per cent of rental listings were affordable to those aged 15–24 — a demographic that includes the highest proportion of renters in the country.

REA Group senior economist Anne Flaherty the affordability crisis was no longer limited to low-income earners.

“Rental affordability is the worst we’ve seen on record, and it’s going to become more and more front of mind for voters and policymakers — especially as we head into a federal election,” she said.

“Even people with stable incomes are being priced out. And aspiring buyers are finding it increasingly difficult to save a deposit — especially without support from the bank of Mum and Dad.”

Victoria remains the most affordable state for renters, with Melbourne’s slower price growth offering some relief. But affordability is deteriorating there too.

In New South Wales a median-income household can afford just 26 per cent of available rentals, with Sydney’s median weekly rent hitting $730. Brisbane rents have jumped 50 per cent since 2020, and Perth renters are paying 80 per cent more than they were at the start of the pandemic.

In Adelaide, rents have soared 55 per cent since early 2020, pushing South Australia into second place behind NSW as the least affordable rental market in the country.

The surge has created a new political pressure point — one that housing campaigners say could become a defining issue at the next federal election.

Campaign group Everybody’s Home, in its response to the federal budget last month, warned that the government’s efforts — including the expanded help to buy scheme — were falling short of what’s needed.

MORE: Family’s heartbreak as Melb west auction battle took emotional turn

“This federal budget has measures that may make housing more affordable for a small number of people, but it doesn’t deliver solutions that will make housing more affordable for everybody,” spokesperson Maiy Azize said.

“The election is an opportunity for the federal government to offer the ambitious, visionary, and transformative solutions that voters are crying out for.”

The group pointed to polling showing three in five voters support limiting or removing negative gearing and the capital gains tax discount — longstanding tax breaks seen by many as worsening inequality in the housing market.

“Polling shows Australians want the federal government to prioritise funding affordable homes over tax breaks for investors,” Ms Azize said.

Everybody’s Home has warned that demand for social housing could reach one million homes within two decades if bold action is not taken.

Ms Flaherty said the federal government could help encourage more supply by supporting build-to-rent — a model already popular overseas — and reducing red tape for long-term rental developments.

“Build-to-rent has been very successful in other countries. It gives renters greater security of tenure and adds much-needed stock to the market,” she said.

“We should be taking it more seriously in Australia.”

Mr Soltani said unless urgent action is taken, the pressure on renters will only intensify.

“With population growth, record-low vacancy rates, and limited housing supply, this isn’t going to fix itself,” he said.

“The longer it goes unchecked, the harder it will be to restore balance.”

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Aussies now more confident they’ll escape mortgage prison in 2025

‘Proof’: huge mistake home sellers are making

140yo former Camberwell bank turned steakhouse site up for grabs

david.bonaddio@news.com.au

Originally published as Aussie renters are facing the worst affordability crisis since the global financial crisis