How Aussie mates turned $1200 into $256,000

If you have $1200 leftover at the end of the year, chances are you’ll tuck it away into savings, but that’s a huge mistake according to these experts.

We don’t know who you are or where you’re reading this but we do know one thing about you.

You spend a lot of time at your job (or at school, university or college getting ready to spend a lot of time at your job).

That is one thing that ties all 8 billion people on Earth together: we spend most of our time sleeping and working.

And we work to get paid.

Investing is a way to have your money work as hard as you do. Once you get paid, you have a choice.

You can take your money and either spend it, save it or invest it.

There is no right or wrong answer, just a choice. But it is a choice that has consequences.

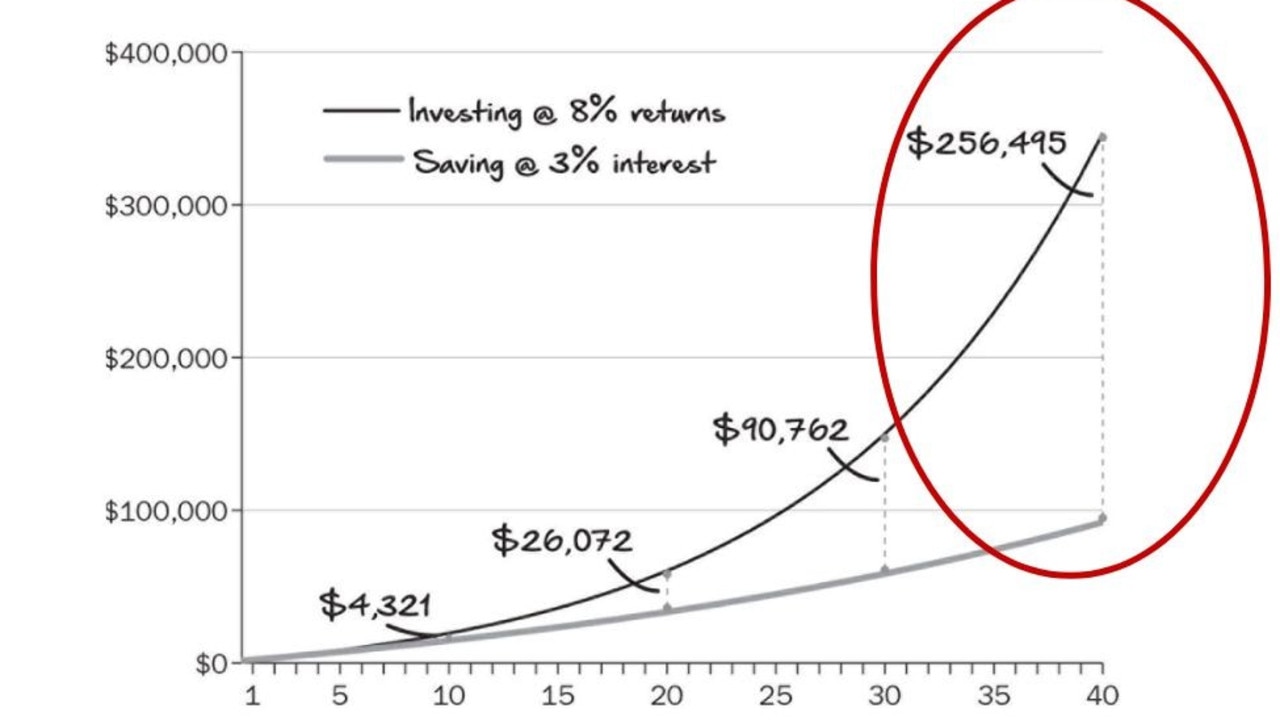

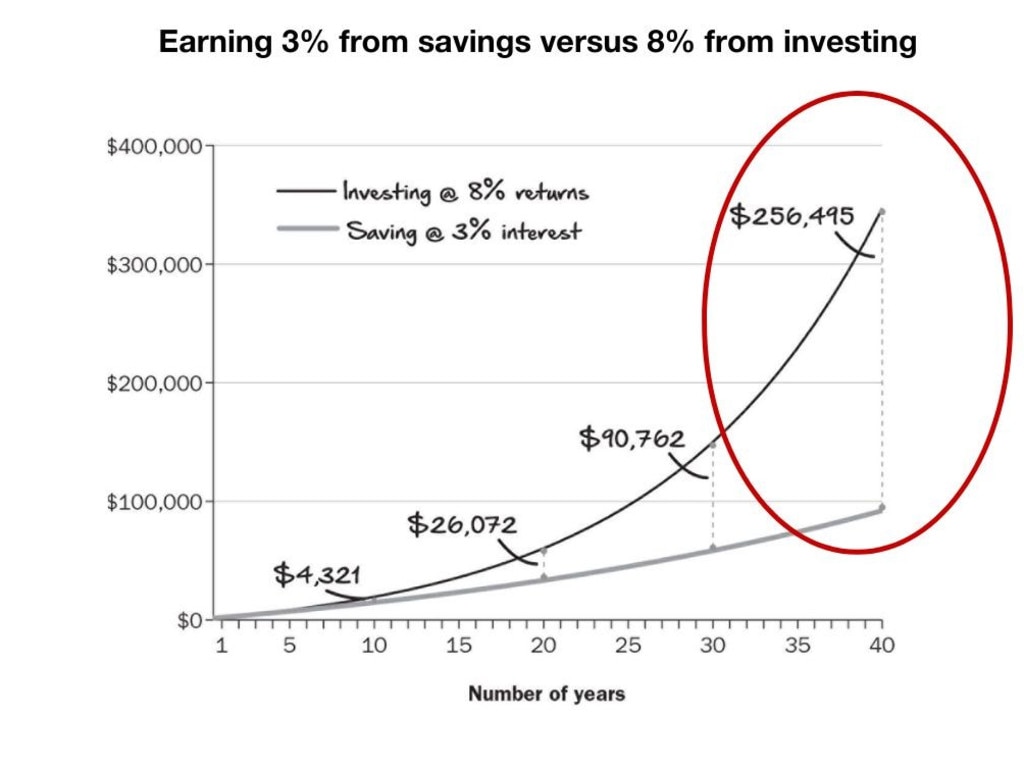

Let’s say at the end of the year, after you’ve paid your rent and for food, you have $1200 left over.

• If you spend it, next year you’ve got $1200 worth of stuff. But no money.

• If you save it, you earn interest on your savings in the bank. Maybe enough to keep up with inflation, maybe not.

• If you invest it, you earn a return on that investment. Historically, this has averaged 8 per cent per year.

Over time, the outcome of those choices starts to become obvious:

• If you’re spending the $1200 you have every year, you haven’t built any wealth.

• If you’re saving it, you will have what you saved.

• If you’re investing it, you will have what you saved and what it has earned.

There is no better feeling than making money from your money.

Let’s say you take your $1200 a year and look at how you’re going after 10 years.

• If you’re spending it, you have $12,000 worth of stuff. Probably some pretty nice stuff. But no money.

• If you’re saving it, you’ll have saved $12,000. With 3 per cent interest you will have a total of $13,974.

• If you’re investing it, you’ll have invested $12,000 and if the market continues its long-term average of 8 per cent a year, you’ll have $18,295.

There’s obviously an ‘if’ there. And it is true that investing is riskier. We’ll get to that.

We’re going to sound like a broken record here but, as we wrote earlier, our brains struggle to understand how small investments compound over a long period of time.

