Young Aussies are feeling the pinch, but still prioritising passion

While Gen Z and Millenials are suffering the most under the cost of living crisis, they are still prepared to splurge on certain items - house deposit be damned.

Young Australians are willing to forgo many little luxuries as they feel the pinch amid a worsening economic crisis, but there is one thing most aren’t willing to sacrifice – their hobbies.

New research from Allianz has shown that Gen Z and Millenials are suffering under the cost of living crunch the most, with three quarters of Aussies aged 18 to 35 cutting their spending.

Tightening the purse strings normally means axing everything from takeaways to new clothes, which 75 and 57 per cent of the cohort have reported doing respectively.

However, regardless of how expensive they may be, young Aussies are still forking out the cash to keep themselves entertained with a surprising 59 per cent refusing to cut finances to their hobbies.

In fact, nearly half would prefer to spend money on their favourite pastime over saving for a bigger purchase like a car or home loan.

Marketing professor at Queensland University of Technology, Gary Mortimer, said splurging on “self-directed consumption” is historically common in times of hardship.

It’s what’s known as the “lipstick effect” – a name derived from tales of women continuing to purchase makeup during the Great Depression.

“Theoretically, the research around self-gifting suggests that when things aren’t great, we tend to consume or buy small things to make ourselves feel better,” Mr Mortimer explained.

“The same is now being applied when it comes to recreational sport or other hobbies — these types of experiences can remove us emotionally or psychologically from where we’re placed.”

Rental vacancies are at an all-time low, rental prices are at an all-time high, the gap between wages and prices is the largest it’s been on record, and food inflation is costing households up to an additional $1924 per year on groceries.

So why are our young people willing to spend thousands on games, sports, music and photography?

The answer, according to clinical psychologist Jaimie Bloch, boils down to self care.

“You get a sense of belonging and social connection which helps create joy and balance in someone’s life,” she said.

“We’ve seen an uptake in hobbies since Covid – people might not have been working or were home a lot, so people invested a lot more in self care.

“Part of that is hobbies.”

Ms Bloch says Millennials and Gen Z are “more connected to their mental health”, and during the pandemic learnt to prioritise experiences that connect them to their passions.

“Young Australians are committing lots of time to their hobbies, seven hours per week, and that just shows you how they’re focusing on their mental wellbeing rather than achieving other goals that are possibly more future-oriented,” she said.

“I think young people’s values might be different to those of the past.

“I can imagine anecdotally that when we are stressed we would connect more to the things that bring us joy and take us out of isolation towards a bigger purpose.”

Why spend on a hobby?

