Things you never knew you could claim on your tax return

MOST Aussies don’t realise these four surprising things can be claimed as deductions — and they could cost you a nice big tax refund.

MOST of us dread tax time — but according to one finance expert, a few simple hacks can help you maximise your refund this year.

Entrepreneur, accountant, financial adviser and best-selling author of Unf*ck Your Finances Melissa Browne said many Aussies are missing out on a fat tax refund because they simply don’t realise everything they are entitled to claim.

She told news.com.au there were four little-known deductions that could make a big difference, including handbags, makeup and cosmetics, stationery and mobile phone data.

• Appalling’ petrol rip-off exposed

• Doctor who decapitated baby cleared

• How to score the best EOFY deals

She said it was all about “turning everyday expenses into tax deductions”.

“For any of us working outside, and for people who go outside regularly to meet clients or get to meetings, we can claim sunglasses but also potentially if there’s SPF in your makeup or moisturiser or lip balm, you might be able to claim that,” she explained.

“People also get excited to hear that handbags can potentially be claimed if they’re bought to fit a laptop or tablet — guys can claim briefcases, and handbags are a briefcase of sorts.

“I always have things like pencil cases in my handbag because I’m a nerd about that sort of thing, so if you have a kikki. K addiction and you’re using those things for work, you can claim them too.”

Another thing people often forget to claim is a percentage of their mobile phone data.

“Many people say they don’t use their own phone for work, but you’re probably using the calendar and apps like Gmail,” Ms Browne said.

“A phone isn’t a phone anymore, and often you can claim a percentage of the data and the cost of owning a phone, as well as other incidentals like covers, chargers and all that jazz we often don’t think about.”

In fact, Ms Browne said many workers may be able to claim deductions if they ever do any work from home.

“People aren’t just working from nine to five anymore, and the ATO has said if you’re working from home you can claim light and heat on an hourly basis — you just have to keep a log book for a month, so you still have time,” she said.

“Keep track of your hours, because people often spend so much longer than expected working from home.

“You can also claim a percentage of your internet as well as other things you automatically pay for each month like your phone.

“Another easy one is your car if you travel between workplaces … or go to see clients. Tolls are another insidious thing that people also often forget about.”

Ms Browne said it also paid to be smart about how you spend your money.

“Understand what you’ll be doing next year — if you’re pregnant and will be on maternity leave next year and you know your income will drop substantially, make sure you are prepaying expenses before June 30 to get the best deduction possible,” she said.

“And in the reverse, if you’ve just started work this year and next year you’ll have been working full-time, don’t be sucked in by ads telling you to spend your money now.

“Hold off for a full year until you’re in the next tax bracket — be smart about when you are spending your money to maximise your tax deductions.”

Ms Browne said if you were lucky enough to get a refund this year, don’t be tempted to blow the lot on frivolous things.

“If you do get a tax refund, spend half on something fun — but take the other half and invest it in something smart,” she said.

“It is unexpected money, so enjoy half but use the rest on something that will serve you long-term.”

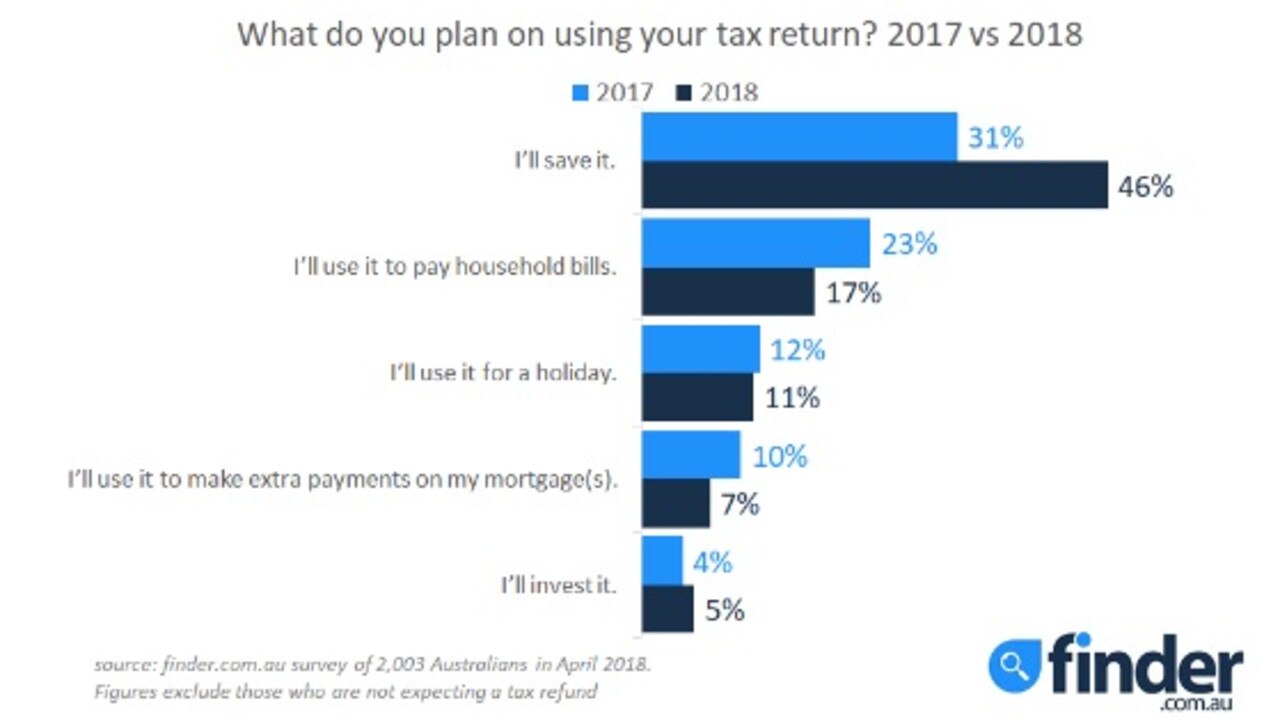

It seems many of us are already planning on using our refunds wisely though, with a recent survey conducted by comparison site finder.com.au revealing 46 per cent of us will save our refunds this year, while 17 per cent will use it to pay bills.

A further 11 per cent will put it towards a holiday, while seven per cent will put it on their mortgage and five per cent will invest it.

Finder.com.au money expert Bessie Hassan said getting cash back means you may have overpaid in taxes during the year, so it can be bittersweet.

“Your tax return is money you’ve worked hard for throughout the financial year for so it can be tempting to want to spend it the minute you receive it,” she said.

“However, depositing your refund into a high-interest savings account like so many Australians are planning to do this year, can really help improve your overall financial health.”