Aussies reveal HECS debt nightmare as many hit with tax return bills

Some Australians have copped a rude shock while doing their tax returns, discovering the brutal impact of one life decision.

For the first time, many Aussies are finding themselves in a position where they are being told they owe the ATO money after completing their tax return this year.

A significant number of taxpayers in this position are those that are still paying off their HECS/HELP debts – many of them young Australians.

The end of the low-and-middle income tax offset (LMITO), combined with this year’s brutal 7.1 per cent indexation on the more than three million outstanding student loans, means that many are being hit with a nightmare bill instead of the nice cash boost they have gotten in previous years.

Aussies have taken to social media in droves to share their fury at being slogged with a tax bill.

One TikTok user, who goes by Lozrob96 online, revealed her partner was horrified after discovering he owed the ATO $1200 after completing his tax return.

“My partner has just done his tax return today. Neither of us have ever had a tax bill before,” she explained in the video.

The 26-year-old said they “knew it was going to be bad” due to the LMITO ending, but were shocked at receiving the bill.

“He is a part-time worker and a uni student and he owes the government $1200,” she said.

“But why do I owe $1200? I have never had a tax bill before. Oh yes so you know that thing that you’re doing, so you can build a career, so that you can actually f**king survive, that university degree? Yeah, it’s because of that.

“He has been at uni for four years, this ain’t his first year. What’s the point?”

Introduced as a temporary measure in the 2018/19 federal budget, the low and middle income offset meant those earning between $37,000 and $126,000 were eligible for a tax cut of up $1500.

Now that it has expired, many Aussies are realising just how much they relied on that extra boost come tax time.

On top of this, from June 1 everyone with an unpaid HECS-HELP loan saw their debt rise by a whopping 7.1 per cent – the biggest increase in 30 years.

HECS-HELP debt does not accrue interest, however, it is indexed for inflation every year.

But, in a move that has been heavily criticised as “unethical”, the indexation occurs before the money paid towards your debt throughout the year is applied.

The ATO holds all payments made towards the debt until you file your tax return on or after July 1, meaning your past contributions are actually applying to the higher indexed rate, despite the money coming out of your pay much earlier.

Another worker, who goes by Abbs on TikTok, issued a warning to other Aussies with HECS debt after receiving an unexpected bill from the ATO.

“I just did my tax return. If you work in healthcare and have a HECS debt do not, I repeat, do not get Remserv until you have f**king paid off your HECS debt. I was mortified,” she said.

Remserv is one of the top providers in Queensland for workplace benefits such as salary packaging.

However, for those still paying off a HECS or HELP loan, salary packaging can mean you may get an unexpected bill come tax time.

The 21-year-old revealed she wasn’t educated on how salary sacrificing can impact you come tax time if you have a HECS debt and now owed the ATO an extra $3249.

“Are you kidding? I actually want to cry. That is what I wanted to get back and now I am f**king paying it. I paid $18,000 in tax and I have to pay another $3000 in tax,” she said.

“F**k the tax department.”

Alison Banney, money expert at Finder, said those who choose to salary sacrifice while still paying off their HECS debt are likely to find they owe money come tax time.

“Salary sacrifice works to reduce your taxable income, meaning your employer withholds less (or no) tax towards your HECS debt,” she said.

“So you’re effectively paying less tax than you owe for your HECS throughout the year - but the debt remains the same and needs to be paid back in full at the end of the financial year.

“This means you’ll be hit with a tax bill, which may be an unwelcome surprise if you haven’t planned for it.”

Melbourne man Andrew Truong has also been hit with a major tax bill.

“I really wish this was a joke, I hate HECS,” he wrote online after finding out he owed $5018.

