NAB banker and ABS employee arrested in alleged $7m insider trading scam

A BANKER and a public servant who were mates at university have been arrested over what police say is an insider trading scam involving the Australian dollar that netted $7 million in nine months.

A BANKER and a public servant who were mates at university have been arrested over what police say is an insider trading scam that netted $7 million in nine months.

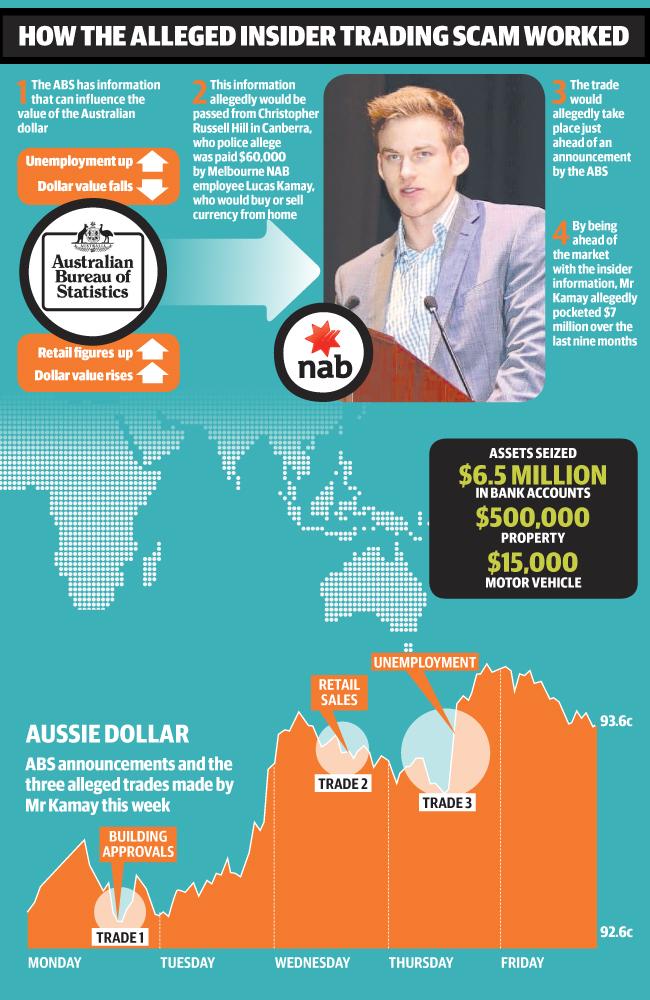

NAB banker Lukas Kamay, 26, and Australian Bureau of Statistics employee Christopher Russell Hill, 24, are accused of using insider information to make millions buying and selling the Australian dollar online.

The pair were arrested pn Friday after a joint investigation by the Australian Federal Police and the Australian Securities and Investments Commission.

Police allege that from last August Mr Kamay, of Melbourne, paid Mr Hill in Canberra for confidential ABS statistics he then used to trade online, betting against movements in the dollar. It’s alleged Mr Kamay profited most.

DO YOU KNOW MORE: EMAIL news@heraldsun.com.au

Police raided the pair’s homes and searched NAB’s Melbourne headquarters and the ABS offices in Canberra.

They froze assets including a $500,000 home, a $15,000 car - and an astonishing $6.5 million in bank accounts.

Mr Kamay, who was sacked by the NAB on Friday, faced Melbourne Magistrates’ Court charged with seven offences.

Mr Hill was to face Canberra Magistrates’ Court on Saturday.

Police allege the pair conspired with the intention to commit insider trading, and that Mr Kamay paid his old Monash University friend $50,000 to $60,000 to persuade him to provide information relating to confidential statistics held by the ABS.

Mr Kamay was also charged with three counts of acquiring foreign exchange derivatives while in the possession of “inside information”.

It is alleged he made transactions on Monday, Wednesday and Thursday this week.

He’s also been charged with using fake identification and dealing with proceeds of crime worth more than $1 million.

Prosecutors agreed to Mr Kamay’s release on bail until August on strict conditions, including a $500,000 surety.

