Major challenge thrown to Anthony Albanese about GST carve-up in NSW budget

The looming expiration of a Morrison-era deal has one state treasurer sounding the alarm about reintroducing “inefficient taxes”.

The expiration of a Morrison-era deal to ensure no state was “worse off” could result in inefficient taxes and risk essential services, according to the NSW budget.

Buried in NSW Treasurer Daniel Mookhey’s first budget was a warning about the GST safety net, challenging his federal counterpart to make the no-worse-off guarantee permanent.

“The no-worse-off guarantee will expire in 2027-28 and will impact NSW’s forward estimates for the first time in the next budget,” the papers said.

“The end of the guarantee would risk essential services and require the reintroduction of inefficient taxes,” it said.

“Given the serious damage that would be caused, and the Australian government’s commitment to essential services, it is not credible that the no-worse-off guarantee should end.”

The Morrison government changed the GST carve-up in 2018 to placate Western Australia and enshrined a floor of 70 cents per dollar of GST in 2021-22 that will rise to 75 cents per dollar in 2024-25.

But any state that received less money than it otherwise would have under the pre-existing formula was given a top-up as part of the transition.

NSW is expected to receive about $3.8bn in no-worse-off payments over the next two financial years.

The budget paper, released on Tuesday, warned that the expiration would be “disastrous”, as the money was required to employ more than 8000 nurses or teachers.

Mr Mookhey told reporters the state “cannot afford to lose a single healthcare worker, let alone 8000 of them”.

“So our message to Canberra is we would love to work with you cooperatively to see this guarantee continue,” he said.

The newest Labor-led state is the latest to heap pressure on the government to take early action and make changes to the GST system.

In March, Victorian Treasurer Tim Pallas demanded the top-up provision become a permanent feature to ensure state budget certainty.

Queensland’s Cameron Dick echoed the remarks following the release of his state budget in June, claiming it was a “big mistake” for the former prime minister to not have legislated the guarantee.

Anthony Albanese has previously said the guarantee’s end date was still “a long way off”.

“It's not surprising that state governments will continue to put forward their suggestions,” the Prime Minister told reporters in Coffs Harbour on Saturday.

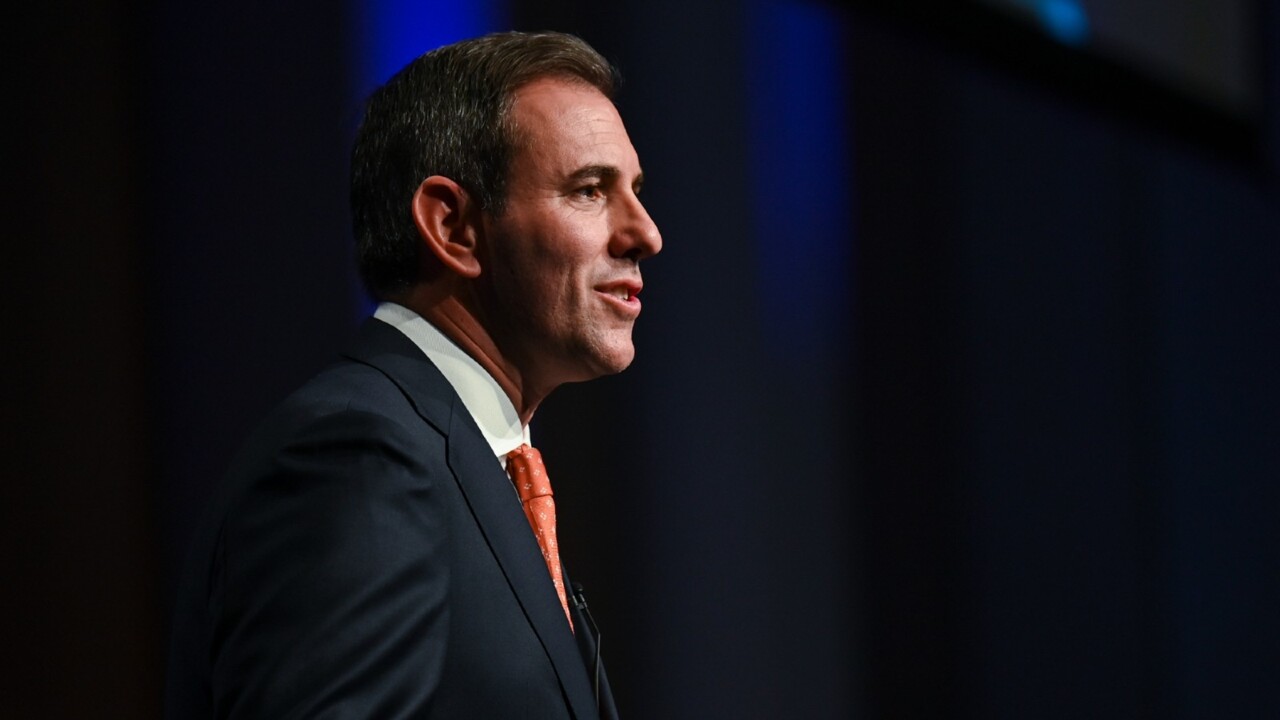

A spokesman for Treasurer Jim Chalmers said the federal government had been “clear and consistent that we are committed to the arrangements implemented by the previous government”.

“Governments at all levels, including the Commonwealth, are facing significant structural pressures on their budgets – these will need to be considered as part of any review of ongoing GST arrangements,” they said in a statement.

A review of the GST formula will be undertaken by the Productivity Commission at the end of 2026. The spokesman said the Treasurer would “continue to engage closely” with the states in the lead-up.