Vaccine billionaire’s 3000 per cent gain with surprise bet

The billionaire behind Moderna is set to receive a 3000 per cent gain after yet another rogue bet on a medical company paid off.

A billionaire behind Moderna is set to reap the benefits of a 3000 per cent gain after yet another of his rogue bets on a pharmaceutical company paid off.

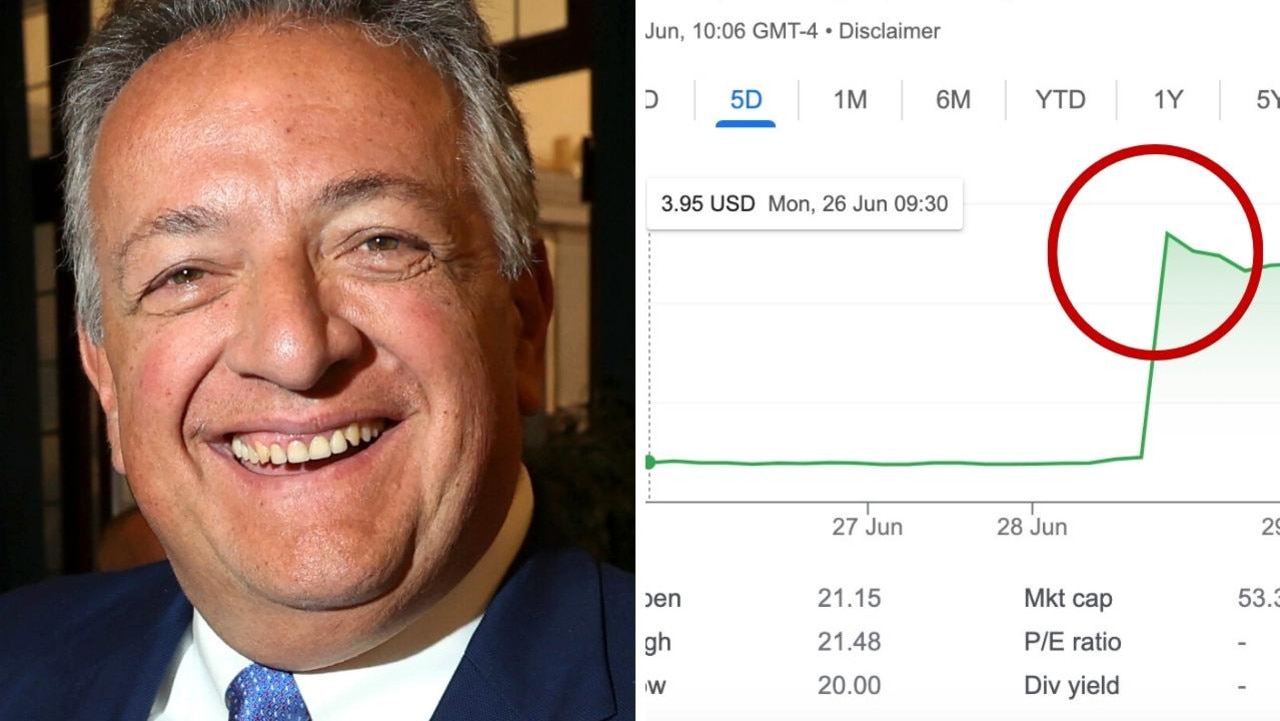

Noubar Afeyan became a billionaire after backing Moderna, the underdog firm that became a household name after developing one of the first Covid-19 vaccines.

He’s now preparing to add to his estimated A$2.1 billion fortune after yet another unexpected bet octupled in value.

