Gambling addict admits losing friends’ $60,000 after fake investment scheme

A gambling addict who took $60,000 from his friends, promising to double their money on the stock market, had admitted he blew it all on sports betting.

A “broker” who took $60,000 from two friends promising he could double their money within 12 months of trading stock market shares has admitted blowing the lot on sports betting, saying gambling “ruined my life”.

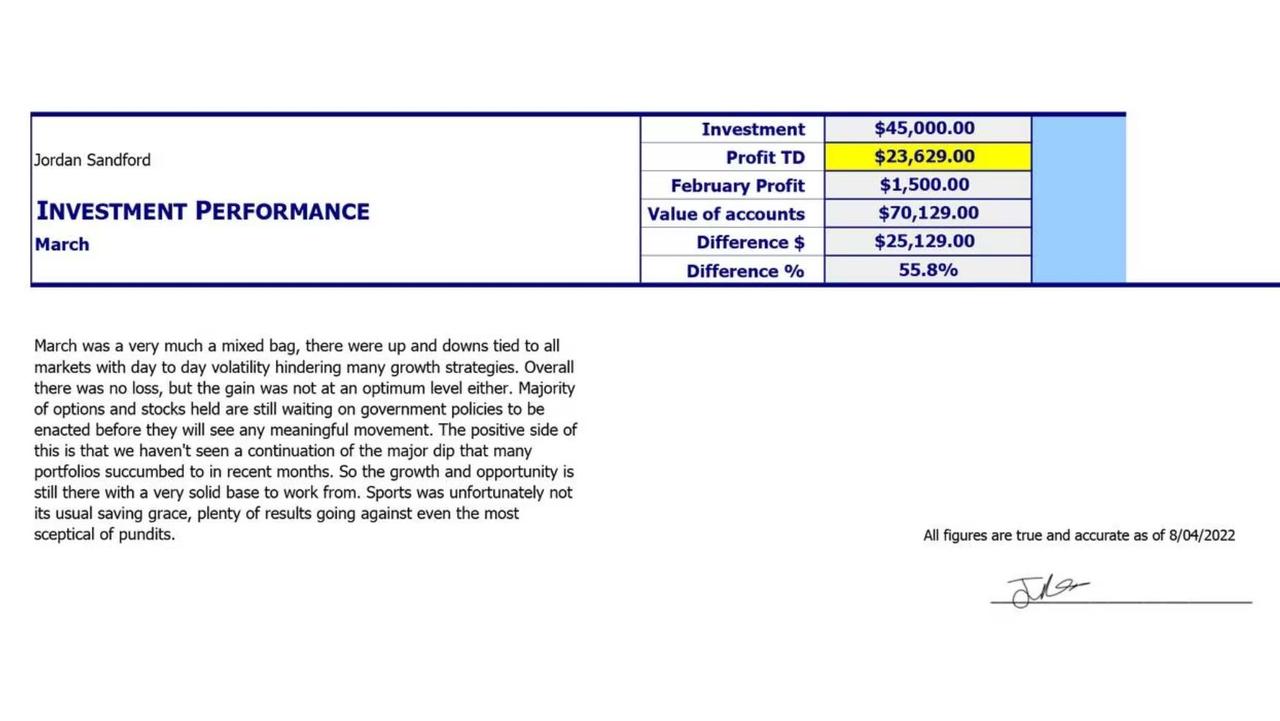

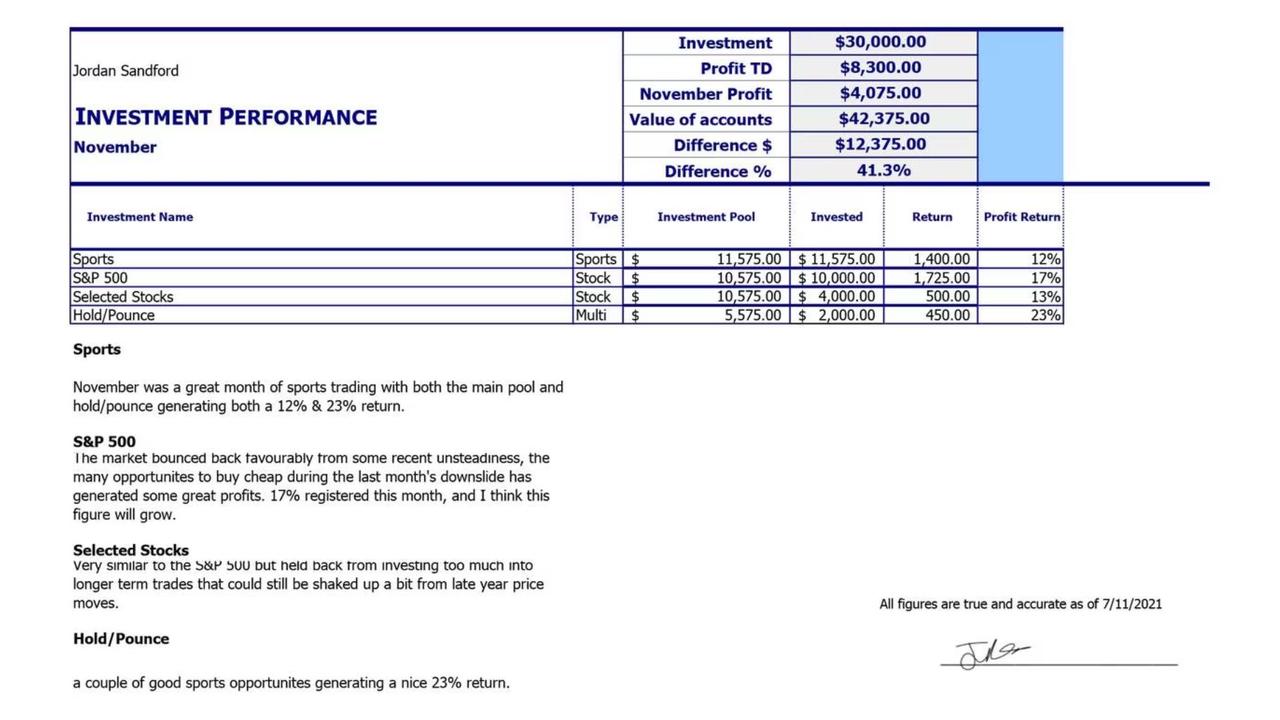

In an interview with the New Zealand Herald, Auckland man Joshua Calvert confessed that he lost the money during 2021 and 2022 while sending his victims bogus monthly financial records tracking their supposed investment returns to make them believe they were getting rich.

The glowing but patently false investment statements appear to have worked, with one of the victims, Jordan Sandford, eventually handing over his life savings.

But little did he know there was no tech stock portfolio or bullish longer-term trades. In fact Calvert had a gambling addiction and was buying time in a bid to recoup his snowballing losses.

Speaking exclusively to the Herald, Mr Calvert, 30, admitted he is not a registered financial service provider and said none of the money was ever invested in shares.

Instead he was spending his friends’ cash on an array of international sports betting sites, using a complicated spread system designed to hedge his losses and guarantee returns.

But when his system failed, he began making bigger, more risky punts in a desperate bid to win back the money and repay the investors.

“It was an awful, awful situation,” Mr Calvert told the publication. “It’s a dark time in terms of the decision-making I made.

“I wasn’t thinking methodically or logically. It was fight or flight. ‘What’s the next game? What can I bid on?’

“The last couple of weeks I was making ridiculous bets – thousands of dollars on some Malaysian league at 3 o’clock in the morning.

