How debt recycling could save you $6000 a year in tax

There’s a little known way to save thousands on your tax return. It’s completely legal, you just need to know how to do it.

Getting onto the property ladder can seem like a huge undertaking. And once you actually take the leap and make your property purchase happen, finding extra money to build assets and invest can seem almost impossible.

Debt recycling is a strategy that can help you pay down your mortgage, build a share portfolio, and create a heap of tax deductions – all at the same time. For example, if you have a mortgage of $500,000, it could save you $6000 a year in tax.

Even if you’re not on the property ladder just yet, being aware of this strategy now can help you understand what’s possible – something you can factor into your future property purchase plans.

What is ‘debt recycling’?

Debt recycling is the process of replacing mortgage debt (which is non-tax deductible), with investment debt (which is tax deductible).

Essentially, how debt recycling works is that you make extra payments on your mortgage, and invest the same amount into a share portfolio.

A key part of this strategy revolves around the fact that instead of just investing money from your bank account into shares, you take money from another loan that’s set up solely for the purpose of this investment.

The rules can get a little complex and confusing here but bear with me.

The strategy works because you’re paying down your home loan (non tax deductible) debt, and at the same time drawing money from a separate loan for the purpose of investing, which makes the interest repayments on this loan tax deductible.

How much could I save debt recycling?

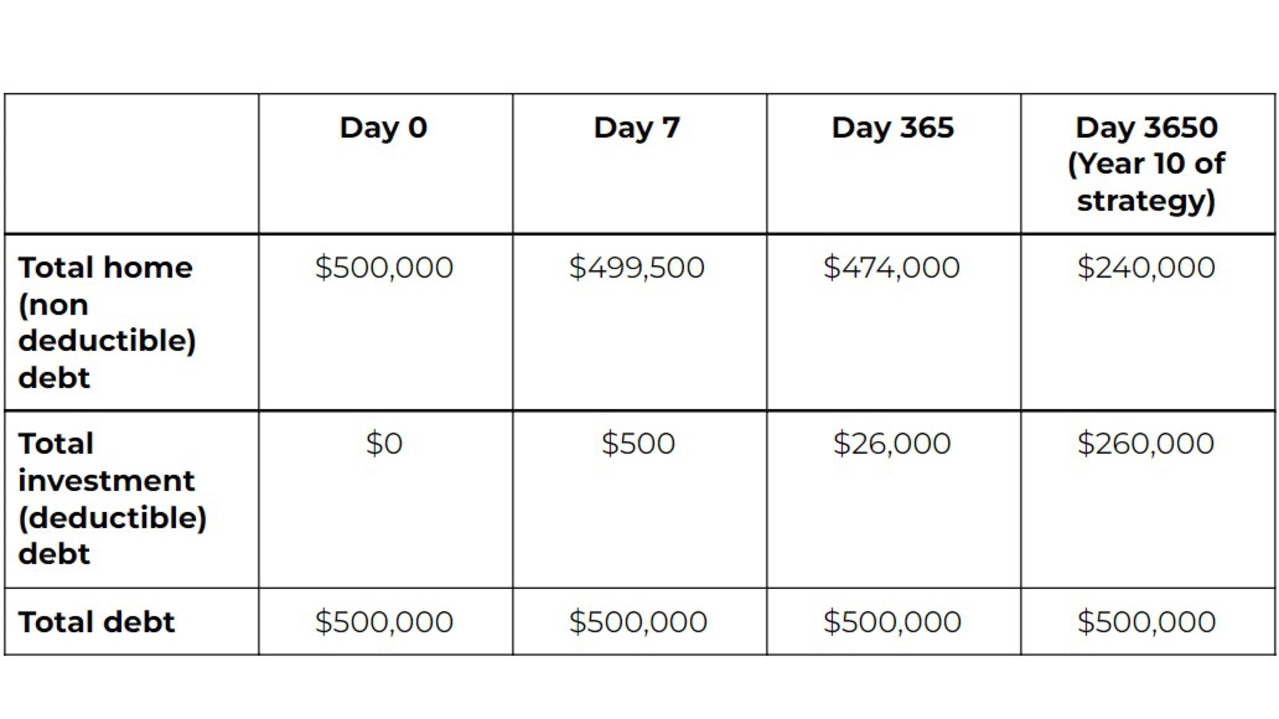

I’ve put together a practical example below showing debt recycling in action. In this example, you have a home mortgage of $500,000 against a property value of $1m, and have $500 per week you want to use to save/invest/get ahead.

To set up a debt recycling strategy, the first step would be to speak to your bank or mortgage broker to set up a new loan. This loan is generally secured against your property, and would essentially sit there with funds available ready for you to draw against.

In week one of the strategy, you pay your spare $500 as an extra payment on your mortgage. At the same time you would withdraw the same $500 amount from the new loan set up for investment purposes and invest this money into a share portfolio.

Note: Because this strategy revolves around paying down non-tax deductible mortgage debt, it’s really only viable for people that have a mortgage against their home or another property that’s not an investment.

