Generation X set to overtake Boomers as Australia’s wealthiest generation, Millennials left behind

The great wealth transfer has finally hit Australia, with Baby Boomers set to lose their title as the country’s richest generation in a historic shift.

The time of Baby Boomers being the wealthiest generation is set to come to an end, with Generation X to take over as the country’s richest Aussies.

Surging property prices and massive share market gains are behind what is being labelled the “great wealth transfer”.

Meanwhile, Millennials are struggling to reap the gains of unprecedented growth in property prices, weighed down by student debts and priced out of the market.

KPMG on Friday released its latest analysis of asset distribution across four generational cohorts.

It showed that, while Baby Boomers still lead the pack in terms of net worth, Gen X has leapfrogged their older counterparts in property wealth and shares.

With the average 51-year old Gen-Xer holding $1.31m in housing value, they have narrowly beat out the average 69 year-old Boomer who holds $1.30m.

Meanwhile, Millennials and Gen Z, who have struggled to break into the market as prices soared across Australian capital cities, lag behind with $750,000 and $69,000 in property, respectively.

KPMG’s Urban Economist, Terry Rawnsley, told Aussies to expect this shift to continue as Boomers downsize and offload their properties.

“Baby Boomers have historically been the largest holders of housing assets, but as this cohort ages into retirement they are beginning to sell down their property portfolios”, he said.

So, while historical trends indicate each generation is generally wealthier than the last as assets build up over multiple lifetimes, the failure of Millennials to break into the housing market may put the brakes on wealth increases.

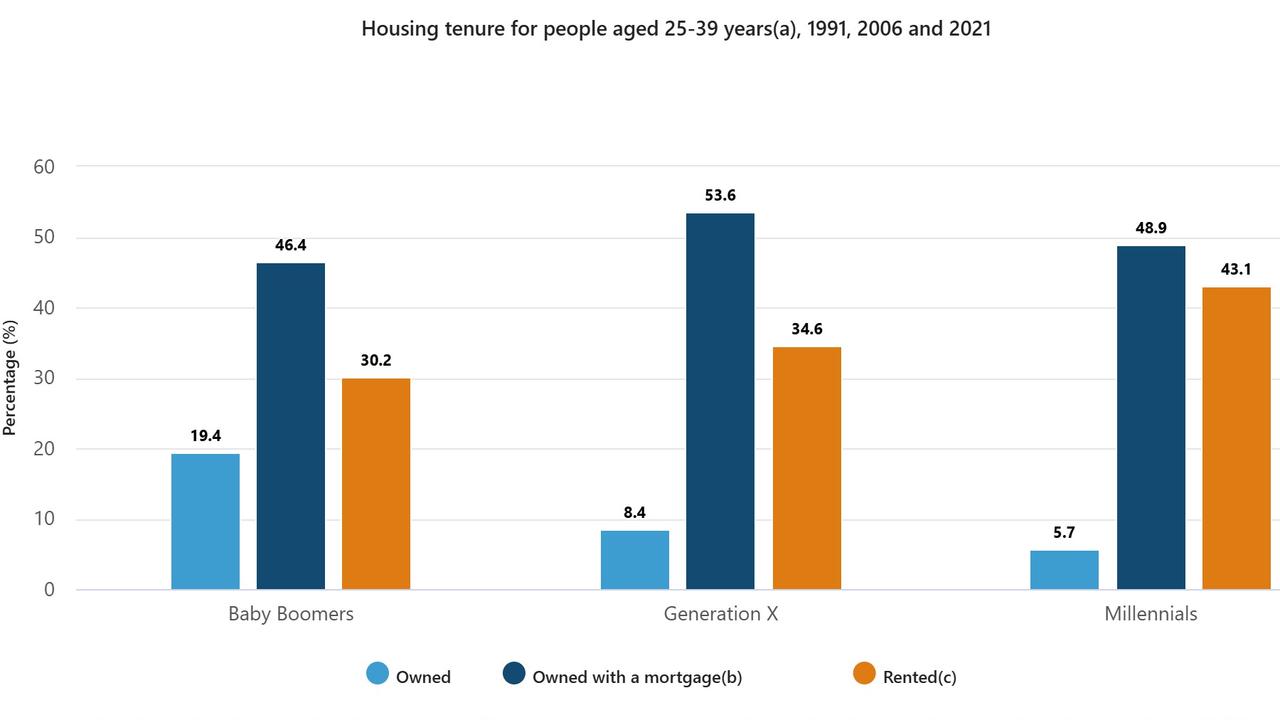

Home ownership levels are about 10 per cent lower for Millennials than that of older generations, but their debt levels are just 8.5 per cent below the average Gen Xer.

However, it’s not all bad news.

Early last year, global real estate consultancy Knight Frank projected almost US$90 trillion (A$144 trillion) of Baby Boomer wealth to be handed down to Millennials in the US alone over the next 20 years.

And with Boomers punching well above their weight in Australia, representing a quarter of the population but owning 53 per cent of national wealth, Millennials may increasingly be relying on inheritance to build housing portfolios.

“While the starter’s gun has been fired on the great wealth transfer, our findings still demonstrate a clear disparity in housing wealth between older and younger generations.” Mr Rawnsley said.

Gen X have also outperformed Baby Boomers when it comes to shares, with an average portfolio of $256,000.

The average Boomer only holds $206,000 in shares, while Millennials and Gen Z have significantly lower amounts, $51,000 and $7,0000 respectively.

“These lower levels of share ownership among younger generations indicate a cautious approach towards equity markets, possibly due to financial pressures and less cash to invest,” Mr Rawnsley said.

Older generations heading into retirement generally tend to prefer less risky investments.

This is also highlighted in the figures for cash and deposits, where Boomers outstrip their Gen X counterparts $242,000 to $176,000.

“Baby Boomers are gravitating towards liquidity and higher cash holdings which reflect their inclination towards safer investments,” Mr Rawnsley said.

When it comes to Superannuation, Boomers and Gen X are fairly comparable, while the balances of younger generations tail off, reflecting their limited time in the workface comparably.

However, Mr Rawnsley highlighted the increases to the super guarantee rate over the years as a potential source of wealth for younger generations.

“There is some good news for younger generations in the superannuation asset class as they are coming off a far higher base than their parents,” he said.

“This means the wealth they will eventually accumulate from super will be far higher than older generations.”

The final category showed loan balances were highest for the average Gen Xer at $448,000, closely followed by Millennials with $410,000.

The tendency for Baby Boomers to deleverage their positions in preparation for retirement was reflected in their relatively low average loan balance of $82,000.

Gen Z’s average loan balance of $49,000 primarily reflects HECS and credit card debt.