So we’re going to say it again (and keep reading, because it won’t be the last time): as we extend the timeline, the difference between putting your money in a savings account and putting your money in the stock market becomes even clearer.

The choice today may not feel like a big one, but you see how those decisions compound over time.

At this point, change the way you think about money.

Working and getting paid isn’t the end of the story. That is the start.

It’s not I work and I get paid, I work and I get paid. Start thinking: I work and I get paid and I invest. And now I get paid by both my work and my investments.

Until we get to the point where our investments work so we don’t need to.

Working is the hard part; investing is the easy part

A lot of us grow up with an idea that learning to invest is too hard and requires too much specialised knowledge, so we figure that the easiest way to grow wealth is to get really good at our jobs, get promoted, negotiate pay rises and increase our salary over our career.

If there is one thing we can change with Don’t Stress, Just Invest, we hope it is that idea.

Investing is the easy part. And we mean easy in two ways.

Firstly, with new technology and platforms, it is easy to actually do (if you don’t believe us, keep reading — you will by the end).

Secondly, the return that you get from investing is hard to match at your job.

Historically, the average return from the stock market has been 8 per cent a year.

Imagine trying to negotiate an 8 per cent pay rise every year from your work.

Imagine the late nights, the extra work, the hoops you’d have to jump through.

We value pay rises from our jobs so much that we celebrate them.

But you can put your money to work and see similar returns by consistently investing in the stock market.

Over time, the money you make from the stock market will start to outpace any pay rise you could dream of.

An increase of 8 per cent in just one year on a half-a-million-dollar portfolio is $40,000. Imagine asking your boss for an additional $40,000 on your salary.

This isn’t to say you shouldn’t work hard and shouldn’t negotiate hard for a pay rise.

All we’re saying is that if you do the hard part, and get the pay rise, you should finish it off with the easy part and put your money to work.

This is an edited extract from Don’t Stress, Just Invest by Alec Renehan and Bryce Leske available from August 22.