Top hacks to prepare your budget for looming economic crisis

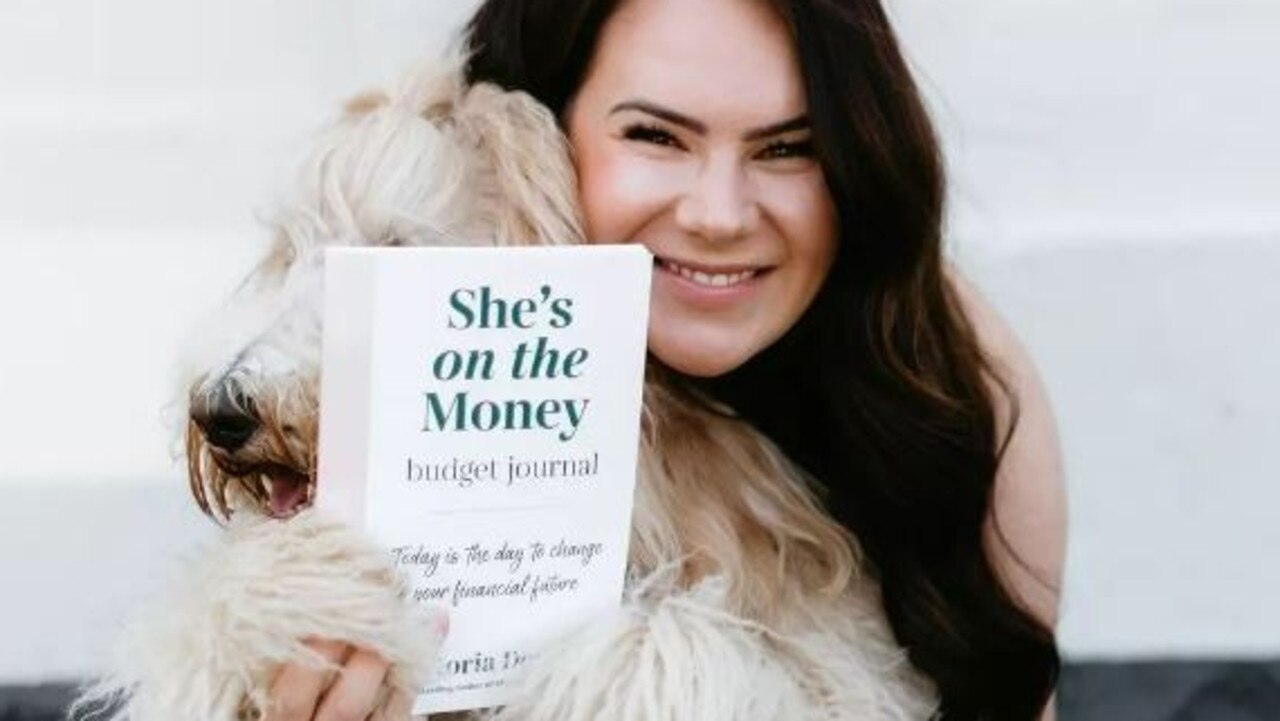

Victoria Devine, host of podcast She’s On The Money has revealed her top tips on how to thrive during the cost-of-living crisis.

While experts continue to forecast the worst is yet to come for the Australian economy, one leading financial expert has revealed her thoughts on why so many people are still in denial about changing their money habits.

Victoria Devine hosts She’s On The Money, among the top finance podcasts in Australia and New Zealand and which helps listeners break down the language and barriers standing between them and achieving their money goals.

The podcast has collected more than 164K followers on Instagram, where it receives thousands of comments every week from listeners sharing how they handle their finances.

“I feel like a lot of us, heading into an economic crisis, choose to stick our heads in the sand, because it’s easier than facing what the reality might be,” she said.

“It’s overwhelming; it feels really icky and you feel insecure and when you’re insecure, you make financial decisions that make you feel secure.”

Off the back of two years in a global pandemic with borders shut, job losses and restrictions on everyday movements, plenty of people have been letting the purse strings loose for overseas trips and online shopping.

“People are doing things that they maybe shouldn’t do,” Ms Devine said.

“So they’re going on holiday, because they’re thinking maybe I won’t be able to go on a holiday in 12 months.”

“The lipstick index” is a term coined by the former chairman of luxury beauty brand Estee Lauder and it reflects the theory that spending on affordable luxuries is on the rise during economic downturns.

Rather than splurging on a big holiday, more people are spending their money on smaller but still expensive items which can add up to a decent dent in an individual or family budget.

“Millennials and Gen Zs spend on things that make us feel good, like finding a little treat during a difficult time,” Ms Devine said.

“I think we actually need to kind of pull our fingers out and prepare ourselves for a recession, which is not the sexiest thing to do.”