“I was beside myself with guilt and anxiety. At that point I was like, ‘I’m probably going to go to prison.’”

Mr Calvert said he did not set out to deceive his friends and genuinely believed he could grow their money and make a profit before things crashed and burned.

“I wouldn’t call myself a scammer, but I would definitely say I’ve done something unforgivable. There’s no defence for what I did,” he said.

Thought it was legitimate

Mr Sandford, 24, is a family violence co-ordinator living in Australia. He told the Herald he trusted Mr Calvert, who he met through an Auckland church. He said the scheme seemed legitimate as each deposit was documented with a signed loan contract, complete with penalty clauses should the broker default.

But things turned sour in the middle of last year when Mr Sandford, who had by then sunk $55,000 into the scheme, became suspicious and demanded his money back.

By that time, the financial statements suggested Mr Sandford’s investment had ballooned to $98,000. But Mr Calvert, who said he had claimed to have set himself up as a trader with numerous other “clients” on his books, began making excuses about why the money could not be paid out.

First, Mr Calvert claimed the money had been frozen in a US trading account because he’d “communicated” with someone under suspicion of money laundering, according to correspondence viewed by the New Zealand Herald.

Next, he was in hospital after a medical episode and could not respond to attempts to reach him because he was under doctors’ orders to avoid stress.

As the situation became more fraught, Mr Calvert told Mr Sandford and his fellow investor – who contributed $5000 – he was sorry for the delay, trying to obtain a personal loan from ASB, and raiding his KiwiSaver account to reimburse them in full.

The money never arrived.

“He said, ‘I’ve definitely got the money, you’ll definitely get paid back,’ and kept stringing us along,” Mr Sandford told the Herald.

