‘Upside is huge’: The smart investing strategy that will make you rich

Every Aussie wants to slash the amount of tax they have to pay – and here’s one seriously smart way to use the rules to your advantage.

The government wants you to be wealthy.

This isn’t necessarily out of care or benevolence, but instead because when people are wealthy, they rely on welfare less (or not at all) and they pay more taxes.

To increase the incentives and likelihood of people being wealthy, the government gives tax breaks for certain types of investing.

Superannuation is one of the areas that offers the most beneficial tax concessions, because the government knows when you save well through superannuation, it goes a long way to your chances of getting wealthy.

A common myth that surrounds superannuation in Australia is that super is its own type of investment, but it’s not. Superannuation is nothing more than an investing account with concessional tax treatment and rules on when and how you can access your money.

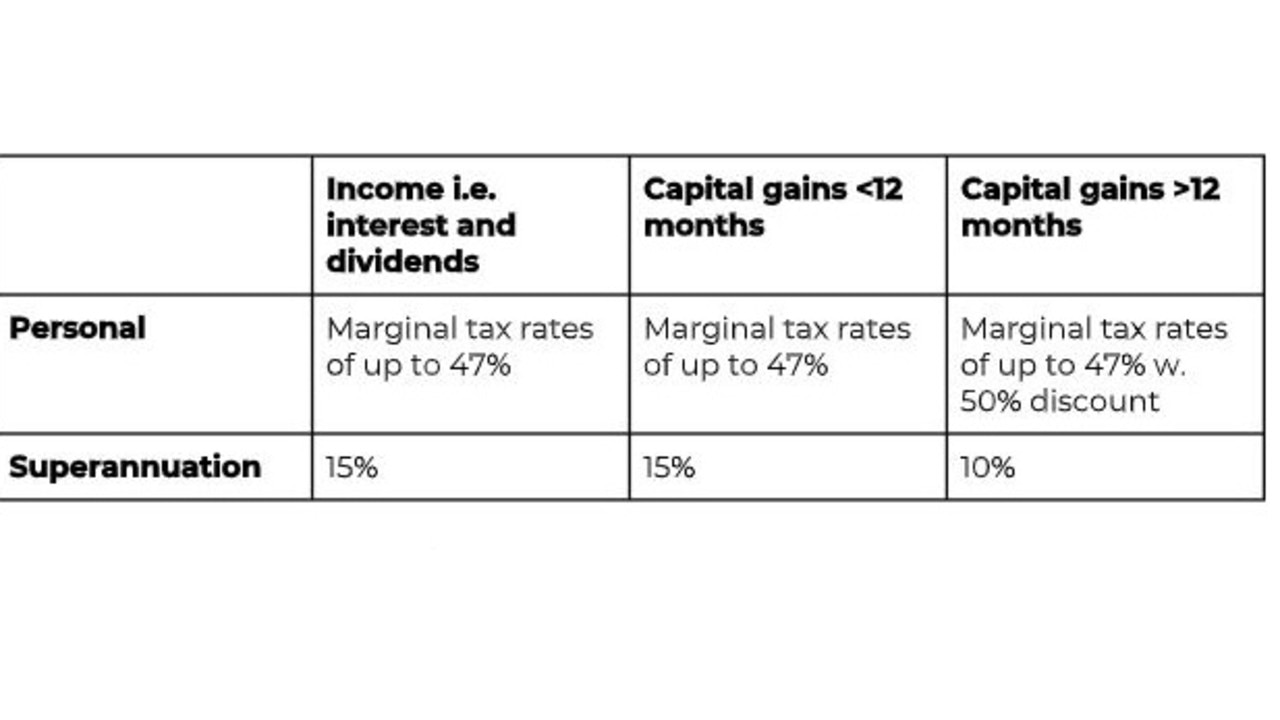

To illustrate the benefits you can access through super, I’ve shown the different tax rates for investing through super as opposed to investing in your personal name below.

As you can see from this table, investing through your superannuation means you pay a much lower rate of tax on your investment income, which ultimately helps you grow your investments faster.

And it gets even better.

Once you hit age 60 and start a super pension, there is no tax payable on the earnings of the first $1.7 million in investments you have in super. And, when you take an income from this super pension, the income isn’t taxed at all. Your super, in effect, becomes like a tax-free investment account.

Consider this example.

You grow your investments to the point where they generate income of $10,000 per month. If these investments were owned in your personal name, under the FY23-24 marginal tax rates, you’d pay tax on this annual income of $31,897.

If instead you were to earn this money in your super fund, the income would be taxed at a maximum rate of 15 per cent, meaning total tax would be $18,000 – saving you $13,897 every single year.

And if you were at retirement age with your super in a pension, the tax paid on this income would be close to zero. The tax benefits of super are huge.

This shows that where you own your investments and where you earn your income makes a big difference to your after-tax return. It also highlights the fact you can be “wealthier” with the same amount of money, if you’re smart about how it’s structured.

Let me illustrate further with an example comparing how an investment portfolio would grow outside of super vs in the super environment.

