Billionaire Mark Cuban reveals exactly how much tax he pays

He’s worth more than $8 billion so when he revealed his tax bill – it had some questioning whether the amount was “fair”.

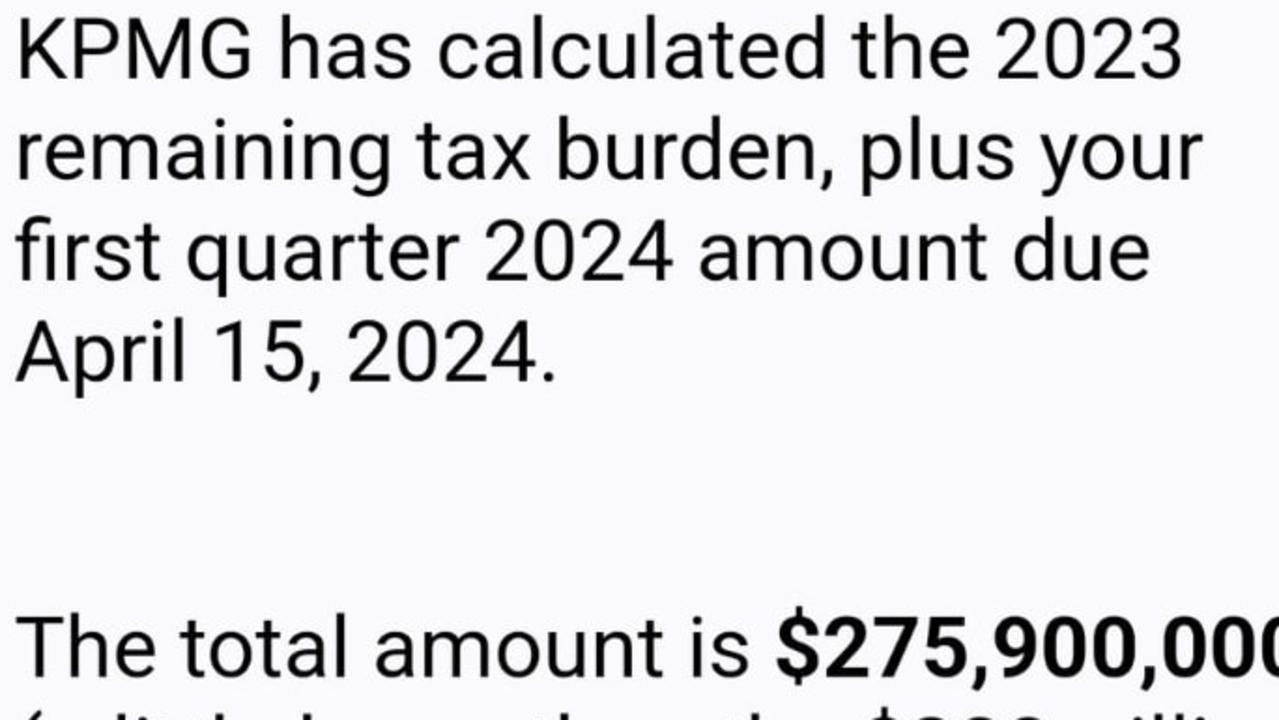

A US billionaire has revealed that he is “proud” to be paying $US275.9 million ($A430.1m) in tax, but some have questioned the “strikingly low” figure.

Mark Cuban, who appears on the reality TV show Shark Tank in the US and is the co-founder of the company Cost Plus Drugs, is worth an estimated $US5.4 billion ($A8.4b).

He also owns a significant stake in NBA team the Dallas Mavericks after making a partial sale in December worth $US3.5 billion ($A5.4b)

Mr Cuban shared on X, formerly Twitter, that he had transferred the $$US275.9 million to the US tax department for the 2023 financial year and for the first quarter of this year.

“Do I expect all of it to be used wisely. Of course not,” he wrote on X.

“But I’m still proud to be able to give back to our country. I’ve said it for years. After military service, paying your taxes is the most patriotic thing we can do.”

However, some people commented that the figure was “strikingly low” and questioned why he wasn’t paying more, while others claimed he was “cheating the government”.

Mr Cuban was asked on X if “you or your corporations pay more than the required taxes in order to pay your fair share” and he replied “I pay what I owe”.

Australia Institute senior economist Matt Grudnoff told news.com.au that it was “very unusual” for a billionaire to reveal his tax bill as “most extremely wealthy people keep that under wraps presumably as they don’t pay as much you might expect”.

While he said the tax bill wasn’t a “huge amount of money” for the billionaire, he did praise Mr Cuban for being upfront.

“The positive thing I could say about it is at least he is showing that tax is an important part of society … (but) the US is a very similar to Australia actually in that largely they are low tax countries compared to other developed countries,” he said.

“We can see that other countries tax far better than Australia and far more than Australia and if we want a first world health and education system and aged care and all the other things that we have seen recently in that era falling down in Australia, we need at first $105 billion a year extra in tax and than we will be at the OECD average.”

It comes at a time where tax evasion and wealth concealment have been shown to be a huge issue in Australia.

A global report released last year suggested Australians hold more than $370 billion in known foreign tax havens.

Meanwhile, the EU Tax Observatory report also suggested that “global billionaires” still have effective tax rates as low as between 0 and 0.5 per cent of their wealth with the use of shell companies common to avoid paying tax on their income.

Mr Grudnoff said the Australian tax system was in need of urgent reform.

“I think the problem with the Australian system and the US system is – they have similar problems – because of the lack of reform its become extremely complicated so the problem with that is the very wealthy can hire very smart people to find loopholes in order to reduce the amount of tax they pay,” he said.

“These loopholes aren’t available to the vast majority of people and so essentially they are able to avoid paying their fair share and effectively the Australian tax system needs to be simpler and needs to crackdown on loopholes.

“Broadly there are a couple of large loopholes – things like trusts only occur in English speaking and developed countries, and they are used by the wealthy people to avoid tax, and the other way is very wealthy people can incorporate themselves and use business tax systems and not the individual tax system to avoid taxation.”

Data from the Australian Taxation Office revealed that 66 people earned more than $1 million in the 2020-21 financial year but paid no income tax.

It showed the 66 people who did not pay tax in 2020-21 earned an average of $14.5 million, while in 2019-20 only 60 people avoided paying tax and earned, on average $3.5 million each.

However, compared to the US which has “excellent” statistics on what the 0.1 per cent top earners make and pay in tax – the same transparency isn’t available in Australia, said Mr Grudnoff.

He said the best data in Australia is the top 20 per cent of households which means there isn’t a good idea on how much “we are missing out on” from high income earners avoiding paying tax.

While making changes to the tax system was politically hard, Mr Grudnoff was optimistic it could be done after the overhaul of the stage 3 tax cuts.

The Albanese government’s rejig of the stage 3 tax cuts retained the tax-free threshold at its current rate of $19,200 and lowered the rate on income earned up to $45,000 to 16 per cent – down from 19 per cent.

It also lowered the rate of the $45,000 to $135,000 tax bracket to 30 per cent – down from 32.5 per cent.

“Despite the fact it had bipartisanship in that both major parties supported it at the last election, we have seen real change,” he said.

“It hasn’t changed the total tax cut but it has certainly changed who gets it and taken a significant part from the top and spread it out for cost of living relief for the majority of Australians and that is very heartening it is possible to get positive tax reform.

“Those who have the most to lose, have the most money and the most influence and they will fight hard in order to stop these type of changes but it doesn’t mean it isn’t worthwhile.”