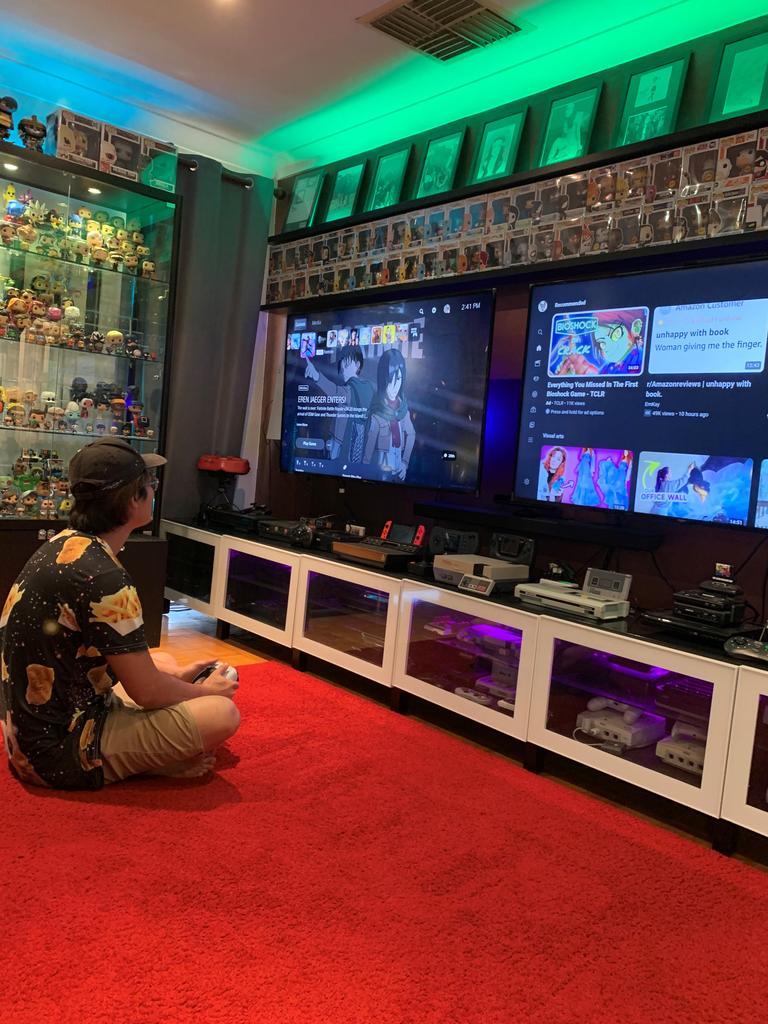

Western Australia-based design and tech teacher Derrek Lau has amassed an impressive collection of games, trading cards, figurines and more — all up worth about $70,000.

“It costs me a lot of money,” he said.

“But I don’t have kids or anything like that so I have to spend it somehow.”

Despite dropping tens of thousands on his hobby over the years, Derrek, now 34, has been able to purchase both a house and car.

“My primary income is as a teacher, but my side hustle is being a magician,” he said.

“My bills and mortgage and my groceries, that all comes out of my teaching income, and the money I make as a magician goes to my collection and my hobby.”

Derrek said “almost everyone” he knows is doing some type of side hustle.

“I think in the past it was accepted that you go to work to make money to pay bills but it doesn’t matter if you enjoy the work or not,” he said.

“Culturally my generation is more like, ‘be whatever you want, find the job you love’, so you pursue the job you want as a side hobby but you have the security of that stable job.”

While he sometimes puts off bigger purchases and says no to pricey outings, Derrek believes investing in experiences and social activities is always important.

He has also made close friends in the cosplay community through his gaming.

Though Derrek saved hard in his twenties to be able to put down a deposit on his home, he sympathises with the Gen Z perspective of seeing home ownership as a “pipe dream”.

“But once you overcome that hurdle and are financially comfortable, and especially if you don’t have kids, there’s a lot you can do.”

James McLennan — sailing

Working as a graduate of architecture, James McLennan says he has learnt important skills and met some of his closest friends through sailing.

“It’s unfortunate I picked the most expensive sport, though,” he conceded.

While ongoing costs of memberships and gear can cost up to $2000 per year, James and his teammates are able to use boats at the Sorrento Sailing Couta Boat Club through their membership.

Buying your own one-person sailboat, however, can set you back about $7000.

James says he has been able to afford his passion through careful budgeting, but worries he wouldn’t be able to should he have children or other large expenses.

“I love it, life isn’t worth living without doing things you like,” he said.

“As much as I’d love to be able to save more money it just wouldn’t be the same without seeing my friends and doing something I love.”

James says his hobby has connected him to lifelong mates and taught him valuable skills.

“Catching up with friends and clearing my mind from work, no distractions, you get to escape the normal stresses of life,” he said.

“It’s expensive and it’s especially hard to justify when you have limited money in uni … but it seems to be more important to my generation.

“At this age we don’t have any responsibilities … I could die tomorrow but the skills I’ve learnt from sailing and the people I’ve met are just as important as all those other things.”

Marcus Casalis — DJing

Marcus Casalis, 23, recently graduated from an engineering degree, and is working two jobs to keep up with cost of living expenses.

In his spare time, however, he explores his passion for music and DJing.

Setting up a small DJ collective called Limittest, Marcus was able to split the cost of his equipment with two friends.

“We paid just over $4000 for our set-up, all of which is pre-owned, but we’re still looking for speakers,” he said.

Savvily sourcing most of their equipment at second-hand shops and websites, Marcus and his friends do sometimes make small amounts of money at booked events, but only $50 to $100 each.

One song costs about $1.50 to download.

“I do it for the fun, not the money,” he said.

“I like sharing music and playing it for my friends, it makes me feel great.

More Coverage

“Most of the time we’re just mixing at home, it’s a good way to relax and take your mind off things.”

Marcus said he isn’t too worried about saving for bigger purchases, such as a home loan, but that he still makes sacrifices to put money aside for his future.

“I’m going to be in debt anyway, so why does it matter if it’s one or two years difference?”