‘Freaking out’: Single mum loses half her superannuation in sophisticated investment scam

A single mum has lost more than half her superannuation after scammers stole her money through no fault of her own.

A single mum has lost more than half the superannuation she shares with her family after scammers stole her money through no fault of her own.

Alice*, who has a five-year-old daughter, works as an accountant in Perth and shares a Commonwealth Bank self-managed superannuation fund with three of her family members.

The woman, in her late 30s, was alarmed when she received a panicked call from her older brother in May.

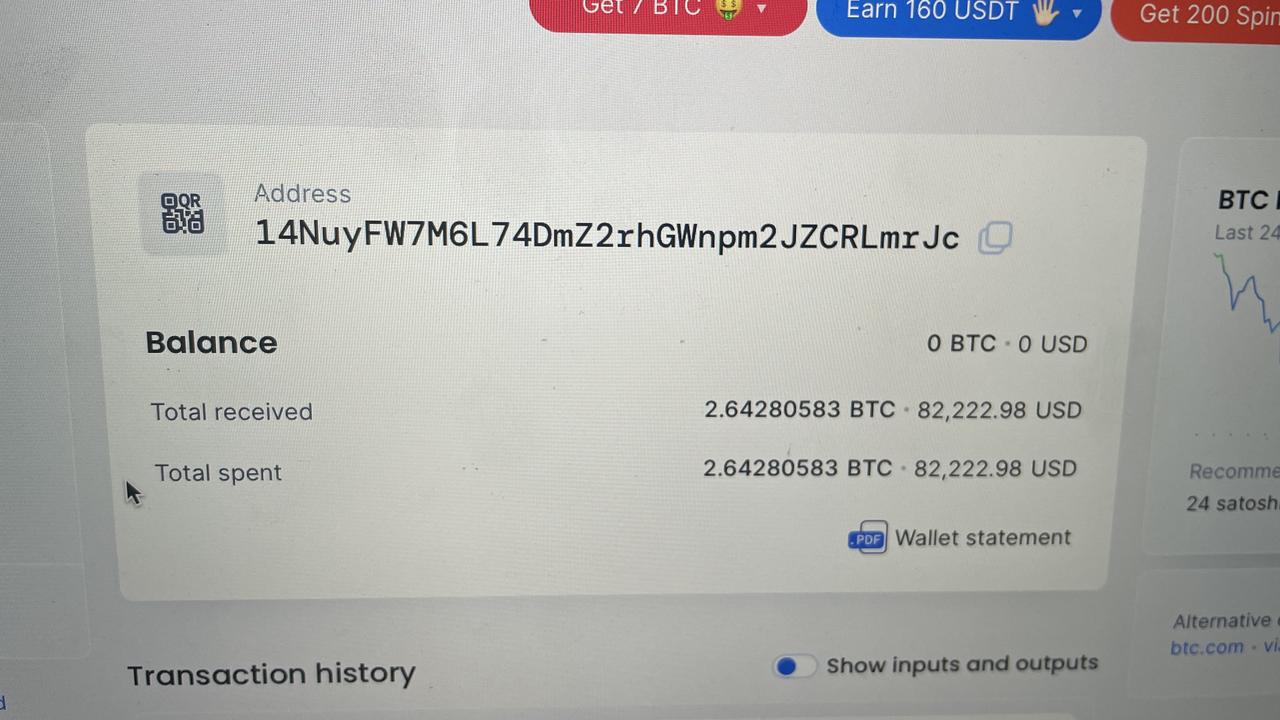

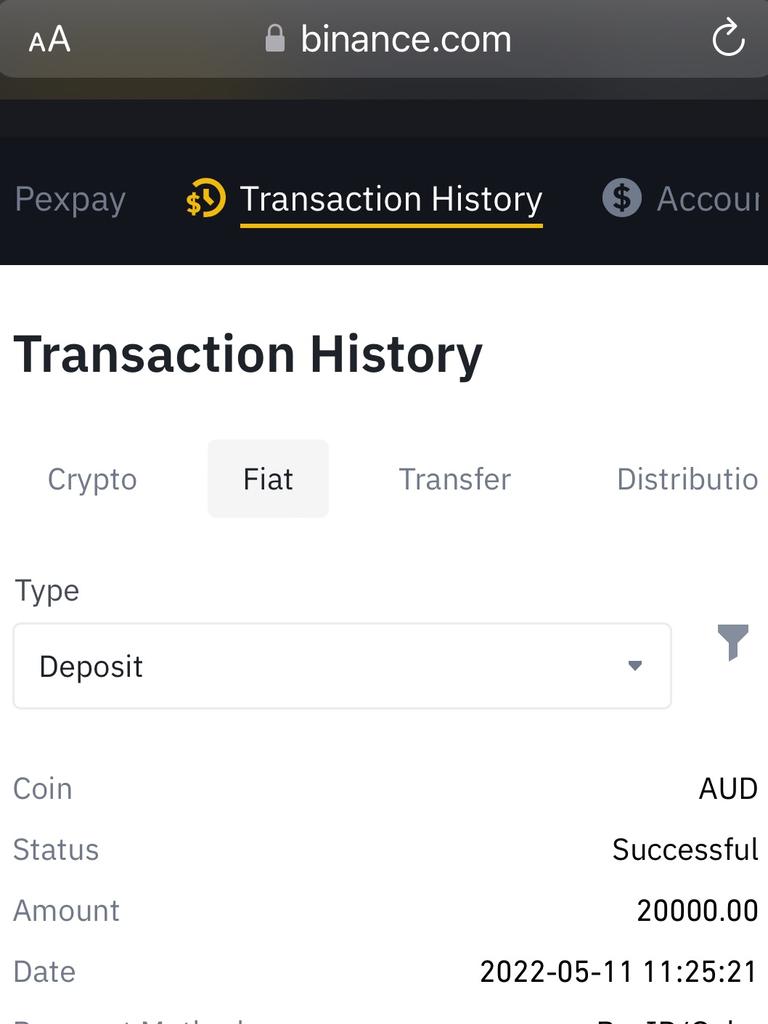

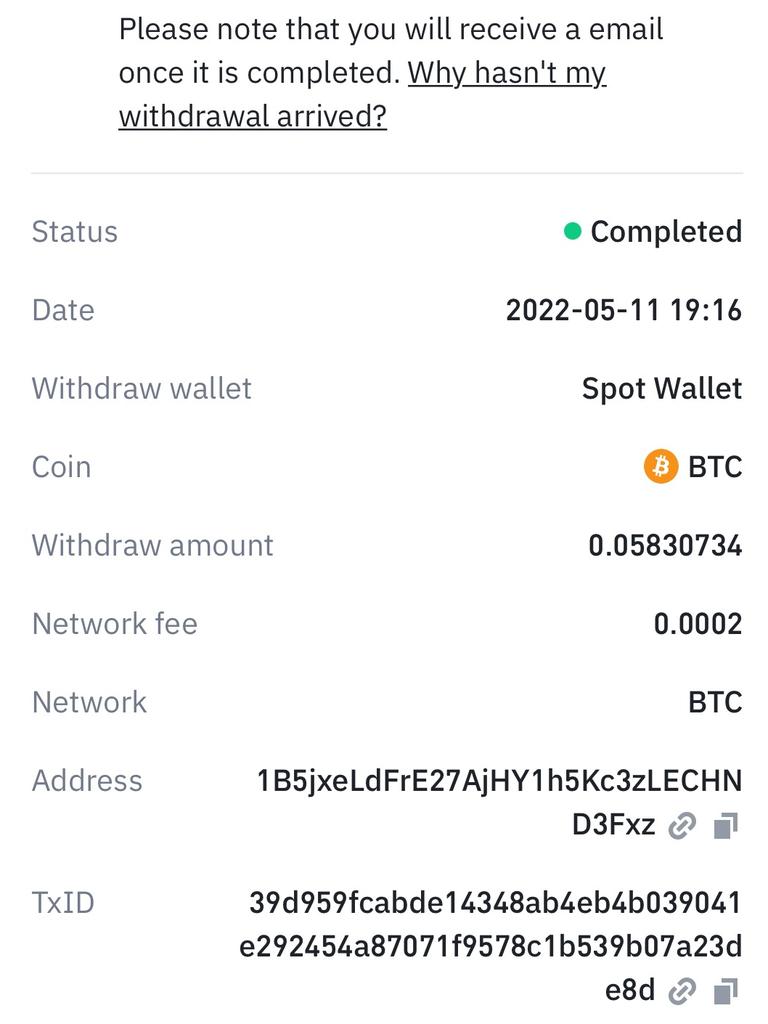

A cyber criminal had drained $20,000 from the fund, sending it to a Binance cryptocurrency exchange where it was then sent out of the network into an anonymous account.

Only $16,000 remains in the super fund.

“Basically most of the money, the assets in there is mostly mine,” Alice told news.com.au.

“$20,000 is a lot to get scammed out of, to us it is.”

Alice tried to remain calm and thought it would be a fairly easy process to get the money back but it has since all vanished into thin air with no chance of recovery.

She partly blames the Commonwealth Bank (CBA) and Binance for being too slow to respond.

The saga began when, like many Australians, Alice’s brother, a tradie in his 40s, was inspired to jump on the cryptocurrency bandwagon.

A few months ago, he spotted a Facebook advertisement ago appearing to show television host David “Kochie” Koch spruiking a cryptocurrency trading platform called Tower Bridge. The Perth tradesman plied $3500 into the venture.

