How to navigate a low interest rate world

THE Reserve Bank has cut the cash rate again, making it more important than ever to know what you are paying and receiving in interest.

LOW interest rates are likely to last a lot longer than many Australians expect, meaning now is the time to think about making the most of the new financial landscape.

Navigating today’s low-interest world starts with shopping around for the best rates you can get for loans, savings accounts and investments.

The Reserve Bank’s 0.25 percentage point rate cut last week is tipped to be followed by another before Christmas, and economists say the world is stuck in a low-rate, low-growth spin cycle.

“Low interest rates are likely to be with us for some time,” says Baillieu Holst financial adviser Alex Butler.

“Now is the time to re-evaluate your financial health and strategy. Otherwise opportunities will be lost and wealth whittled away.”

While the big banks only passed on a portion of the RBA rate cut, they lifted some of their term deposit rates more than three times as much to about 3 per cent.

That means it’s more important than ever to shop around for deposit rates because the gap between the best and worst is growing. Check online comparison websites and speak with your bank.

Investors, Butler says, should hold shares within their investment mix, focusing on proven stocks with solid dividend yields plus capital growth.

The income yield of the All Ordinaries index is currently about 4.2 per cent, and close to 6 per cent once you include tax benefits from dividend franking.

Financial strategist Theo Marinis says diversification is important. “Nobody’s upset when markets go up, but when they go down, as long as you don’t crystallise your loss by selling, they eventually go up again,” he says.

Retirees relying on cash deposits paying 2-3 per cent is not a good idea, especially when you get twice as much from shares and also can diversify into property, corporate debt, infrastructure and alternative investments.

Longer lifespans mean people need their assets to grow at least in line with inflation. “For a couple of 65-year olds, there’s a 90 per cent probability that at least one of them will live into their 90s,” Marinis says.

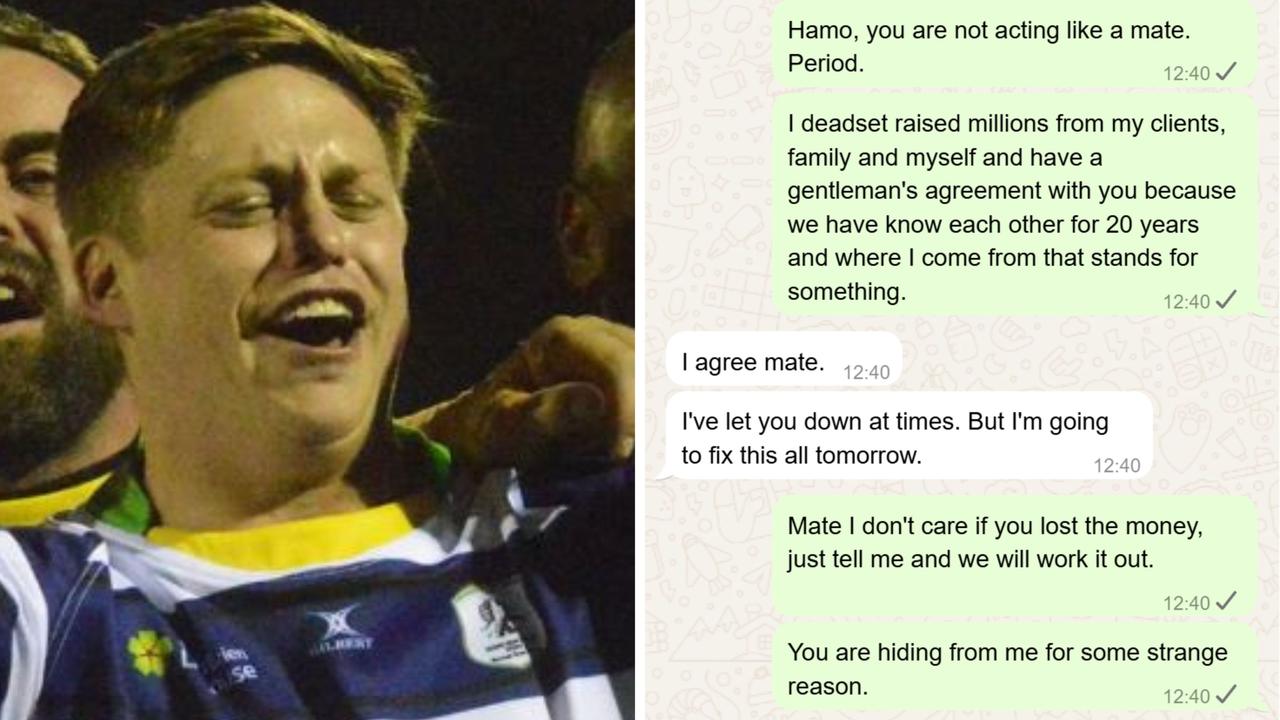

Wealth on Track principal Steve Greatrex says retirees should beware of investment schemes offering income returns that are much higher than cash in the bank. “People have to get used to much lower returns across the board,” he says.

Take advantage of the low inflation and low rate environment by embracing lower costs in areas such as petrol, electronics and holiday accommodation, he says.

Mortgage experts say that borrowers should demand a better deal if the home loan rate they are paying is greater than 4 per cent.

Tough competition among lenders has improved the bargaining power of people prepared to question their lender.

Interest rates on credit cards are still stuck at high levels, which makes falling mortgage rates more attractive for people to switch debt from a card to their home loan — as long as they don’t reload the credit card with fresh spending.