‘Secret weapon’ to get $14,000 extra per year

Aussies are struggling to make ends meet but they’re “missing a trick” when it comes to getting an extra $14,000 per year.

In the current cost of living crisis, with record inflation, rent rises, petrol prices, and the fastest interest rate tightening cycle in a generation, people are struggling to make ends meet – and it’s no surprises why.

People are frantically looking at their budget and spending, looking at how they can find a way to save. But most people are missing a trick.

There’s a limit to how much you can cut your expenses, but there’s no limit to how much you can increase your income.

Getting a pay rise is the forgotten secret weapon when it comes to saving, with most people focusing way more on cutting costs at the other end of the ledger. But spending less always comes with sacrifice, and if you can find a way to earn more it will allow you to save more without sacrificing anything.

Today it’s easier than ever to earn more money, but most people ignore this highly effective lever when it comes to their money.

Earning more (read: enough) money is a critical part of getting the results you want from your money. When your income is higher, you can more comfortably cover the spending you need or want, and on top you can find money to save and invest to get ahead.

I wanted to cover the different ways you can pump up your income and save more without sacrificing.

Get paid more in your current role

Particularly today with record low levels of unemployment, there’s a talent war on in full force. Good companies are struggling to find (and keep) good people, so speak to your boss or employer about what you’d need to do to earn more money in your current role.

A good company knows that more output means better commercial outcomes for the business, so you can position your role and work to be more productive, and in turn share in the commercial uplift.

Get a promotion

Understanding the next step in your career and accelerating your development to get there faster means faster income growth. Chat with your employer about what this could look like for you, and what you’d need to do to get there.

Taking this path may take a little longer and a little more effort, but can seriously pay off in terms of a much bigger salary uplift over time. It’s common for people to be focused on their day to day and not always be thinking ahead, but laser focus on your next step will help you get there faster.

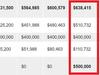

Change jobs or companies

The statistics show that the average salary bump when changing jobs is 14.8 per cent, while wage growth is only 5.8 per cent – based on the average income of $95,581 this means a pay bump of $14,146 every year and highlights a huge opportunity. In today’s job market where unemployment is at record lows, there are a stack of companies hiring. Finding the right role can seriously accelerate your income growth.

Given the uncertainty in the economy today, it’s important if you’re considering this path you do your research and find a good company that will actually be good to work with long term. The last thing you want is to change jobs only to realise that you hate the role, company, or that they’re struggling financially – so do your research and choose wisely here.

Get a second job

This one will involve more hours at work, but with the current record job openings there are a lot of companies looking for part time or casual workers. Picking up even one extra shift per week can make the difference between struggling and saving enough to get ahead investing, so it’s worth looking into.

These days technology is also making it super simple to pick up some gig work, driving for rideshare services, doing deliveries, or jumping on Airtasker. All of these options will give you a quick injection of extra cash with no long term obligation.

Start a side hustle or business

This one shouldn’t be taken lightly given the amount of work (and risk) involved, but if you have a skillset or passion that you can monetise, you can build a second source of income to supplement your full time career.

Once again, the rise of technology is making this easier by the day. But a word or warning here, I’ve seen too many people to count lured into the ‘side hustle’ life by the promise of easy money, only to realise it comes with a huge amount of work. Then when they calculate how much they’re getting paid for the amount of time they’re putting in, they realise this isn’t a smart play – do your research before jumping in.

The wrap

Budgeting is important, and it would be a mistake to ignore where you’re spending your money – particularly in today’s cost of living crisis. But at the end of the day, there are only so many things you can cut out of your spending and still enjoy a decent lifestyle.

Increasing your income is an often forgotten lever you can use to cover your ideal lifestyle spending and save more money at the same time without making any sacrifices at all. Don’t ignore this important driver or your money success.

There are a lot of different ways to make this happen, some of them will be completely wrong for you, but others may fit in nicely with your skillset, interests, and life stage – take the time to understand your options and think about whether these levers can help you come out of this cost of living crisis in a stronger position than you’re in today.

Ben Nash is a finance expert commentator, financial adviser and founder of Pivot Wealth www.pivotwealth.com.au. Ben is the creator of the Smart Money Accelerator program that helps people build a second income investing faster.

Ben is also the Author of the brand new book, ‘Replace your salary by Investing’ and the host of the Mo Money podcast, https://pivotwealth.com.au/podcast/, and runs regular free online money education events, you can check out all the details and book your place here

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.