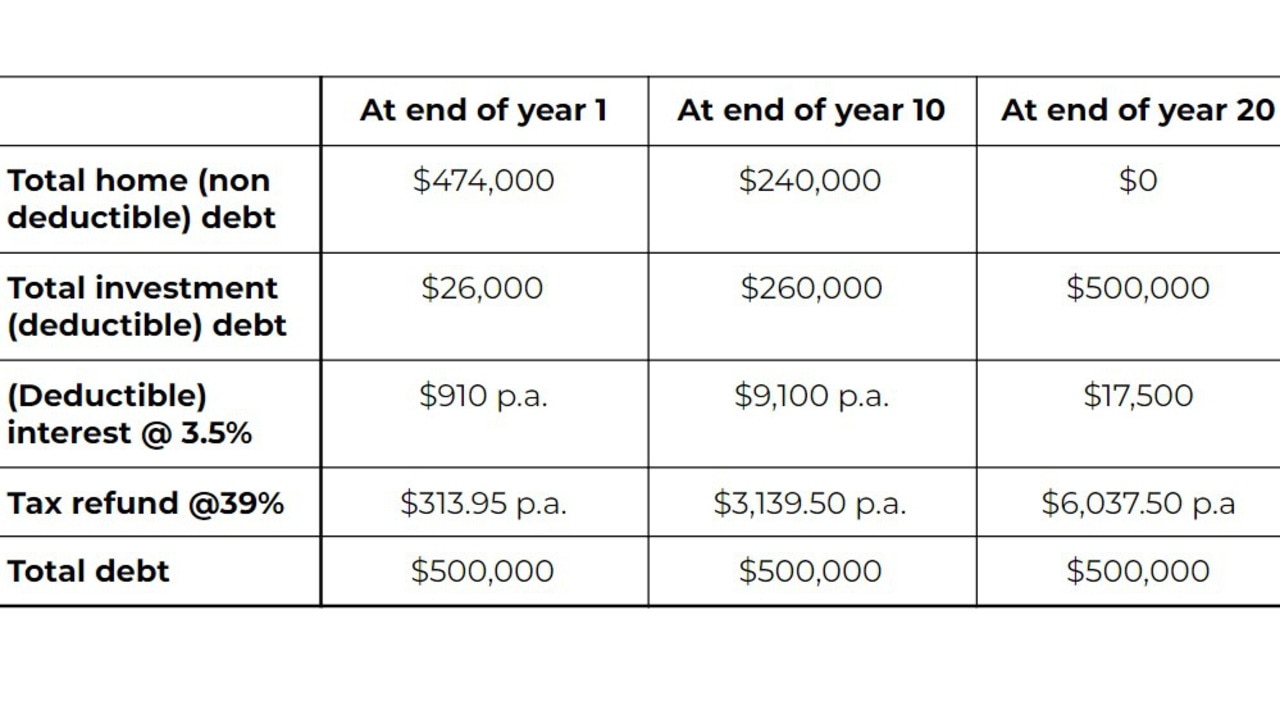

In the table below I’ve built on our previous example to show the interest deductions you can create and the potential tax you can save.

For the example below I’ve used a marginal tax rate of 34.5 per cent, which is the tax rate (including Medicare levy) you’d pay if your annual taxable income is above $45,000.

The key benefit of debt recycling is that over time you’re ‘recycling’ non tax deductible mortgage debt and essentially turning it into tax deductible investment debt.

The strategy can help you create thousands of dollars of tax deductions each year, which in turn will result in a bigger refund to you at tax time. This money can then be used to save, invest or pay down your mortgage faster.

What are the risks of debt recycling?

The first key risk or downside of following a debt recycling strategy is that you don’t actually reduce your debt levels over time. This happens because you’re increasing tax deductible debt while reducing your non-tax deductible debt – this is clearly a good thing but the net result is that your debt levels remain the same over time.

Carrying more debt means risk around increasing interest rates, the cashflow risk of having to fund your debt repayments, and the potential negative impact if you lose your job or want to change careers or roles.

To minimise this risk, take the time to put together a clear exit plan for your debt, build up a solid cash buffer for emergencies, and think about insurance like income replacement cover to reduce the risk of the unexpected.

You will also face some risk with this strategy driven by the fact you’re going to be investing money into the sharemarket which can be volatile.

When there is disruption in the economy or the sharemarket, often even the best companies will suffer a drop in their share price. This means that it’s possible your share portfolio can end up being worth less than the amount of money you’ve invested. And because with debt recycling you’re essentially using borrowed money, you might be in a position where you owe more than the value of your investments.

It’s critical in this case that you have a solid plan in place, choose good investments that will bounce back when markets recover, and that you put yourself in a position where you’re not going to be forced to sell your investments at the wrong time.

Cover these bases before you get started and get some good help at the front end so you can set up your debt recycling strategy for success. Get some good help here if you need it, the support will pay for itself many times over when you get this right.

Is debt recycling right for you?

Debt recycling can be a powerful strategy to accelerate how quickly you get ahead. If you own your own home, have some equity in the property, and have a few spare bucks you’re wanting to use to invest, debt recycling is worth serious consideration.

Debt recycling can help you become mortgage free, create some solid tax savings you can use to create more wealth, and build a share portfolio to help drive financial security and freedom for the future. But it’s not without risks; you’ll be maintaining debt levels for years into the future, be at the mercy of interest rates, and subject to the ups and downs of the share market – all risks that shouldn’t be taken lightly.

If you think debt recycling might be right for you, take the time to lay out the strategy as part of your broader money plan. This way you can ensure the strategy comfortably fits with the other things you have going on in your financial life. When you do this, you’ll be set up to make your next money move with confidence and go a long way towards setting up your money strategy for success.

Written by Ben Nash, a finance expert commentator, podcaster, financial advisor and founder of Pivot Wealth, and Author of the Amazon Best Selling Book ‘Get Unstuck: Your guide to creating a life not limited by money’.

Ben is putting on a series of free money education events in 2022 to help you get on the front financial foot. You can check out all the details and book your place here.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.