Five tax tricks to save $84,000 in 2024

Saving tax is the best way to get ahead with money without making any huge sacrifices – and it could save you tens of thousands.

January is known for getting people pumped up to get ahead with money, but in the middle of a cost of living crisis, finding extra money to save and invest can be close to impossible.

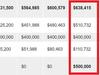

Saving tax is one of my favourite ways to get ahead with your money, because it’s one of the only things you can do to give you more money without making any sacrifices at all. To help you kick start your money momentum in the new year, I cover five tactics you can use to create $84,222 of tax deductions in 2024.

Motor vehicle deductions

If you use a vehicle for your work, you can claim up to $3900 in deductions each year without a log book under the ATO’s rules.

Under the fixed rate motor vehicle deduction method, you can claim a tax deduction of 78 cents per kilometre travelled for work purposes, up to a maximum of 5000 kilometres each year. The result is a tax deduction of up to $3900 per annum, meaning more tax dollars in your pocket that you can use to get ahead.

Invest with a bond

Investing into shares, ETFs, or funds allows you to use compound interest to build your money momentum. The only downside is that when you invest in your personal name, all your investment income adds onto your salary or wages and is taxed at your top marginal tax rate – but it doesn’t have to be that way.

When you invest through an investment bond, all investment income is taxed inside the bond as opposed to in your personal name – and the maximum rate of tax is 30 per cent. This 30 per cent tax rate is 17 per cent lower than the top marginal tax rate of 47 per cent. And further, if you invest through a bond for ten years or more you don’t pay any capital gains tax.

This means that if your aim is to build an investment income of $10,000 in 2024, having this money invested under an investment bond as opposed to your personal name will save you $1700 in tax each year.

Debt recycle

This strategy can help homeowners with a mortgage who are looking to pay down their mortgage, invest and save tax at the same time.

Debt recycling works by making extra repayments into your non tax deductible home loan, and then drawing money back out to invest. When the money is drawn out of the debt and used to invest into something like shares or an ETF, because the new purpose of the borrowing is to invest, the interest payments on this debt become tax deductible.

Based on the average mortgage size of $610,000 in Australia and current average variable mortgage interest rates around 6.5 per cent, this has the ability to generate deductions of $39,650 each year.

Any time you use debt to invest you need to be careful with your planning and manage your risk, but one of the big advantages of debt recycling is that because you’re paying down debt at the same time as drawing it out, your total debt levels don’t actually increase.

Buy an investment property

Negative gearing delivers you tax savings along with the added benefit of using borrowed money (leverage) to invest more money than you can with just savings alone.

Based on current mortgage interest rates, owning an average Australian property valued at $732,886 would deliver you tax deductions of $21,986 each year – noting this is in addition to the potential growth upside as the value of the property increases into the future.

Super contributions

Under the current rules you can make tax deductible contributions to your super each year of $27,500 including any money contributed by your employer.

For someone on the Australian average salary of $95,581 receiving only the compulsory super contributions at 11 per cent of salary ($10,514 p.a.), this means there is room to contribute a further $16,986 p.a. – and claim a tax deduction for the full amount you contribute.

The downside of this strategy is that once the money is in your super fund it’s stuck in there until you can access your super at age 60, but the upside is that on top of the initial tax deduction, investment income and growth inside your super fund is taxed at a lower rate than in your personal name.

The wrap

Saving money is hard, and there is a limit to how much you can cut back – particularly in today’s cost of living crisis. Making your money work smarter, as opposed to you working harder means using the rules to your advantage, ultimately helping you get ahead faster and easier – with less sacrifice.

The five tactics covered here can be combined to deliver some serious tax savings, with the cumulative total deductions coming in at a whopping $84,222 per annum. This ultimately means you keep more of your hard earned income, and have more money leftover to use getting ahead – not just keeping up. Make 2024 the year it comes together for you.

Ben Nash is a finance expert commentator, financial adviser and founder of Pivot Wealth www.pivotwealth.com.au. Ben is the creator of the Smart Money Accelerator program that helps people build a second income investing faster.

Ben is also the Author of the brand new book, ‘Replace your salary by Investing’, host of the Mo Money podcast and runs regular free online money education events, you can check out all the details and book your place here

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.