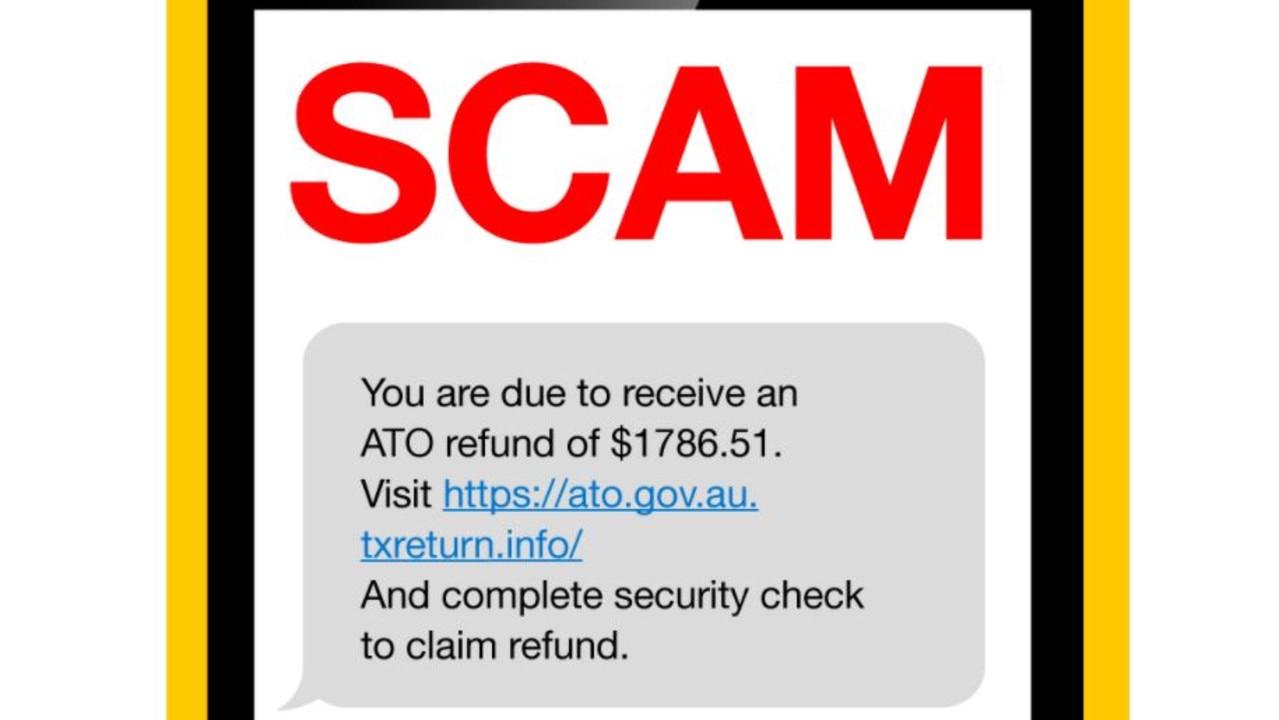

Fresh warnings to avoid tax time scams

Australians are being warned about a big rise in tax time scams after people were defrauded out of $900m during the last year alone.

Australians busily getting their tax affairs in order for the end of the financial year have been issued a warning – scammers are about and tax time is the best time to extract cash from the gullible.

Last year, scams cost Australians $851 million, according to the Australian Competition and Consumer Commission (ACCC).

And very little of that money is ever recovered.

“Unfortunately scammers continue to become more sophisticated and last year used the Covid-19 pandemic to scam and take advantage of people from all walks of life during this crisis,” said ACCC deputy chair Delia Rickard.

But scam watchers have said there are some easy ways to avoid falling foul of a financial faux pas.

Why people are fooled

“Tax time is the perfect opportunity for scammers, as taxpayers are often time-poor, working to a deadline and are conscious of the legal consequences of failing to comply,” Associate Professor Paul Haskell-Dowland and Dr Nathalie Collins of Perth’s Edith Cowan University wrote in a piece for website The Conversation.

“They’ll be everywhere this EOFY.

“Receiving an email, SMS or voice call at this time of year with a tax-related matter has an air of legitimacy (we expect them) and a sense of urgency (we don’t want to be fined),” they said.

“But illegitimate demands for payment and requests for information can lead to huge financial losses and identity fraud.”

The pair said that the true cost of tax scams was probably far bigger than recorded due to many people not reporting they’ve been fleeced because of the shame of having the wool pulled over their eyes.

Scammers have lots of tricks up their sleeves to do just that – mainly for us to either hand over personal information, cold hard cash or sign up to a shonky scheme.

“The excitement of chasing (and getting) a good deal leads to a feeling of self-satisfaction that’s hard to resist. Bargain-hunting, in other words, makes us feel smart. But it doesn’t mean we are smart,” said Prof Haskell-Dowland and Dr Collins.

“Criminals rely on this to bypass a potential victim’s rational brain and appeal directly to their emotions. Scams will often frighten victims with threats of financial or even criminal penalties.”

RELATED: Tax return: How Aussies are planning to spend their refund payments

Tax time the best time to scam people

Phone scams, where people receive a recorded phone call saying for instance that their tax number (TFN) has been suspended and criminal action is being undertaken, is a classic of the genre.

The vast majority of people will see straight through it and hang up. But scammers need just a few people to fall for the trap to make the nefarious enterprise worthwhile.

But it’s worth remembering that the ATO never uses prerecorded messages and while someone from the body may text or call you, suspending TFNs is simply not a thing that it threatens to do.

On its scam website, the ATO stated “We will never threaten you with immediate arrest” or demand you make a payment there and then.

Nor does it accept payment in Bitcoin or Google Play or iTunes vouchers or via Western Union. These are huge red flags that it’s a scam because of how hard it is to track these payments down the track.

As ever, being asked on a cold call for personal information such as a date of birth or bank details, is dodgy.

If you are suspicious of a call from the ATO, the organisation urges people to finish the call and then phone it directly on 1800 008 540 to see if the contact was genuine.

Similarly, be wary of emails supposedly from the ATO demanding immediate payment. And be cautions when clicking on links in unsolicited emails.

“If you are suspicious of a communication you’ve received, the best way to react is to not react,” said Prof Haskell-Dowland and Dr Collins.

“Take a breath, count to five and ask yourself whether what you’re looking at seems legitimate. Is it unusual in any way.

“Scammers rely on victims acting quickly on impulse. Pausing and reflecting is the best weapon against social engineering. Take time to consider who the message is from. What are they asking you to do, and why?”

RELATED: 11 things you can’t claim that Aussies try to get away with

Can I get my money back if I’ve been scammed?

If you believe you may have been scammed, the ATO wants to know about it and has a dedicated page where you can report it.

Doing so may help others avoid the same fate in the future. But it may not help you get your cash back.

“If you’ve already lost money to scammers, unfortunately there are limited options because most scams send stolen money to offshore accounts, making recovery almost impossible,” said Prof Haskell-Dowland and Dr Collins on The Conversation.

If you’ve bought gift cards you can contact the retailer, but most are non-refundable. If you’ve transferred funds or made a credit card payment, your bank may be able to recover the funds. But they also may not be able too.

“Year after year, we can’t avoid doing our taxes. But if we’re careful, calm and aware, we can at least avoid being taken advantage of by scammers.”