‘I’ve never come across such a mongrel bunch of bastards’: Four Corners to highlight ATO abuses

IMAGINE getting home from work and opening the mail to find a bill for $440,000 from the ATO. That’s what happened to this guy.

THE Australian Taxation Office is facing growing calls for increased oversight ahead of a joint ABC-Fairfax investigation to air on Four Corners on Monday night, which will highlight “disturbing” behaviour at the powerful organisation.

Under the spotlight will be the ATO’s treatment of small businesses and individuals that have been financially destroyed by incorrect tax assessments.

“In dealing with the ATO I’ve never come across such a mongrel bunch of bastards in my entire life,” said Mark Freeman, whose sewage recycling company Blackwater Treatment Systems was hit with a $250,000 tax bill in 2013.

Mr Freeman spent an estimated $750,000 fighting the ATO, which in 2015 finally accepted it had made a mistake — and offered him $1500 in compensation.

“In the beginning people would say, ‘Pay them. You’ll never win’,” he said. “But we did win. We got an apology and we beat them on the debt. Now we’re fighting for proper compensation.”

According to Four Corners, in 2017, the ATO amended 253,000 tax assessments including individuals and businesses. Fewer than 25,000 appealed, and just 456 took legal action. Last year, the ATO wound up or bankrupted 37 businesses every week.

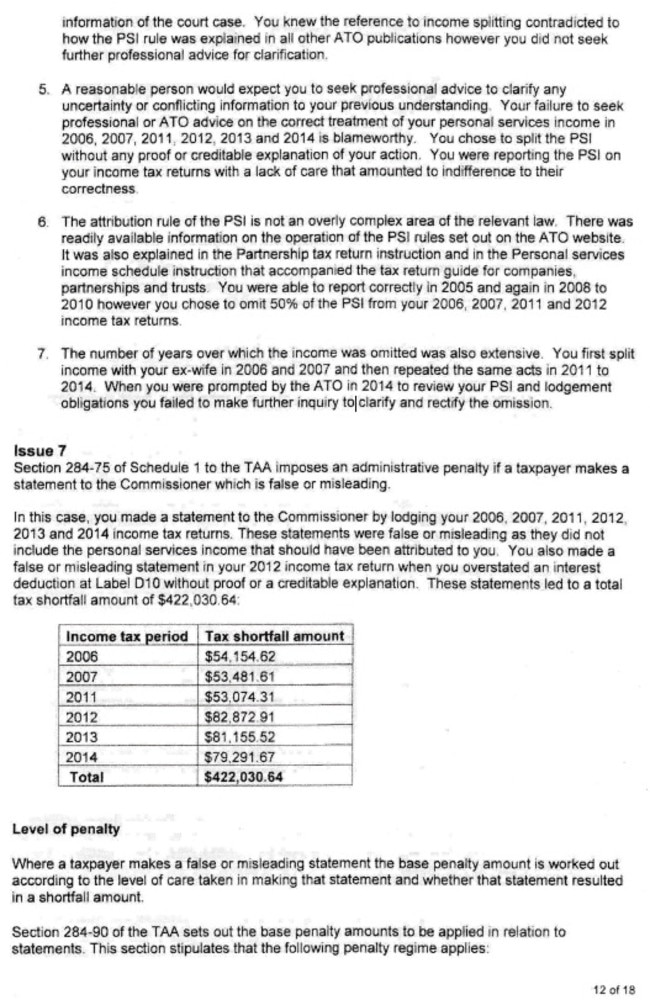

Perth IT contractor Rod Douglass, who in 2015 was slapped with a $440,000 tax bill backdated to 2006 after the ATO accused him of fraud, will also appear in the program.

“I did nothing wrong. I just filled out my tax returns according to advice on the ATO website. For doing this the ATO accused me of fraud,” Mr Douglass told lobby group Self Employed Australia, which acted on his behalf to organise a successful legal defence.

“This is not a matter of Rod not paying his taxes,” the group said.

“He has consistently declared all income and paid taxes. The issue is over highly technical interpretations of tax law relating to how income of self-employed people should be treated. The ATO ‘forms opinions’ which are legally suspect, then attacks aggressively.”

Last week, Australian Federal Police and ATO officers raided the Adelaide home of whistleblower Richard Boyle, who will appear in Monday’s program, over allegations he breached privacy and secrecy laws to access taxpayer information.

“Today, swift action was taken, in the execution of a search warrant against an individual in Adelaide, to secure information which we believe was obtained contrary to our secrecy obligations,” the ATO said in a statement on Wednesday.

“The Commissioner is committed to doing everything possible to secure taxpayer information, and will pursue cases where taxpayer confidentiality has been compromised.”

In an internal memo to staff addressing the raid, ATO Commissioner Chris Jordan said the upcoming Four Corners story would “focus on some critics of the ATO’s treatment of small business, the ATO’s administration of the Australian Business Register, the ATO’s approach to debt collection, and the level of scrutiny applied to the ATO”.

“We should all be proud of the good work we do for the community, especially small business,” Mr Jordan said. “We regularly receive extremely positive feedback from credible sources — like small businesses themselves, and their representatives.”

Mr Jordan said once the show aired, “we will take appropriate steps to ensure the community conversation is balanced, and that we can uphold the strong reputation of the ATO and our people”.

In a memo to members last week, the Australian Services Union said it “rejects scurrilous criticisms of tax officers”. “The idea that the ATO is not subject to proper oversight is far removed from reality,” ASU tax branch secretary Jeff Lapidos said.

“Taxpayers have a right to complain internally if they think a decision is wrong. Complaints teams routinely reconsider and seek to resolve taxpayer’s concerns.

“The real problem for small business is that the ATO is not adequately resourced to identify and correct those business owners who cheat on their taxes and thereby have an unfair advantage over their competitors.”

Mr Lapidos asked members to watch Four Corners and “let us know your views about what it says about your work”. “The ASU will publish your views, making sure you cannot be identified,” he said. “We want the reality of being a tax officer to come through and not the sensation that we fear Four Corners wishes to generate.”

In a statement on Monday, Liberal Democrats Senator David Leyonhjelm said a bill he introduced last year would prevent government agencies like the ATO from taking advantage of a claimant’s lack of resources when litigating a dispute.

“As taxpayers we are at the mercy of an entity with unparalleled power to act as investigator, prosecutor, judge, appeal judge and sentencer,” Senator Leyonhjelm said.

“The ATO assesses what an individual or business must pay and it’s too bad if that assessment is wrong. The current system demands the taxpayer to pay up anyway, then go through the courts to seek justice.

“Those with deep pockets can send in the big legal guns but there are myriad examples of small businesses and individuals who have either been sent to the wall fighting their case or simply paid up because they know to take on the ATO would financially ruin them.

“The Productivity Commission has already recommended that state and federal governments should impose enforceable model litigant obligations on its agencies, given governments’ power, resources, ‘frequent-player status’ and role of acting in the public interest.

“There are too many stories of the ATO getting it wrong and leaving a trail of devastated businesses and individuals in its wake, and offering paltry financial compensation that is too little too late as its only redress.”