“But there was no money left and he’d falsified everything.

“He sent us monthly statements that detailed what stocks he’d put the money into, including the very small amount of money he supposedly put into sports betting.

“I thought this would be a great way to have someone steward my money and make sure it was being looked after responsibly,” Mr Sandford said.

“But it turned out he was actually falsifying those accounts and gambling the funds from the beginning, which was a pretty bitter pill to swallow.”

‘Made absolutely no sense’

Eventually, Mr Sandford’s friend David Jansen – a corporate bond market trader – reviewed Mr Calvert’s financial statements and smelled a rat.

Mr Jansen told the Herald the statements were “b*llocks”.

“It just made absolutely no sense on the bulls**t radar.”

Mr Calvert had claimed the impressive investment returns he was supposedly generating came from a mix of trades on the US and New Zealand stock exchanges, augmented with his sports hedge bets.

But the apparent windfall profits described in the statements defied market trends, Mr Jansen told the Herald.

“They were showing significant returns and this was over a period when the share market was reversing. It just didn’t look right.”

Mr Jansen confronted Mr Calvert by phone and said the former Vodafone worker confessed to the ruse.

“He lost control and was doubling down on the sports betting and just couldn’t stop. He said in the end he was just doing Hail Marys and putting straight naked positions on, and trying to get their money back.”

He claimed Mr Calvert said: “‘I’ll just tell you straight – none of those financial statements exist. I was just doing that to keep Jordan on-side and buy myself time to sort everything out.’ He was very upfront about it.”

“He lost control and was doubling down on the sports betting and just couldn’t stop. He said in the end he was just doing Hail Marys and putting straight naked positions on, and trying to get their money back.”

After learning the money was gone, Mr Sandford and Mr Jansen approached Mr Calvert’s parents in a bid to mediate and agree a repayment plan to stave off legal action.

However Mr Calvert was on a benefit and could only afford a nominal weekly repayment which Mr Sandford estimated would take 17 years to reimburse his losses.

The negotiation ended and Mr Sandford contacted police in November.

In a statement obtained by the Herald, police said they’d received a report of alleged fraud and investigations were “ongoing”.

But after Mr Calvert said he had not been contacted by investigators, the Herald asked police what inquiries had occurred and why no one had tried to interview him four months on from Mr Sandford’s complaint.

Police told the publication they had nothing further to add.

Mr Sandford and Mr Jensen also alerted the Serious Fraud Office and Financial Markets Authority (FMA). However, both agencies declined to investigate. The FMA told the Herald the matter was outside its remit because no financial product or financial services were being offered.

‘A lot of red flags’

Mr Sandford said Mr Calvert was extremely convincing, charismatic and “can certainly sell things”.

He described his actions as “intentional, methodical deception”.

“He took everything.”

Mr Sandford is now in debt to his family and said he was speaking publicly to warn other investors about potential risks.

“I literally gave him everything I’d saved since I started working, which was unwise but I felt that it was protected because of the contracts,” he said.

“It is embarrassing. There were lots of red flags when I look back on it. I just assumed, ‘Why would he do that to me, I grew up with him.’”

Mr Calvert told the Herald he first started gambling about five years ago after getting hooked on the thrill of winning money during a horse race.

He had a “dummy” Plus500 trading account where he successfully traded stock using $20,000 of fake money, and thinks Mr Sandford and his other friend believed it was a legitimate trading account.

He never corrected them.

Mr Calvert also claimed his friends approached him about the investment opportunity and that he cautioned them about sinking all their money into the scheme and advised them to seek legal advice.

“I made a mistake with good intentions. I decided that stocks would be too risky and I thought I’d just keep making money with my sports betting.”

But when he lost a large amount on one bad bet, things began to snowball.

“Up until that point the hedging was working so I maintained the story that I was stock trading, although I never actually bought or sold any stocks.

“The original plan was risk-free in my mind. I’m not saying it was risk-free. I’ve learned from that. The risk-freeness was if it worked.”

Mr Calvert said he had been diagnosed with ADHD and had an addictive personality, which meant he was “constantly searching for a high”.

He believed this was linked to his problem gambling and that mental health issues contributed to the situation unravelling.

He said his “horrible” case reflected a broader problem with New Zealand’s gambling culture, and he hoped sharing his story would shine a light on the insidious addiction.

An FMA spokesman told the Herald the case appeared to be an “alleged fraud” and it was appropriate it was referred to police.

In New Zealand, anyone offering financial services to retail investors should be registered on the Financial Service Providers Register.

This article first appeared on the New Zealand Herald and was reproduced with permission