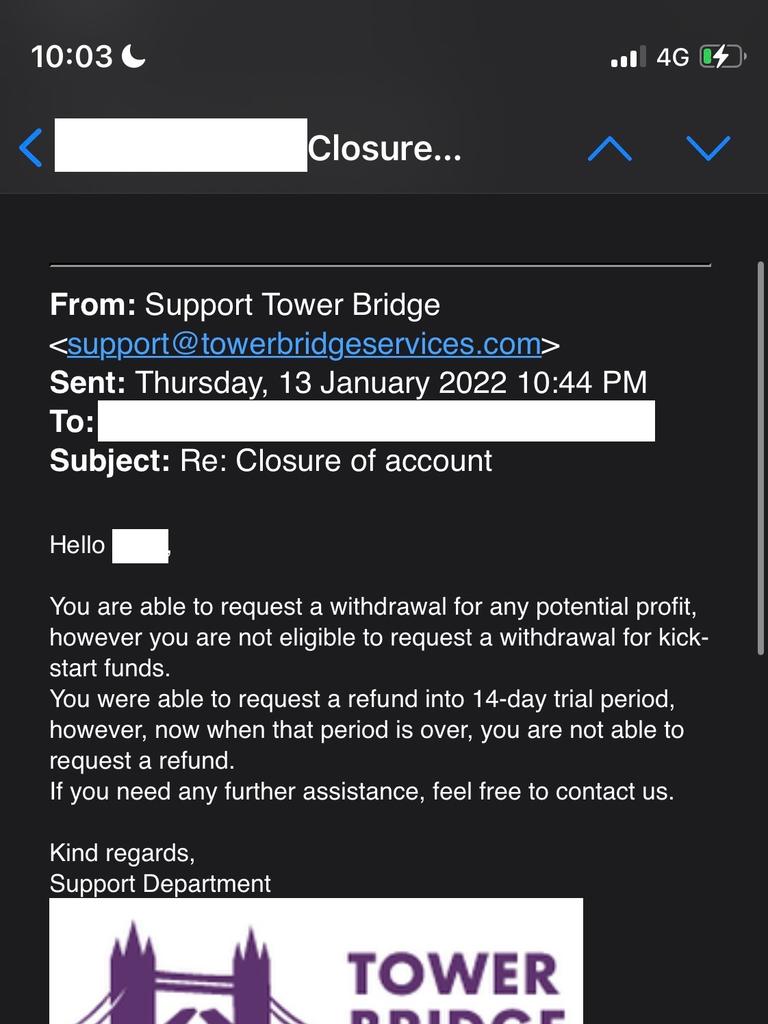

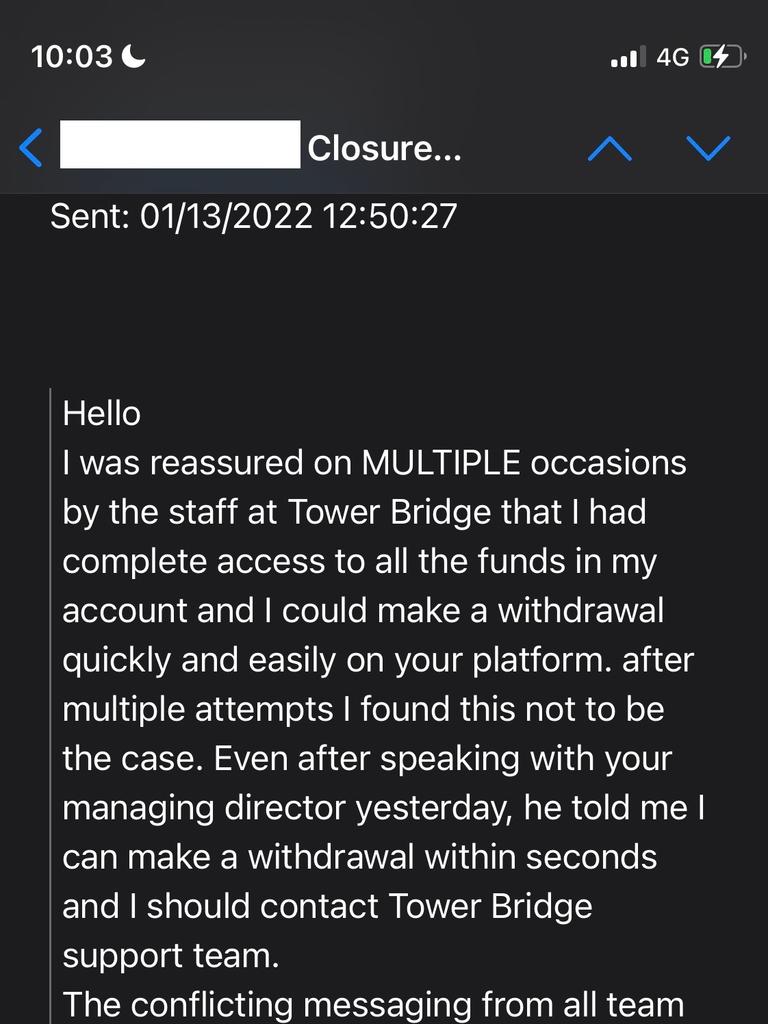

But when he tried to cash out some of his Tower Bridge cryptocurrency, he had trouble doing so.

He contacted Tower Bridge in May saying he was struggling to withdraw funds. Under the guise of assisting him, a so-called employee of the platform convinced him to download a program called AnyDesk, a remote-access desktop application.

They then took over his computer using the software and were able to access his online banking system, where he was already logged in. The scammer then opened the family’s shared super account and the tradie watched helplessly as $20,000 was transferred out of the fund right before his eyes.

Have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

At that point, he was “freaking out”, the man told his sister.

The internet criminal controlling the man’s computer quickly assured him the funds had been transferred in error and that they would give him the money back.

They told him they would return the funds via cryptocurrency, prompting the man to hand over login details to the account he held with crypto trading platform Binance.

Alice’s brother complied and they did indeed put the money into his Binance account. But then quickly transferred it to another blockchain with tens of thousands of dollars of more dollars in it — likely proceeds from other scams.

In the days and weeks afterwards, Alice’s brother was in a state of shock and the role of recovering the money fell to her.

