NAB increases fixed interest rates on loans

Another major Australian bank has announced increases to its interest rates in a move that will have borrowers ‘reconsidering their options’.

NAB has become the second major Australian bank to announce hikes to its interest rates in another worrying move for borrowers.

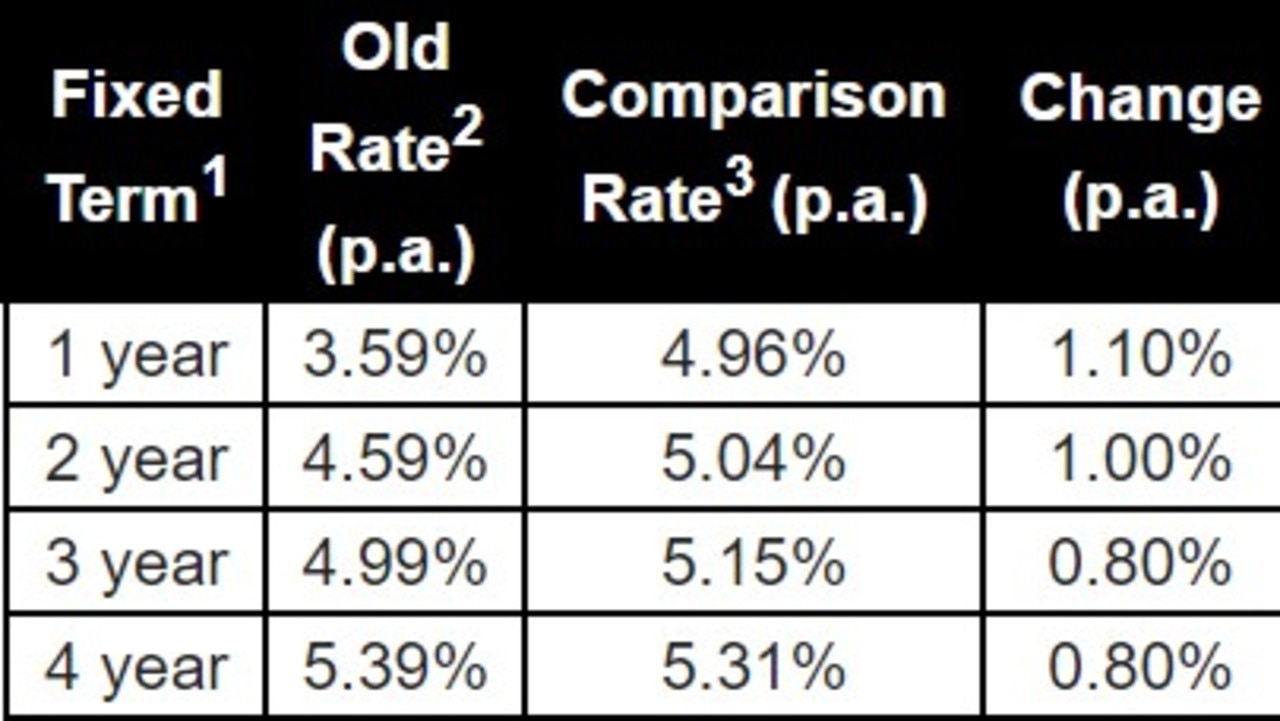

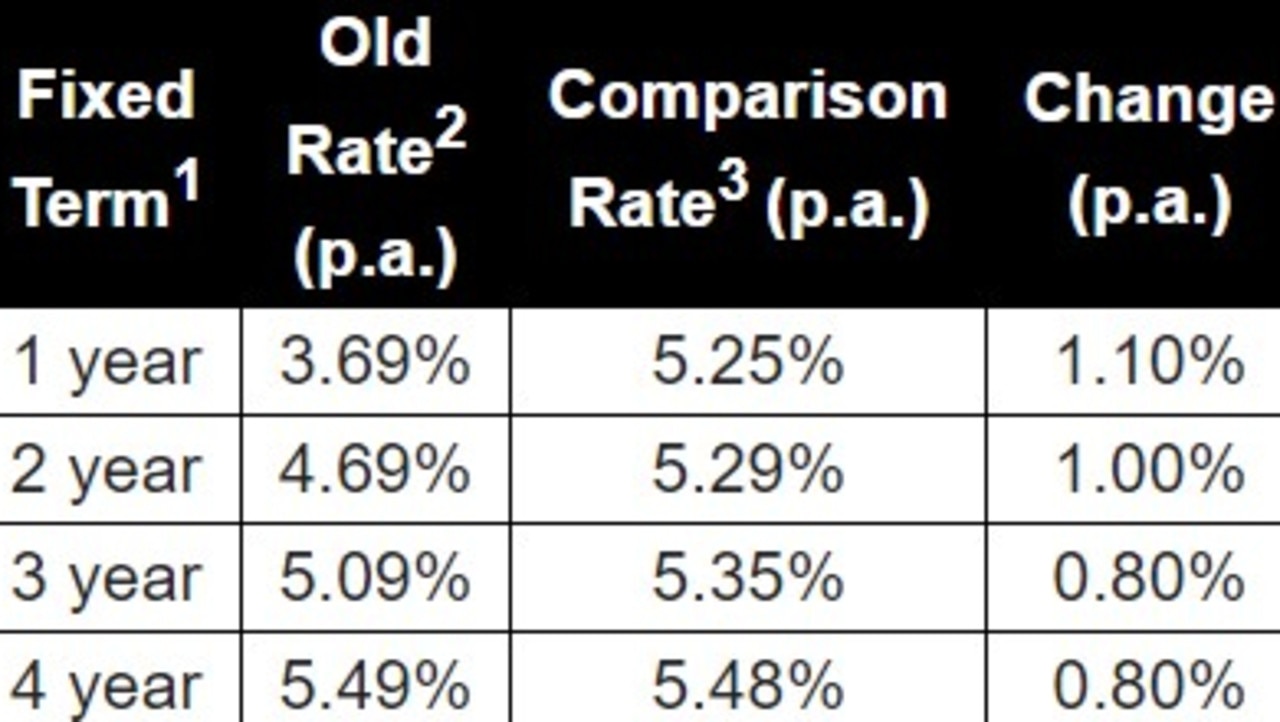

The bank announced huge and immediate increases on Friday for two of its loan services, the Choice Package and Tailored Home Loan, for both owner-occupiers and investors.

The rates for one to five year loans have gone up by up to 1.1 percentage points for both groups, in a sign Australian borrowers could be in for more pain.

RateCity research director Sally Tindall said while NAB’s hike was not as substantial as the CBA’s, she thought borrowers would still be considering their options.

“NAB has pulled the trigger on an extensive round of rate hikes,” she said

“While the hikes aren’t quite as large as CBA’s, many borrowers who were looking to fix with NAB are now likely to be reconsidering their options on the back of this news.”

The one and two year fixed interest rates for Choice Packages and Tailored Home Loans have both gone up by 1.0 per cent for NAB owner-occupiers.

The fixed rates increased by 1.1 per cent for one year and 1.0 per cent for the second year.

Rates increased by 0.9 per cent in year one and 0.65 per cent in year two for investors using the Choice Package.

NAB and CBA’s increases come ahead of the Reserve Bank’s July board meeting next Tuesday, where rates are expected to rise for the third time in a row.

RBA governor Philip Lowe said last week an interest-rate increase of 0.75 percentage points would not be “on the table”, but suggested a 0.25 or 0.5 hike in percentage points could happen.

Ms Tindall said it was “hard to see” the board going for anything less due to the current rate of inflation.

“Governor Lowe has said the board will be considering both a 0.25 percentage point hike and another double hike of 0.50 percentage points at Tuesday’s meeting,” she said.

“It’s hard to see the RBA opting for anything less than a double hike at this stage. Governor Lowe has said the RBA is prepared to do what it takes to get inflation back into the target band and hiking rates now will send a message that the RBA is on the case.

“When you consider these points, how could the RBA do anything less?”