US stock market bloodbath: Amazon and Apple take a beating

It was a bloodbath on the US stock market with some of the biggest losses in years, with shares in Amazon and Apple taking a beating.

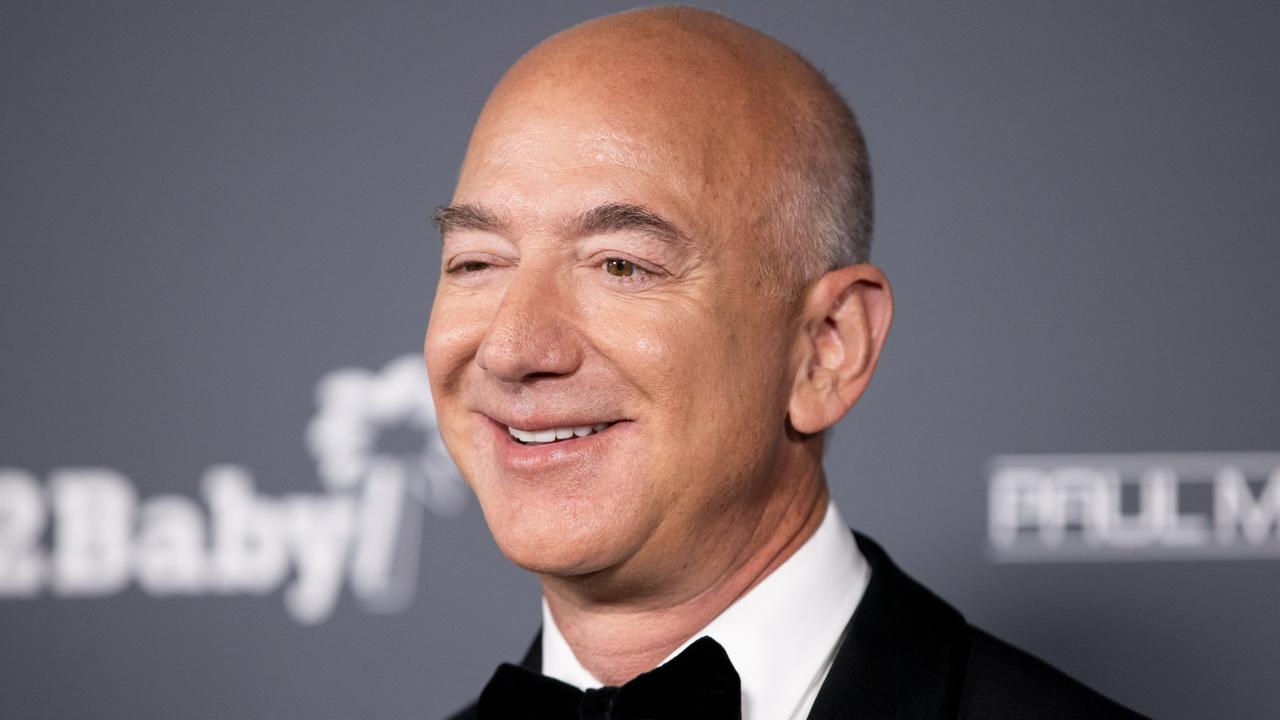

Amazon founder Jeff Bezos had a whopping $US13 billion ($A18 billion) wiped from his fortune after a bloodbath on the US stock market.

The e-commerce giant’s shares took the worst hit on Wall Street on Friday plunging by 14 per cent in its poorest showing on the stock market since 2006.

It came as Amazon reported its slowest sales growth since 2001, while the company also registered its first quarterly loss in seven years losing $US3.8 billion ($A5.3 billion) as it dealt with a slump in online shopping, higher workforce costs, supply chain issues and skyrocketing inflation.

At the same time last year, Amazon had recorded a profit of $US8.1 billion ($A11.4 billion).

Bezos, the world’s second richest person after Elon Musk, could see his net worth drop by a staggering $US155 billion ($A219 billion), according to the Bloomberg Billionaires Index, if Amazon continues to take a hit.

He was worth more than $US210 billion ($A297 billion) at his peak last year.

Tech stocks experienced the biggest losses on Wall Street with Apple shares also dropping by 3.7 per cent, while Intel was down 6.9 per cent.

The S&P 500 was 3.6 per cent lower with every major sector in the red, while the tech rich Nasdaq 100 fell by 4.5 per cent, rounding out a bad month with its losses sitting at 13 per cent, the most since October 2008.

The stock market is being knocked amid fears of US interest rate rises, as well as concerns of the impact of China’s lockdown and the invasion of Ukraine by Russia.

“Key tech giants have been keeping the stock averages from falling even further than they already have, so it looks like April is going to end on a sour note,” wrote Matt Maley, chief market strategist at Miller Tabak and Co.

“But experience tells us that these kinds of wild intraday moves (and wild day-to-day moves) that we have experienced on many days in recent weeks are signs of an unhealthy market.”