Bitcoin steady as analysts look lower, CommBank hits pause on crypto pilot

Bitcoin is attempting another crack at US$30k support in a market lacking confidence. And CommBank has put a crypto pilot on ice.

Bitcoin is attempting another crack at US$30k support at the time of writing.

But there’s hardly oodles of confidence in the market right now – something CommBank is across.

Last November, the Commonwealth Bank of Australia revealed its planned foray into the world of crypto trading.

Australia’s largest bank then announced a pilot program for a service that would ultimately enable more than 6.5 million CommBank app users to buy and sell up to 10 cryptos, including Bitcoin, Ethereum, and Litecoin.

For the latest health and biotech news, sign up here for free Stockhead daily newsletters

The program was under way, too, but as of today its pause button has been hit, with no exact time frame yet as to when it will resume.

The dust stirred up from the Terra LUNA fiasco might need to settle first.

As uncertainty reigns over the market, the Commonwealth Bank of Australia has paused the launch of its planned crypto trading service. pic.twitter.com/IXpUAPa4KU

— Mr. Blockâ„¢ (@mrblock_com) May 19, 2022

In a tech briefing this week, as reported by The Guardian, the bank’s CEO Matt Comyn noted:

“As events of the last week have reinforced, it is clearly a very volatile sector that remains an enormous amount of interest. But alongside that volatility and awareness and I guess the scale, certainly globally, you can see there is a lot of interest from regulators and people thinking about the best way to regulate that.”

Visit The Australian’s Stockhead page, where ASX small caps are big deals

Comyn added that CommBank, which participated in the Gemini crypto exchange and custody firm’s US$400 million funding round last November, still intends to restart the crypto-trading pilot.

But, added the CEO, there are “still a couple of things that we want to work through on a regulatory front to make sure that that is most appropriate”.

Ah well, onwards and upwards … (after chopping sideways or potentially falling off another cliff first).

Top 10 overview

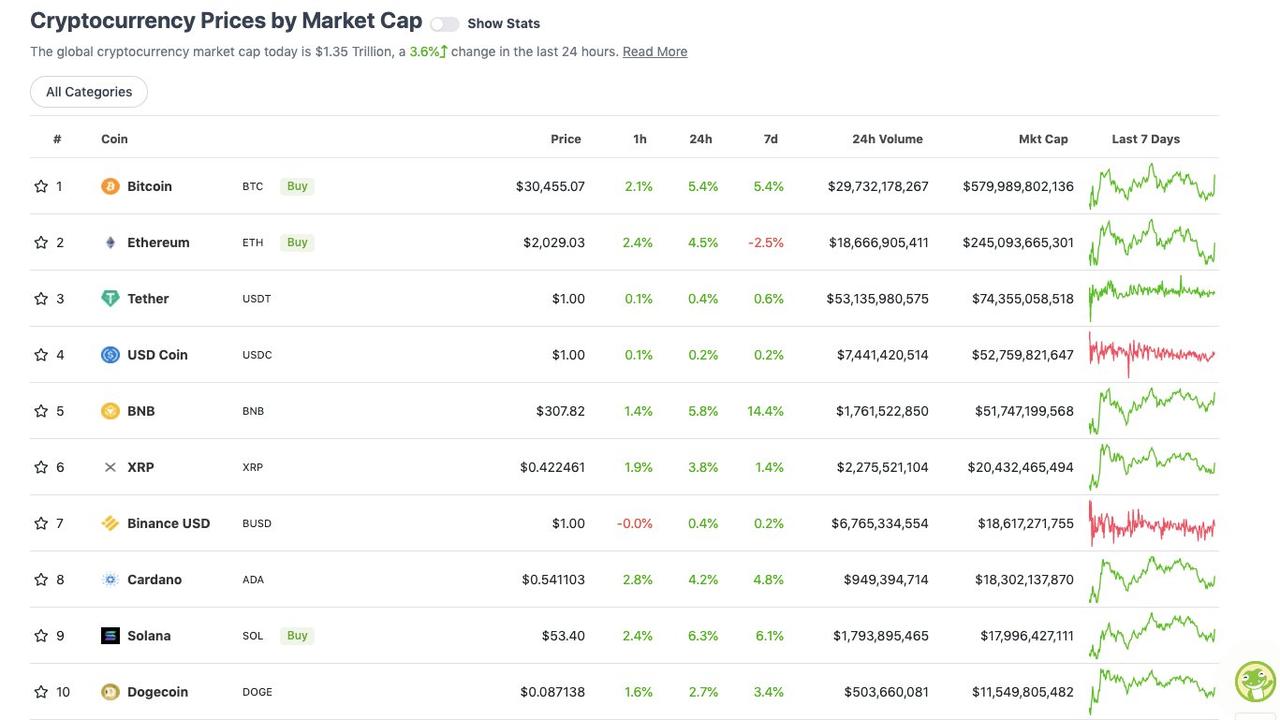

With the overall crypto market cap at roughly US$1.35 trillion, up 3.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s looking just slightly healthier than this time yesterday, as is the industry’s number one sentiment indicator – the Crypto Fear & Greed Index – which we had thought could be a single digit today.

It’s actually up one point out of 100 since Wednesday, which makes it only very marginally less likely to wet its pants in its extremely fearful state.