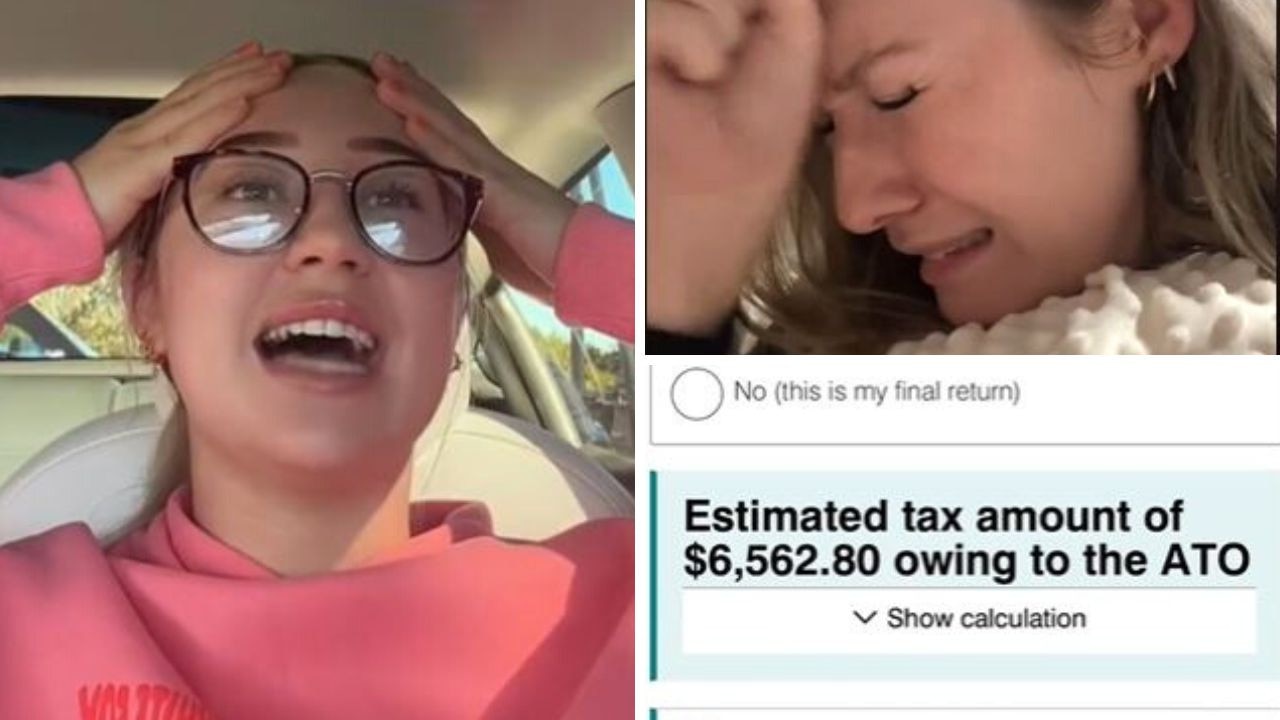

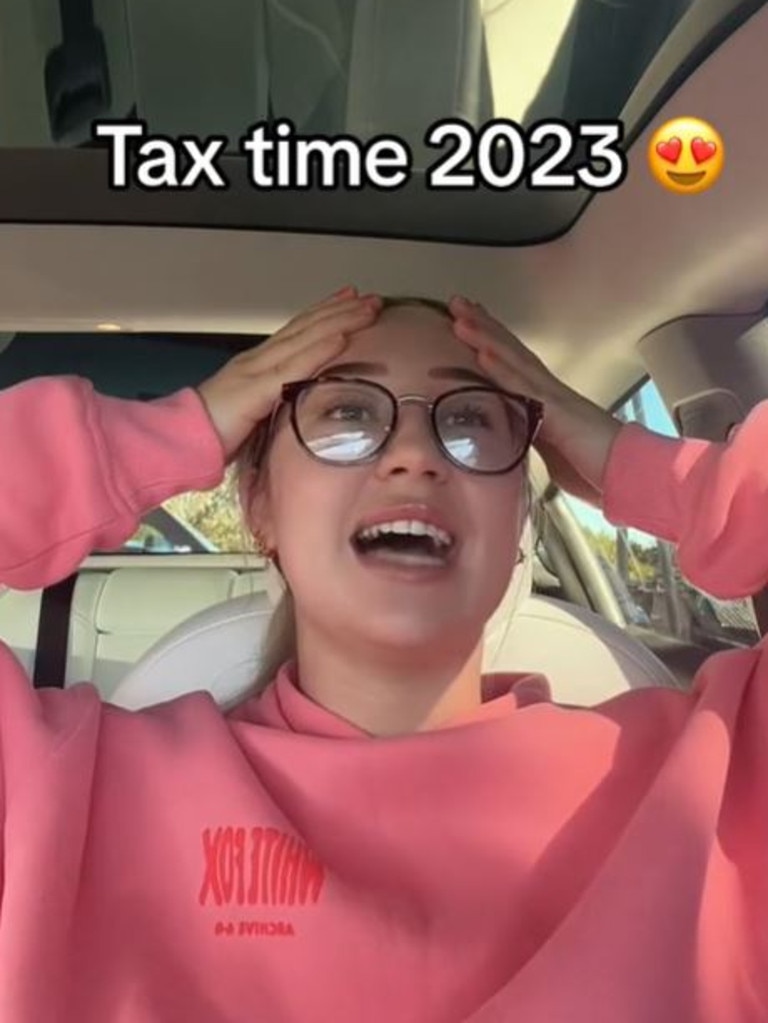

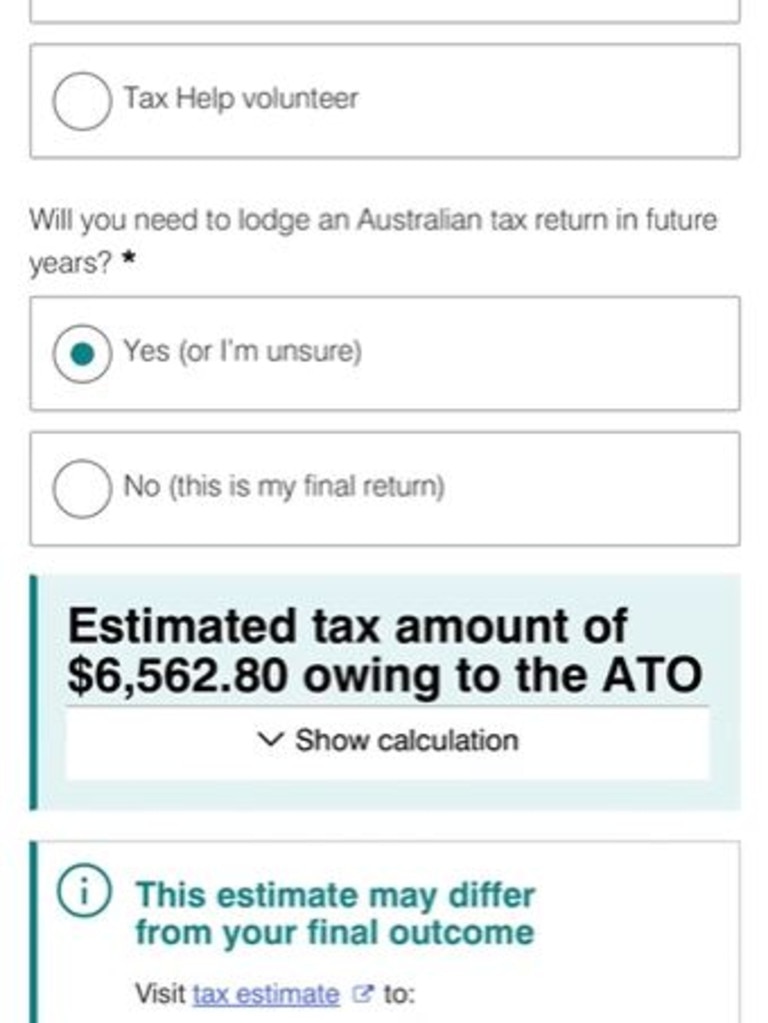

Other videos under the #hecsdebt hashtag include a clip from TikTok user Annie Marie who owes $6562 to the ATO.

“Well there goes the holiday plans,” she wrote.

Another user, Phoenix Burns, said “tax 2023 is not a vibe” after being hit with a $1448 tax bill.

Ms Banney told news.com.au that the key to reducing your tax bill is to claim more deductions.

“A tax agent may be able to help you claim more things than you realised you were eligible to claim,” she said.

“If you’re really stuck with your tax bill, you can set up a repayment plan with the ATO so you can pay it back in installments rather than all at once.”