How a family trust can save you $17,000 per annum in tax

It’s the most common tax structure used by those looking to build a serious level of wealth, so here’s what you need to do in order to save heaps.

Everyone wants to save tax, but most people are going about it in completely the wrong way. Ultimately there is a limit to how many tax deductions you can get. But when you invest, the tax savings are unlimited – when you get your tax structuring right.

If you think about being a successful investor, your main objective is to replace your salary with investment income. This means that by definition, over time you’ll be looking to build tens of thousands of dollars of investment income, maybe even a hundred thousand dollars (or more).

The less tax you pay on this investment income, the faster you’ll get ahead and reach true financial success.

Family trusts or discretionary trusts are a tax entity that gives you a lot of flexibility around your tax planning and can deliver some serious tax savings. This is why they’re the most common tax structure used by people looking to build a serious level of wealth.

How family trusts work

When you set up a trust, you get it registered and can then start opening investment accounts, saving accounts, and even buy property inside the trust. These investments will then start generating investment income, and the main rule of trusts is that this income needs to be ‘distributed’ to a ‘beneficiary’ – it’s then this beneficiary that pays the tax on the income.

The most common beneficiaries used with trusts are other people, for example if you have a partner, children, or other family members, you can ‘distribute’ funds to them.

But you aren’t limited to making distributions to people, you can also use a private Pty Ltd company as a beneficiary – and this can save a serious amount of tax.

Private investment companies

Most people are familiar with regular operating companies that run a business, but you can also set up a privately owned company for the sole purpose of investing. The advantage of doing this is that these companies have a flat tax rate of 30 per cent, and as mentioned above can be used as a beneficiary of a family trust.

Following this approach, if you have a trust that generates investment income that isn’t immediately needed for spending, you can use the private investment company as a trust ‘beneficiary’ where income is taxed at the company tax rate of 30 per cent as opposed to marginal tax rates of up to 47 per cent.

This can create some significant tax savings, and is why trusts are commonly paired with a private investment company which then work together to save tax when you invest.

Investing through a trust

If you’re looking to invest through a trust, once you’ve put your initial contributions of funds in, it will start generating an income, and you then choose the best way to distribute this money.

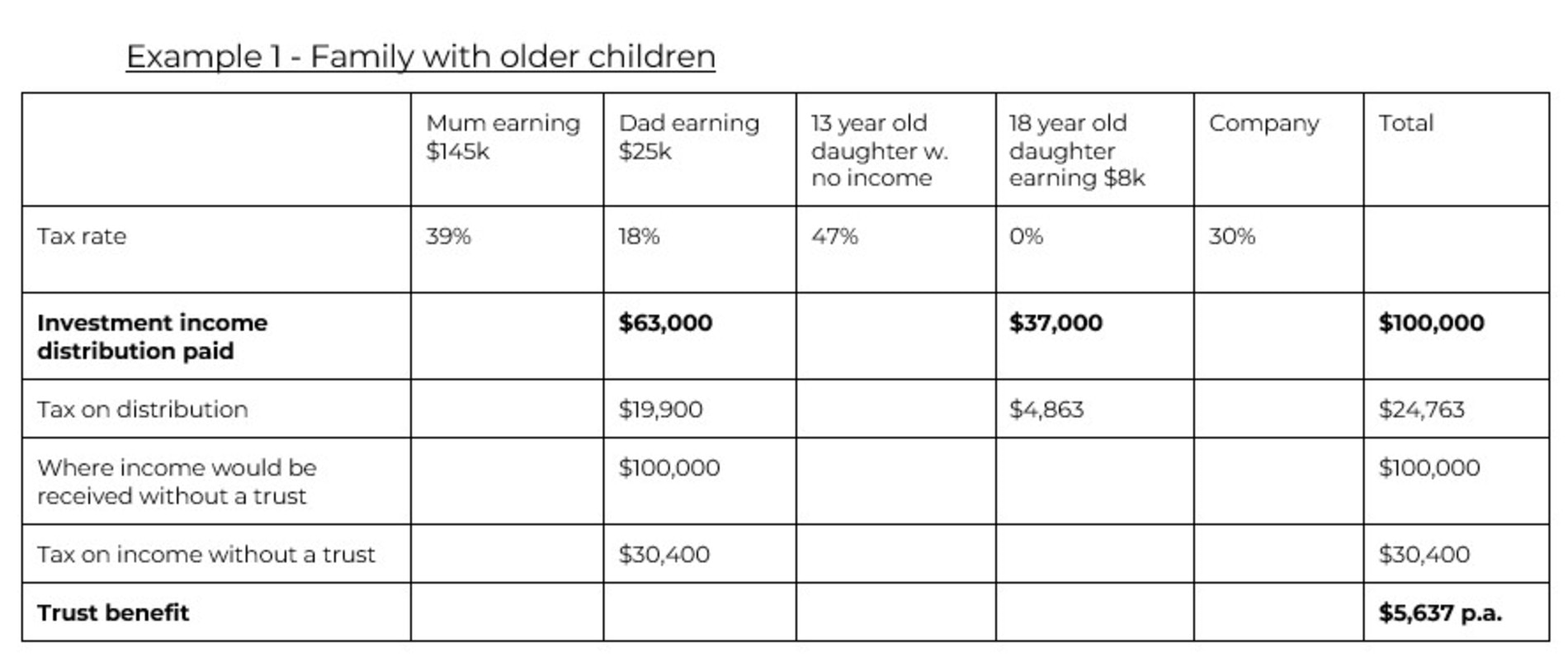

In the scenario that assumes you have a trust that’s generating an annual investment income of $100,000, the tax rate for a mum earning $145k would be 37 per cent. For a dad earning $25k it would be 18 per cent, for a 13-year-old daughter with no income it would be 47 per cent, for an 18-year-old daughter earning $8k it would be 0 per cent and for a company it would be 30 per cent.