“He’s taking it hard,” she said. “He couldn’t think straight, it was like he’d been drinking.”

Alice chased up the stolen money and was dismayed at what she found.

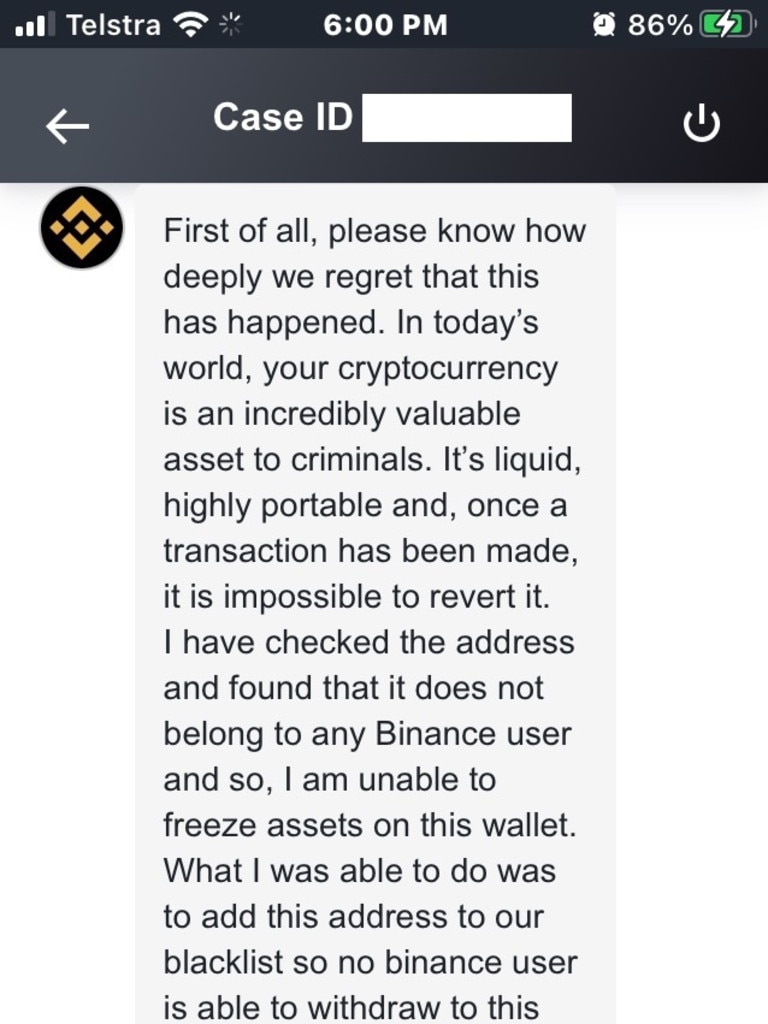

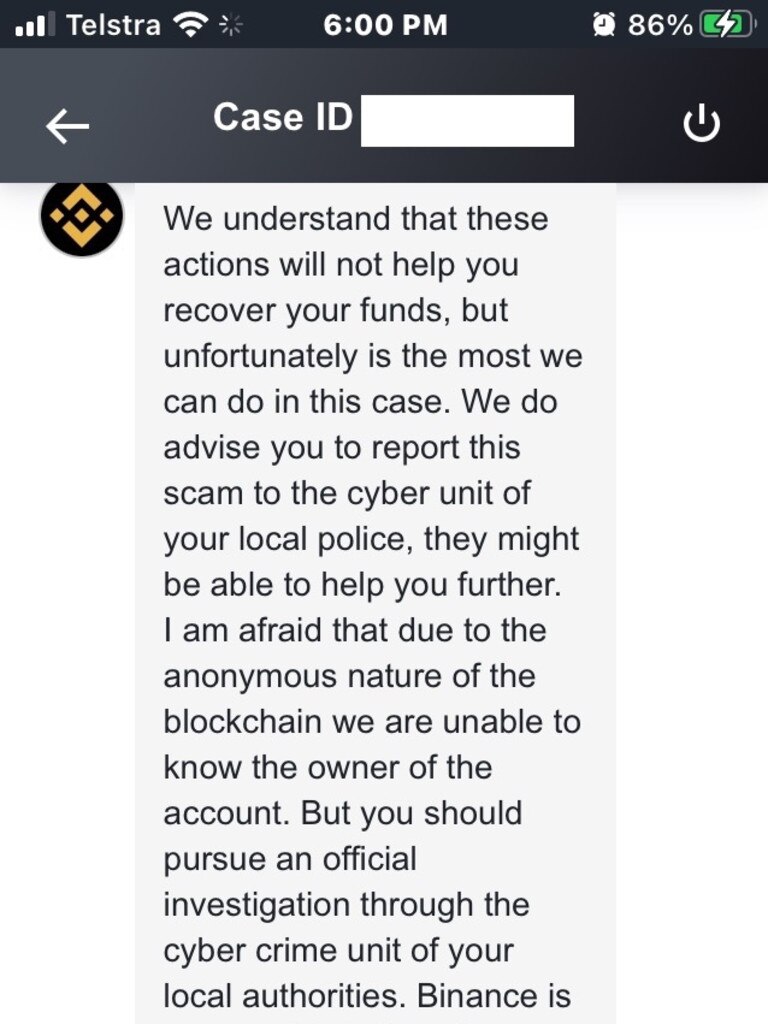

“We tried to discuss it with Binance, it was just on an online chat,” she recalled.

“They told us that there wasn’t much chance, that we weren’t going to get anything back, so there was no point in calling because they wouldn’t be able to tell us anything.”

In a statement, Binance said it couldn’t comment for privacy reasons and encouraged anyone who thought they had been a fraud victim to report it to local police.

Alice was also unhappy with the Commonwealth Bank, saying that “$20,000 should never be allowed to leave without using two-factor authentication”.

She said there were “loopholes” in the bank’s system, which had allowed her money “to be stolen without any authority”.

“I argued that it should not have been set up like that, there are so many laws about being able to withdraw (from a super fund), it’s not his money to begin with,” she added.

The self-managed fund was a Commonwealth Direct Investment Account, which the bank advertises as helping customers “grow your SMSF wealth while maintaining easy access to funds”, and therefore was not subject to the same restrictions as a normal super account.

Because the scammers used her brother’s Binance account, the money transfer bypassed the CBA’s normal security protocols.

The transfer didn’t require two-factor authentication because the Perth man had previously paid money from another of his personal accounts directly to his cryptocurrency account and verification is only required for first time payments.

