Armour-coated: 25 areas so strong that prices can’t fall now

It doesn’t matter what happens to interest rates in these Aussie suburbs. They all have one thing that means property prices can’t fall no matter what.

Australia’s housing crunch has pushed 25 areas into armour-coated territory, thanks to one key reason that’s forcing such strong growth there’s no chance prices can fall now.

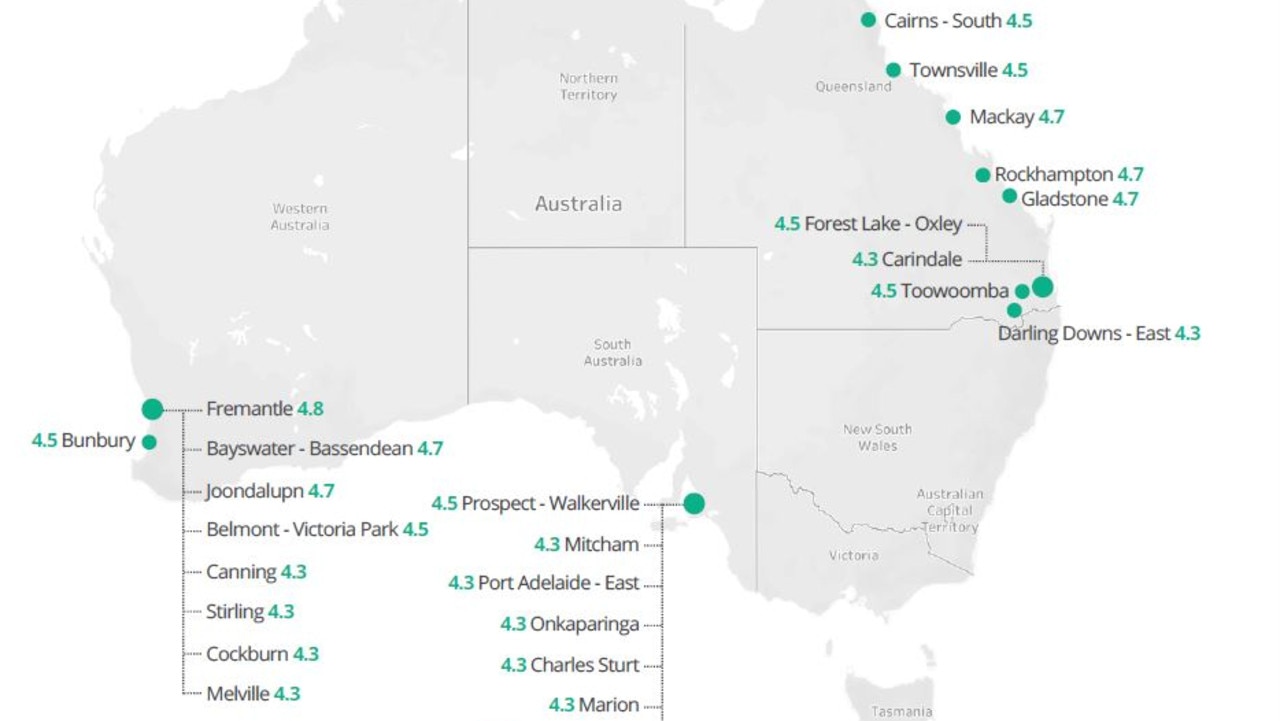

A new report on Australia’s housing supply crunch by InvestorKit analysed 330 regions, with 25 flagged as having such critically low levels of housing supply that no matter what happens to interest rates or national housing trends, there is now no chance of prices falling.

MORE: Tiny cottage that held out for decades breaks record at auction

38 yr old worked 80 hour weeks to afford first home

InvestorKit head Arjun Paliwal said “our forecast, especially for the seven regional centres, is that they will all see upwards of 10 per cent capital growth in 2025”.

Three key states are in the crossfire, Queensland, South Australia and Western Australia, with other states and territories not seeing anywhere near as high supply strife levels as those areas.

“We do a national review of the report, and I was quite surprised that nowhere else in the country was making (it into) this data set. So it’s really these three states that leading growth drivers for the country. There is growth happening in other areas, but it’s definitely not as undersupplied as these.”

Mr Paliwal said the 25 markets named in the report were expected to see the highest capital growth in 2025.

“The biggest gains that happened during the last four years since this huge property boom kicked off came off a supply crisis. It wasn’t to do with just demand,” he said. “That supply crisis was the big driver.”

MORE: Shock as big bank now expects rate cut within weeks

Inside outgoing Virgin Aus boss’ $16.9m renovator

Mr Paliwal said those undersupplied zones were a property investor’s dream, with the top seven tightest areas in Greater Perth and Regional Queensland, including Fremantle, Bayswater-Bassendean, Joondalup in the former and Mackay, Gladstone, Rockhampton and Townsville in the latter.

Other capital city regions named within the outstanding growth category for 2025 were Greater Perth’s Belmont – Victoria Park, Canning, Stirling, Cockburn, Melville, seven out of Greater Adelaide: Prospect-Walkerville, Mitcham, Port Adelaide-East, Tea Tree Gully, Onkaparinga, Charles Sturt, and Marion, and two in Greater Brisbane: Forest Lake-Oxley and Carindale.

Of the seven regional areas named, all were in Queensland including Cairns-South, Toowoomba and Darling Downs-East.

“What many people don’t recognise is that there is a substantial undersupply of housing in these areas. This is actually quite common when you go through a long period of underperformance like they did earlier in the decade, from 2012 all the way to 2020. Construction supply reduces, building activity reduces, and also that ability or desire to sell in these areas starts reducing year after year.”

He said Gladstone for example had seen a massive 31 per cent decline in listings over the past decade, while the population rose 8 per cent.

“That’s not a big growth in population, but it’s all about relativity – a reduction of 31pc in established supply and then also a reduction in the last three years of new build approvals by 48pc. The supply level is well under.”

As a result he expected Queensland’s strongest growth performers this year to be those undersupplied areas led by Townsville, Rockhampton, Mackay and Gladstone.

In Perth, Fremantle’s population jumped over 14 per cent in the past decade, he said, while for sale listings shrank by -29 per cent and the new house building approvals rate decreased by -77 per cent in three years.

The pandemic era boom of blanket growth across the country was over this year, Mr Paliwal said.

“We’re seeing a divergence of trends,” he said. “Now you can clearly see across Australia which areas are slow moving, which areas are okay moving, and which areas are likely to perform at high rates of growth.”

“That’s a property investors dream, because it’s hard when everything everywhere is making such big gains, and you don’t know where to put your money … Now investors and buyers have to be savvier in 2025 because these trends are now more clear. You cannot make a decision that holds you back if you can clearly see that these are the most undersupplied.”

Mr Paliwal said Australia’s housing was now “among the least affordable in the world due to growing demand, low established supply and a decline in national average household size, and we are still a long way from resolving the issue”.

Originally published as Armour-coated: 25 areas so strong that prices can’t fall now