Trusts in practice

Below I’ve included into the example a trust and investment company structure, showing how these can be used to save tax. For this example, the trust is generating $100,000 of annual investment income.

In this scenario, using a trust allows this family to split their distributions between an older child and one parent, generating a tax saving within that year of $5637.

Further, in this scenario it’s highly likely there will be benefits from using a trust in future years as the second child gets older and is able to receive investment income distributions without paying tax at the top marginal tax rate.

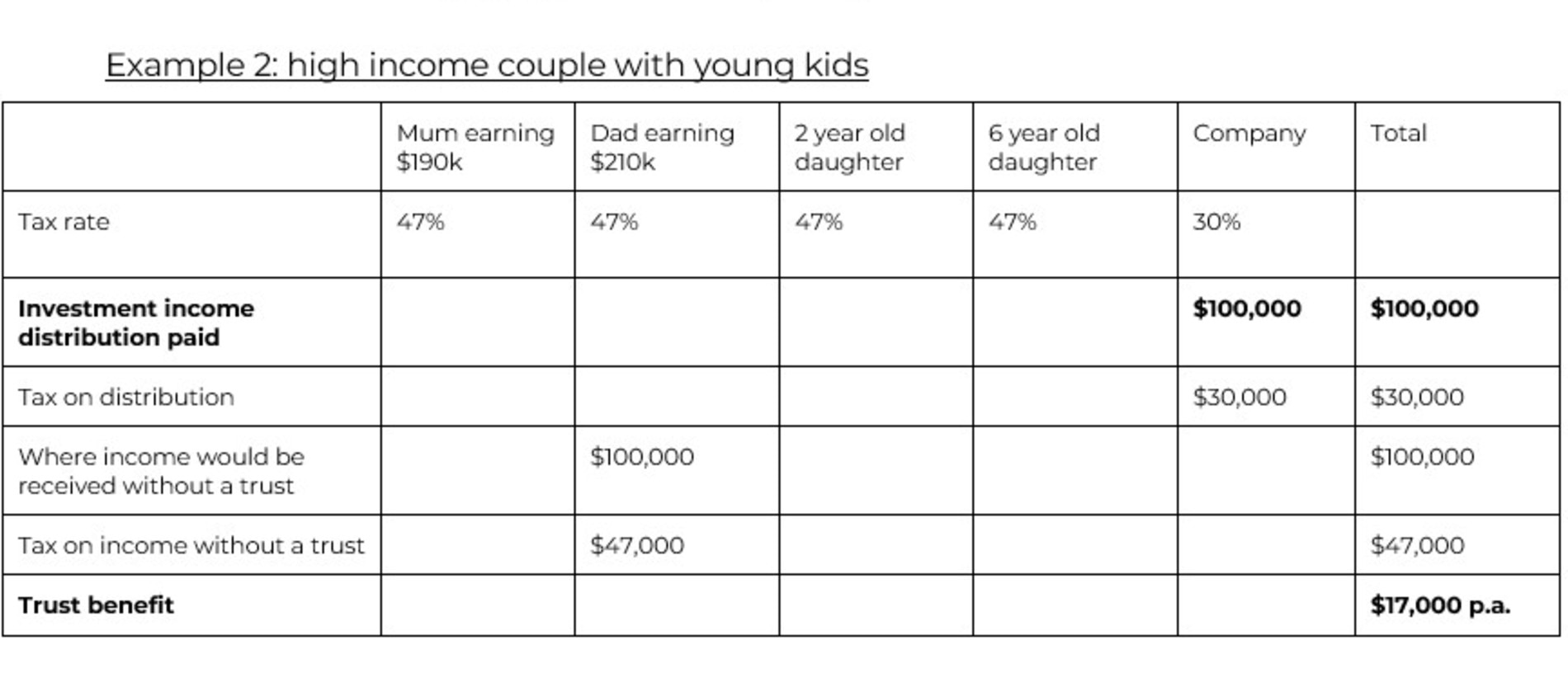

In this scenario, because these children are younger they are unable to receive investment income distributions from a trust without paying tax at the top marginal tax rate, and therefore there is no benefit from distributing funds to them. Both parents (investors) in this case are also in the top marginal tax rate, and so distributing investment income to them would see them paying tax at the top marginal rate.

But there are some tax benefits to unlock – because in this scenario investment income can be distributed to an investment company. This results in a lower rate of tax than what would be paid if the income was to be received by mum or dad, delivering an annual tax benefit of $17,000.

Costs vs. benefit

Any time you use any tax entity you need to consider the costs of establishing and operating the entity. You should look to ensure that the benefit you receive from a trust is higher than the cost of setting up and running your trust.

In the examples above, this benefit is clear – but it isn’t always the case. If you’re thinking about setting up a trust you should do your research and get some good advice to make sure you make the right moves.

The wrap on trusts

Trusts can be an effective way to distribute investment income and reduce the total amount of tax paid on this income. Trusts are particularly beneficial where you have income that fluctuates from year to year, or where you have children that will at some point be able to receive trust income distributions.

Trusts aren’t for everyone, but if you’re in the right position to take advantage, they can deliver some serious tax savings. If you think a trust might be right for you, it’s worth running your numbers and seeing how this could fit within your investing plan.

Ben Nash is a finance expert commentator, podcaster, financial adviser and founder of Pivot Wealth, and Author of soon-to-be- released Book, Virgin Millionaire

Ben runs regular money education events to help you save more and invest smarter. You can check out all the details and book your place here.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs.

Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.