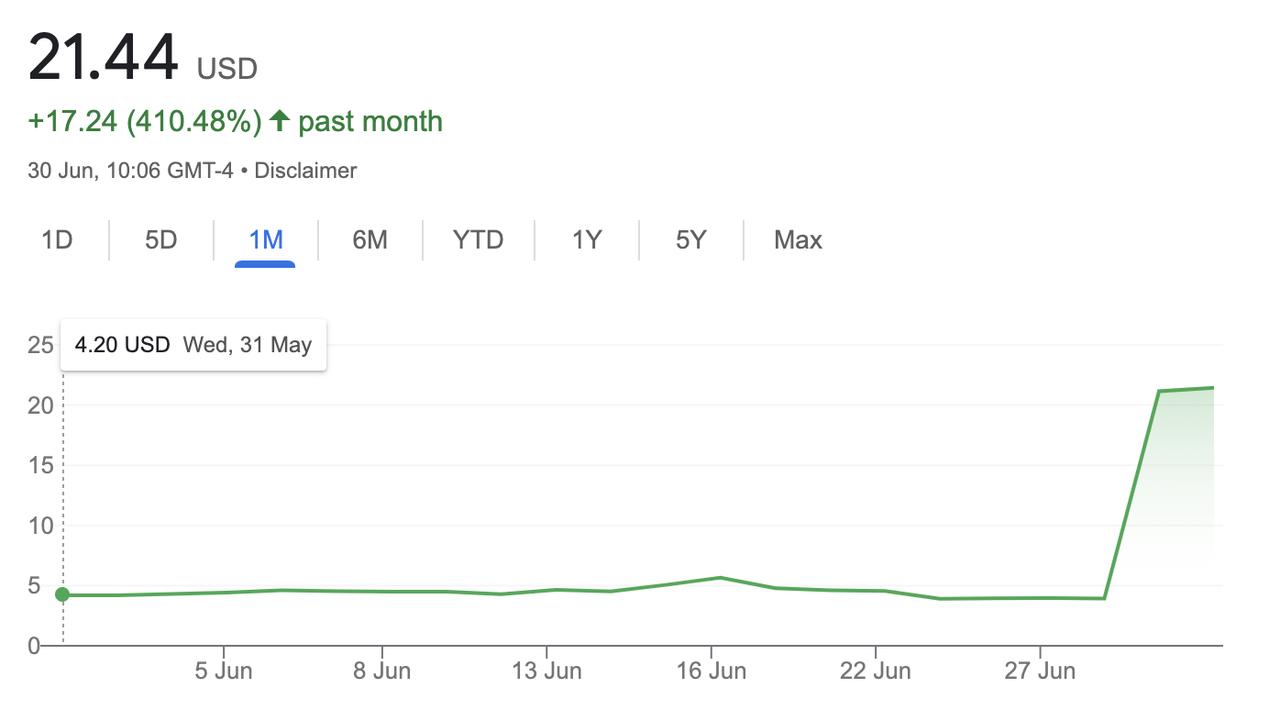

Sigilon Therapeutics, a biotech firm that specialises in non-viral engineered cell-based therapies for diseases such as diabetes, saw its stock price soar more than eightfold to US$27 (A$40) on Thursday after pharmaceutical giant Eli Lilly agreed to buy it.

Funds of Afeyan’s venture capital firm, Flagship Pioneering, own 31.9 per cent of Sigilon, according to the company’s latest proxy filing.

Historical trades indicate Sigilon is yet another of Afeyan’s remarkably well-placed bets.

Just last month, the company was at risk of being delisted because its shares were priced so low. It underwent a one-for-13 reverse stock split — meaning the number of existing shares were consolidated into fewer, proportionally more valuable shares — which boosted its value just enough to satisfy the minimum price requirement for continued listing on Nasdaq.

Eli Lilly, a major provider of diabetes drugs and insulin, owned a nearly 8.44 per cent stake in Sigilon as of March 27 and has now offered to buy the lot, giving it access to Sigilon’s signature diabetes-management products.

Afeyan is poised to receive an even larger windfall if Sigilon hits certain benchmarks.

To get the full offer, Sigilon products are required to complete three fairly demanding steps. The final and largest payout is contingent on regulatory approval of a specified product.

If all its criteria are met, Eli Lilly’s offer would soar as high as US$126.56 per share and bump Afeyan’s firm’s windfall to US $101 million (A$152 million).

At the close of the deal, Sigilon shareholders will receive a total of US$34.6 million, equal to US$14.92 per share — or up to US$126.56 per share if all the benchmarks are met.

“There can be no assurance that any payments will be made” with respect to the contingencies, Sigilon said in a filing Thursday. BTIG analyst Thomas Shrader said the conditions of the first payout are very likely to be met, while he gave the second payout a “no better than 50/50 shot”.

Sigilon stock was trading at US$21.44 on Friday — higher than Eli Lilly’s initial $14.92 payment, indicating investors believe at least some of the hurdles will be met.

More Coverage

Sigilon, like Moderna, is based in Cambridge, Massachusetts. It also shares a co-founder — MIT professor Robert Langer, who also became a billionaire through the vaccine maker.

A biochemical engineer by trade, Afeyan holds more than 100 patents and has been involved in building more than 70 start-ups in the life sciences industry, according to his bio.

Born in Lebanon, his family moved to Canada in 1975 to flee the civil war. He came to the US to attend graduate school at Massachusetts Institute of Technology (MIT) and has lived in the area ever since.