So what are various analysts seeing today? WhaleMap, which tracks and analyses the trading patterns and movements of large Bitcoin investors, is spotting support levels a fair bit lower than the US$30k the market’s shooting for right now.

About US$24k to $26k is where it’s at, apparently, otherwise … see you down in “goblin town” as the crypto kidz say.

Lets keep it simple

— whalemap (@whale_map) May 19, 2022

Do or die supports for #Bitcoin right now are:

$26,439

$25,666

$24,718

$24,673

This or we going much deeper pic.twitter.com/h6PEHL2HDz

Want something more short-term bullish? Yesterday we said @Roman_Trading has been fairly consistently bearish in recent months, but a good five hours ago (at the time of writing), he was spotting an “inverted head and shoulders” pattern on a low time frame.

That often precedes a move up, although it may have already played out, pulling Bitcoin back above US$30k again.

Not saying it’s a move that’ll sustain, but it seems he’s made another correct short-term call.

$BTC 30m

— Roman (@Roman_Trading) May 19, 2022

Not a fan of LTF but I pointed out low volume going into 28.6k support last night. That generally signals a bounce is at play or at least more consolidation.

I’m seeing an inverted HS (bullish reversal pattern) confirming here.#bitcoin#cryptocurrency#cryptotradingpic.twitter.com/hItajUwwDE

Meanwhile, another solid chart watcher, Rekt Capital is one trader who’s been eyeing off the RSI (relative strength index) – which is a “momentum indicator that measures the magnitude of recent price changes to analyse overbought or oversold conditions”, according to Investopedia.

Seeing the Bitcoin RSI this low and “oversold” seems kind of tantalising, indicating a market bottom could, in theory, be near.

#BTC RSI is now entering a period that has historically preceded outsized Returns On Investment for long-term investors

— Rekt Capital (@rektcapital) May 19, 2022

Previous reversals from this area include January 2015, December 2018, and March 2020

All Bear Market bottoms$BTC#Crypto#Bitcoinpic.twitter.com/jofNT7gnsT

But … then again … as author and trader “Cheds” pointed out recently, RSI trends can hang around for a long time.

Quick reminder as $BTC RSI approaches “oversold†on larger time frames.

— Cheds (@BigCheds) May 9, 2022

Being “oversold†is a better reason to sell than buy.

Trends tend to continue. RSI can stay “oversold†or “overbought†for a long time.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11.3 billion to about US$563 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• XDC Network (XDC), (market cap: US$589 million) +11%

• Gala (GALA), (mc: US$639 million) +7%

• Synthetix (SNX), (mc: US$604 million) 7%

• Cosmos (ATOM), (mc: US$3.16 billion) 5%

• The Sandbox (SAND), (mc: US$1.59 billion) 5%

DAILY SLUMPERS

• TerraUSD (UST), (market cap: US$891 million) ($0.078) -22%

• Terra (LUNA), (mc: US$919 million) -19%

• Chain (XCN), (mc: US$1.56 billion) -15%

• Convex Finance (CVX), (mc: US$640 million) -6%

• Waves (WAVES), (mc: US$617 million) -5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye …

DAILY PUMPERS

• DIA (DIA), (market cap: US$43m) +48%

• Marlin (POND), (mc: US$44 million) +41%

• PolySwarm (NCT), (mc: US$37m) +36%

• Keep3rV1 (KP3R), (mc: US$57m) +35%

• RAMP (RAMP), (mc: US$18m) +29%

DAILY SLUMPERS

• Goldfinch (GFI), (market cap: US$13m) -21%

• Retreeb (TREEB), (mc: US$16m) -18%

• Tokemak (TOKE), (mc: US$72m) -16%

• UniLend Finance (UFT), (mc: US$15m) -16%

• Anchor Protocol (ANC), (mc: US$36m) -13%

Around the blocks

A lot of new macro-economic experts in the last week popping up talking about recession this and recession that. Feels like getting a tip from the barber or taxi driver when you're this far into the recessional pregnancy. Nov was the time to be an expert. Not -70% later lol

— Pentoshi 🧠(@Pentosh1) May 19, 2022

They can have their moment.

— Erik Voorhees (@ErikVoorhees) May 19, 2022

#SPX flat, #DowJones down #Bitcoin up 6%. Too early to tell if we are decoupling but that’s a big delta 🔼🙠pic.twitter.com/NCduHKPKyW

— InvestAnswers (@invest_answers) May 19, 2022

Elon, 2021: “We’ll stop accepting BTC in the Tesla web store until bitcoin mining becomes more ESG compliantâ€

— Vlad "BTCTKVR.com" Costea âš¡ï¸ (@TheVladCostea) May 19, 2022

Elon when Tesla stonk gets downgraded by S&P 500 due to lack of ESG compliance: “ESG is woke leftist compliance bullshitâ€

Oh, how the tables turn @elonmusk

My POV: The biggest two biggest themes were:

1. Web3 studios have to build great games. It starts there. Without a great game, web3 gaming doesn’t matter.

2. Great games take time. Be patient and build wisely to navigate the market highs and lows.

— Chaseᵍᵐ @ Permissionless (@itsmechase) May 19, 2022

— Shibetoshi Nakamoto (@BillyM2k) May 19, 2022

More Coverage

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as Bitcoin steady as analysts look lower, CommBank hits pause on crypto pilot