For us to make this comparison, we need to look at the after-tax return on each option. For this I’ll use the 30-year return on the Australian sharemarket of 9.8 per cent, which is the return before any tax is applied.

Investing in your personal name, under the current tax rules if you’re earning the Australian average income of $92,029, you’d be firmly in the $45,000-$120,000 tax bracket, meaning you’d pay a marginal tax rate (plus Medicare levy) of 34.5 per cent.

This would bring your after-tax investment return (total return less tax) to 6.42 per cent (9.8 per cent*[1-34.5 per cent]).

On the other hand, investing through superannuation would mean your after-tax return would be 8.33 per cent (9.8 per cent*[1-15per cent]).

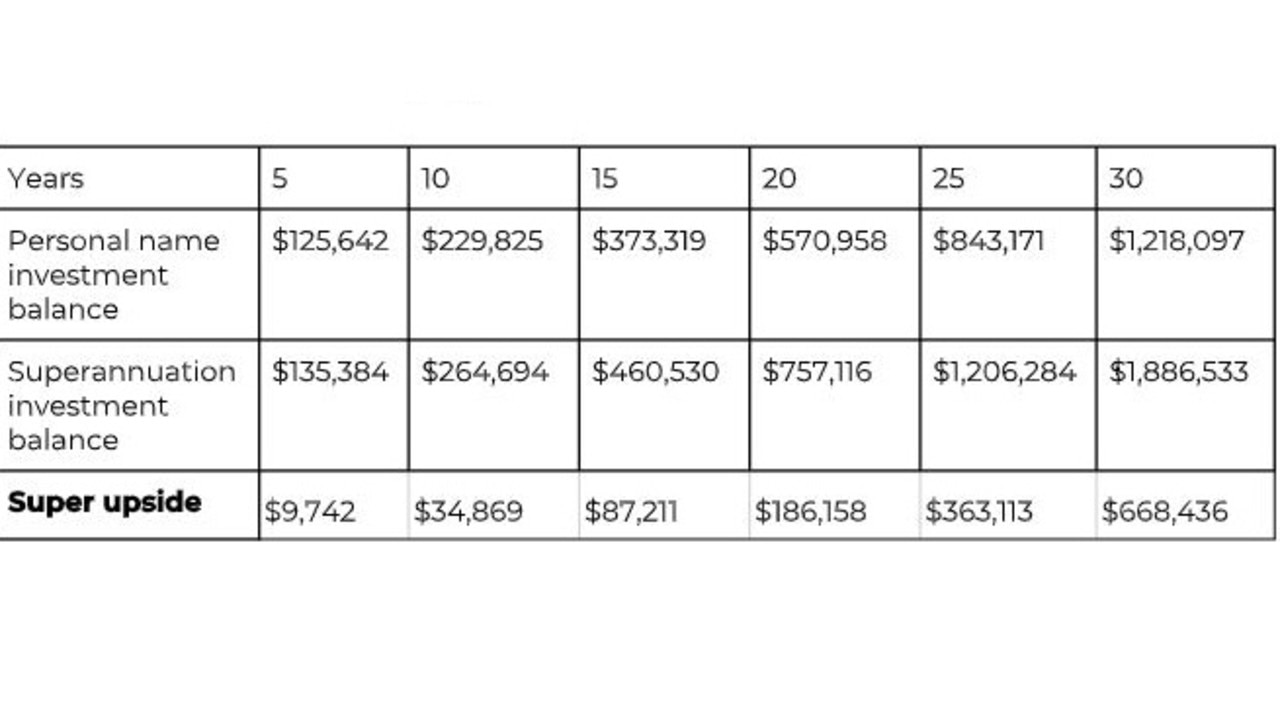

Comparing the two using a compound interest calculator, I’m going to use an example based on a person aged 30 with $50,000 they’re looking to invest, with regular ongoing investments of $805 per month.

In the first scenario, the individual is investing in their personal name (not through superannuation), and in the second the investing is happening within superannuation.

For context, the reason the $50,000 starting balance has been chosen is that it is roughly the average super fund balance for a 30-year-old. The regular investment of $805 per month is based on the current compulsory employer super contribution rate of 10.5 per cent for someone earning the average Australian income of $92,029. So let’s look at the numbers:

You can see from these numbers that by age 60, you could have over $668,000 more investments by building these through superannuation as opposed to in your personal name. These figures show how you can go further and faster with superannuation investing.

The wrap

The rules around superannuation can be complicated and a little confusing.

But when you take the time to understand these rules and how to use them to your advantage, the upside is huge.

Because of the rules and restrictions on access, superannuation is unlikely to be your first go-to investment strategy.

But as you can see from the tax benefits covered here, it also shouldn’t be last on your wealth building list.

Disclaimer: The information contained in this article is general in nature and does

not take into account your personal objectives, financial situation or needs.

Therefore, you should consider whether the information is appropriate to your

circumstances before acting on it, and where appropriate, seek professional advice

from a finance professional.

Ben Nash is a finance expert commentator, financial adviser and founder of Pivot Wealth, the creator of the Smart Money Accelerator, author of Replace Your Salary by Investing and host of the Mo Money podcast. He runs regular free online money education event which you can book here.