Jessica Irvine’s five top tips to boost your tax return

WANT to increase your annual rebate? Follow these five easy steps and boost your tax return this year as the tax year comes to a close.

CAN it really be that time again? Nothing makes me feel older than the passing of yet another tax year. July 1 looms large and that shoebox full of receipts in the cupboard is about to get a workout.

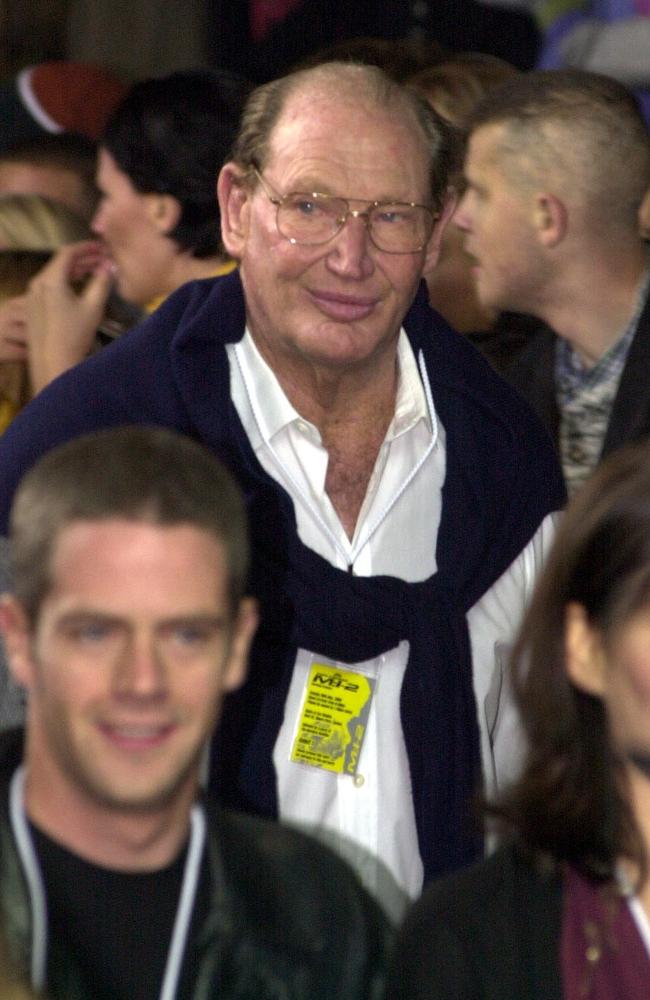

It was the late billionaire media mogul, Kerry Packer, who famously outlined to a parliamentary inquiry the approach he believed Australians should take to their tax returns.

“If anybody in this country doesn’t minimise their tax they want their heads read because as a government I can tell you you’re not spending it that well that we should be donating extra.”

It seems we agree.

Figures released by the Australian Tax Office this week show Australians claimed a whopping $19.5 billion in work-related tax deductions last year. That’s an average of about $2000 for every taxpayer.

If you’re not claiming $2000 from that shoebox, you’re just not trying hard enough.

ANNUAL RETURNS: ATO announces its targets

Personally I don’t begrudge the Taxman his cut of my hard earned cash. Tax is the price we pay to live in a civilised democracy. It’s the price we pay to fund the schools, hospitals, roads and police we all enjoy. This year, for the first time, every Australian will receive a personalised thankyou note from Treasurer Joe Hockey outlining exactly where all that hard earned cash went. You’ll get one of these “tax receipts” after you have submitted your tax return. Most people will be surprised to learn that by far the biggest area of government spending is on welfare — for families, the unemployed, the disabled and aged.

WELFARE NATION: Half of families pay no net tax

NOOSE TO TIGHTEN: Taxpayer funding Islamic Jihadists

COMMENT BELOW: What is your favourite tax deduction?

That said, there’s no reason why you should donate more to the taxman than necessary.

So here are my top five tips to maximise your tax return this year.

First, check you are making all the work related deductions relevant to your profession. Most people are aware that you can claim deductions for home office expenses, work-related travel and professional memberships.

But did you know, for example, that workers in “adult industries” can also claim the cost of costumes and lingerie (but not blouses and skirts) used in the course of earning their income? Dance lessons may also be claimed if they “maintain your existing dance skills or to learn new dance skills”.

Eye-opening, huh?

The ATO is very specific about what you can and cannot claim and its website has more than 40 guides to “deductions for specific industries and occupations”, including in the less exotic fields of airline workers, factory workers, builders, cleaners, hairdressers, nurses, police, teachers, IT professionals.

My second tip is to avoid being audited by the Tax Office by carefully considering how you claim your use of electronic devices this year. The ATO is on the rampage, having noticed a big increase in people claiming deductions for smartphones, internet, computers and other devices. Remember, you can only claim the proportion of your use of these devices that is work-related. I know we all feel chained to those darned things, but you may be less productive with them than you think. You need to keep records so that if you are audited, you can produce evidence for work use. You’ll need phone records or a four week diary detailing your work use of the equipment.

Third, consider when you file your tax return. Timing can be key. If you know you’re heading for a tax bill, wait until the last minute to file. Better to have that money in your pocket earning interest until the last minute. October 31 is the deadline for tax returns, but if you use an accountant you can often delay this until the following year. Conversely, if you’re due a tax refund, file asap and earn at least three months’ worth of additional interest on that money

Fourth, where possible you should prepay expenses and delay income beyond June 30. If you’re fortunate enough to own an investment property, you would know you can claim a range of costs to reduce your taxable income, like interest paid on the loans, the cost of home improvements and maintenance costs. Get any work due done by June 30. Conversely, if you have any control over when you are paid money for work you have done, better to receive it after July 1 than just before because you won’t have to pay tax on it for an entire year.

Lastly, if all else fails, hire a tax accountant to give you some advice. Three quarters of Australians use a tax agent each year. There is an upfront cost, but you can claim it as a deduction on next year’s tax return. It’s worth a go at least once to see if there are any deductions you are missing out on.

Kerry would approve.