Alice’s brother also had increased his maximum spend to $20,000 a few months earlier.

It’s understood the bank is in discussions with Alice in what they insist is a goodwill payment but what she claims she is entitled to in compensation.

In a statement, a CBA spokesperson said to news.com.au: “If a customer notices an unusual transaction on their account, they should contact us immediately to report it.

“Once we have been made aware of suspicious activity on an account we work closely with other banks to take action and we do our best to recover any funds.”

The scam Alice and her brother fell victim to is one of many that sees scammers using fake celebrity endorsements online to convince Australians their crypto trading platforms are legitimate.

Celebrities commonly featured in the scams included David Koch as well as other TV personalities such as Virginia Trioli and Waleed Aly, and also movie stars Chris Hemsworth and Nicole Kidman, and entrepreneurs Dick Smith, mining magnate Andrew “Twiggy” Forrest and Boost juice founder Jenine Allis.

All those high-profile individuals do not have any link to fraudulent cryptocurrency investment schemes.

In fact, Mr Forrest is taking Facebook to court for failing to prevent scammers misusing his name and image while Australia’s consumer watchdog, the ACCC, is also pursuing legal action.

According to Scamwatch, so far this year, Australians have lost at least $243 million to investment scams, compared to $178 million for the entirety of 2021.

That number is also expected to be a lot higher because not every scam victim reports their experiences to Scamwatch.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au