He must not leave Australia, has surrendered his passport, and must live at his parents’ Eaglemont home.

He must also report to police daily and has been banned from any form of trading on Australian markets.

AFP Acting Assistant Commissioner Ian McCartney said police would allege Mr Kamay obtained unpublished labour force figures and retail and trade figures from Mr Hill in order to predict fluctuations in the Australian dollar.

He said Mr Hill would face charges of insider trading, receiving a corrupt benefit, releasing sensitive information, and abuse of public office.

“They had a prior relationship through their attendance at a university,” Mr McCartney said. “We’ll allege that (Mr Kamay) obtained the significant … share of profits from this criminal activity.”

Police said no NAB funds or systems had been used.

ASIC’s Chris Savundra said such actions may have had international repercussions for other investors.

“Insider trading, a form of dishonestly using non-public, price-sensitive information belonging to others for personal gain, is not on and it will not be tolerated by ASIC or the AFP.”

Mr Savundra said the Australian dollar was one of the most traded currencies on the foreign exchange market, which had daily turnover of $5 trillion. “Its movement, directly or indirectly, (affects) all Australians,” he said.

NAB Group CEO Cameron Clyne said the bank had terminated Mr Kamay’s employment and had co-operated fully with the police.

The ABS said the relatively junior Mr Hill had been suspended, no other staff were suspected, and there was no evidence the disclosure included any details about any person or business.

ellen.whinnett@news.com.au

>>>

MILLIONS SEIZED IN INSIDE TRADE PROBE

THE insider trading case that emerged yesterday didn’t have the verve of a Gordon Gecko Wall Street plot.

But small movements in the Australian dollar can nevertheless generate huge dollar returns - if you’re on the right side of the bet.

The Australian dollar seesaws on the basis of a variety of different types of information, the main one being the future direction of interest rates.

This was the key to the $7 million insider trading scam that authorities say allowed Lukas Kamay and Christopher Russell Hill to rock the $5 trillion foreign currency market.

Two factors that influence the Reserve Bank board’s decisions on altering the interest rate are unemployment and retail sales figures.

These were data police say were leaked by Mr Hill at the ABS to Mr Kamay at National Australia Bank.

The allegation is that the market was manipulated by using that data to place bets against future movements of the Australian dollar.

The currency can regularly move 1-2c in a 24-hour period.

The Australian Federal Police allege NAB employee Mr Kamay paid his university mate Mr Hill between $50,000 and $60,000 to persuade him to provide information related to confidential statistics held by the ABS - mainly jobs and sales data.

They say three transactions occurring on Monday, Wednesday and Thursday this week coincided with the release of ABS data - covering building approvals on Monday and sales and unemployment figures on the Wednesday and Thursday.

Police say the insider trading arrangement between the two began in August last year.

Mr Kamay, who worked as a junior dealer on the markets desk at NAB, has also been charged with using fake identification and dealing with the proceeds of crime worth more than $1 million.

It is further alleged Mr Kamay acquired foreign exchange derivatives while in possession of inside information provided by Mr Hill.

Sources close to the case claim the information was given to Mr Kamay often only hours before its official release.

But on the market, being minutes or even seconds ahead of your rivals can generate millions of dollars in profits.

Insider trading within NAB’s foreign currency division plunged the financial institution into disarray eight years ago.

The bank lost more than $360 million and sacked a list of senior managers inside its foreign exchange trading desk.

This week, NAB executives have been co-operating with police. NAB sacked Mr Kamay on Friday, after he was arrested and charged as a result of an investigation by the AFP and Australian Securities and Investments Commission .

The bank said the charges do not relate to the former employee’s work at NAB and none of its money or customers’ money was involved.

No NAB systems were involved in any trading and no other NAB employee is alleged to have been involved.

NAB Group CEO Cameron Clyne said the activity alleged was unlawful and completely unacceptable to NAB.

In a note to all staff, Mr Clyne encouraged employees to report any behaviour they believe is not right.

- Stephen McMahon

stephen.mcmahon@news.com.au