Top tips for recession-proofing your budget

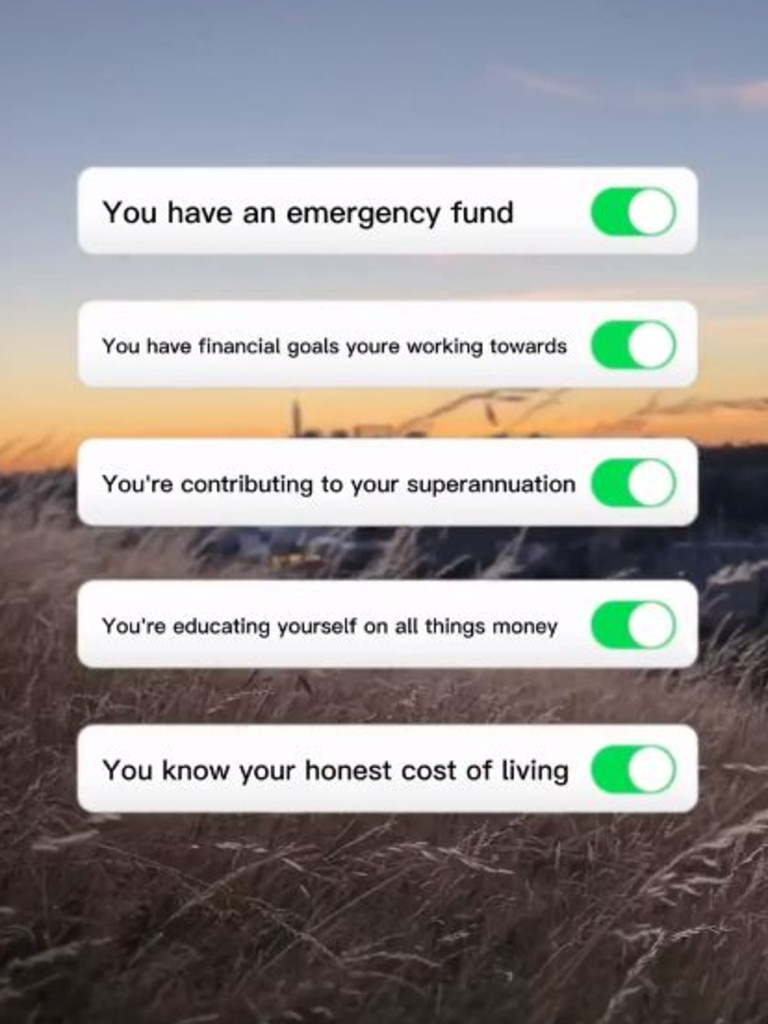

1. Know your “honest” cost of living

“Prioritising your budget should be the priority for everybody in general, but especially when preparing for a recession,” Ms Devine said.

She says it’s not about restricting yourself, but rather understanding the reality of your budget, which can give you a sense of control over it.

“It’s actually about saying, ‘I spend X on groceries, am I okay with that?’ And being okay with every cost,” she said.

2. Build an emergency fund

An “emergency fund” can be a vague concept but put simply it’s a fund that is created only to pay for surprise costs.

Ms Devine suggests starting with three months worth of expenses – including rent, groceries and bills – and avoiding touching this fund.

If you do have to take money out of the fund, it should be the first thing you replenish once you’re paid next.

“That’s not including your savings or your investments. It’s just keeping a roof over your head, keeping food on the table and all of your bills paid,” she said.

3. Then payoff high-interest debt (if you can)

Ms Devine says financial experts will often scream at the top of their lungs that paying off debt is the first way to climb out of financial stress, but there is a reason behind her unique method.

“I believe a lot of people in the finance space would be yelling and jumping up and down to ‘get out of debt’,” she said.

“But I’m of the opposite opinion. I believe that the emergency fund can provide you with a level of financial security which will mean you’re going to sleep better at night.”

If something unexpected happens like losing a job, you have cash available and can avoid going into further debt to pay for unavoidable expenses.

“It might take a little bit longer to get out of debt, but I can almost guarantee that if you set yourself up in that way, you’re actually going to stay out of debt instead of staying in that cycle,” she said.

4. Play smarter not harderwith your savings

Rather than hunting around for a high-interest savings account, Ms Devine suggests a few ways to work smarter not harder with your savings.

“Interest rates are not that sexy at the moment, so there's not that many high interest savings accounts on the market,” she said.

Another thing to remember is you still pay tax on any interest you make in that account.

If you have a mortgage, it can be a good time to put some savings into an offset account to offset the interest that you’re paying on your mortgage.

Or if you are in the financial position to, Ms Devine recommends looking into your investing options.

“A lot of people are really scared as the market seems to be coming down but when we look at the market in general, we know historically we recover from these things and it’s just who’s willing to hold on for the ride,” she said.

5. Know your WORTH

With the looming threat of a recession over our heads, it can be a scary thought to consider asking for more money in your current role.

“I think a lot of people during a recession often don’t want to move jobs but it is actually a candidates market,” she said.

“There are more jobs than there are skilled professionals in the marketplace at the moment.”

Ms Devine says knowing “your worth” is a really helpful way to boost your earning potential.

“Do you know what your job is meant to be paid? Have you done an audit of your job description versus what you’re actually doing in your role?” she said.

She recommends Hay’s Salary Guide as a good place to start comparing your salary with similar roles.

“I think that if you approach that situation with grace and kindness and no aggression, the worst thing they can say is no,” she said.

“And that’s not the worst thing ever, because at least you practised for the next time that you might ask for a salary increase.”